Strategy Links & The Most Recent Forward Test

An updated list of links to all published strategies

Important: There is no guarantee that ATS strategies will have the same performance in the future. I use backtests and forward tests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. The best way to trade is with a simulated account on live data. I recommend using ATS strategies in simulated trading until you/we find the holy grail of trade strategy. This material is for educational purposes only and should not be viewed as investment or financial advice.

How does the process work?

As a subscriber you get instant access to the strategies (code included) below. If the strategy is not listed below, it is NOT included in the subscription. You can use the strategies as they are OR to create something new. You can build the strategy yourself using the description provided or you can import the download from Google Drive into Ninjatrader (code is in C#).

The evolution of the Forward Test

2023: Initial serious commitment to live forward testing

2024: Methodology upgrade—tracking individual variations instead of strategy groups

2025: Next-level alpha hunting through ML pattern recognition, optimal portfolio allocation, and advanced risk management.

Q3 2025 Portfolio Composition

While I don’t share the exact strategies in the portfolio I can tell you about it’s composition and that it contains 24 ATS trading strategies across 16 unique strategy types deployed on various instruments and timeframes.

Instruments Traded

NQ (Nasdaq futures): 17 strategies (most common)

MNQ (Micro Nasdaq): 3 strategies

GC (Gold futures): 3 strategies

ES (E-mini S&P 500): 2 strategies

ZN (10-Year Treasury Note): 1 strategy

ZB (30-Year Treasury Bond): 1 strategy

Data Series / Bar Frequency

Minute-based: 22 strategies (ranging from 5-minute to 90-minute)

Tick-based: 2 strategies (1400 tick)

Account Structure

All strategies run on simulated accounts

Account naming convention: SimAccount[StrategyNumber][Instrument][Timeframe]

Some accounts run multiple instruments or timeframes

Incubator Standouts Join the Field

Some of the strategies in the portfolio are from the Q2 Forward Test. All others are from the Incubator.

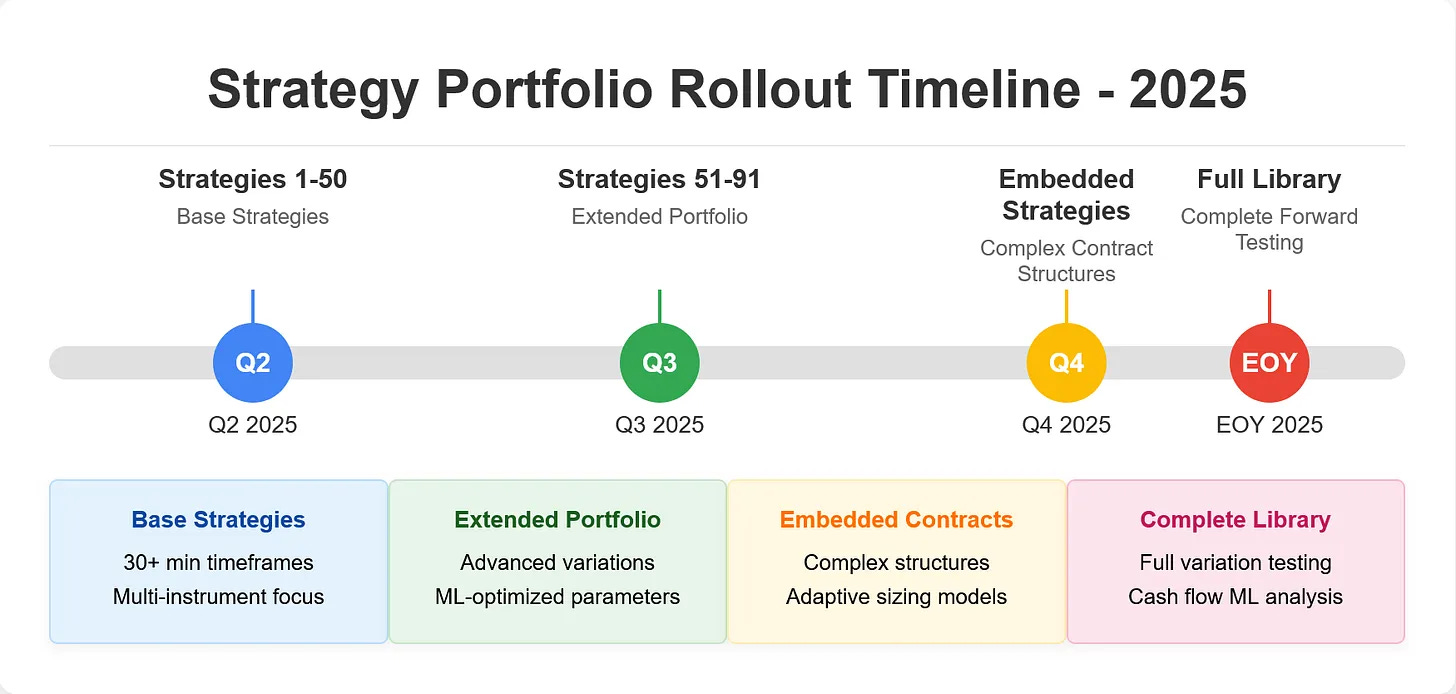

The Incubator showcases different variations of the first 50 strategies. In Q3, I’ll add strategies 51 through 91 and in Q4, I’ll add all strategies with embedded contracts. Here’s a tentative timeline:

The hope is to obtain as much actual data as possible for ML pattern recognition analysis by year end.

Click here for a list of FAQs.

Please let me know if you have any questions: Celan at AutomatedTradingStrategies@protonmail.com

Strategy Links

Automated Trading Strategies: Strategy #1 (unlocked)

Automated Trading Strategies: Strategy #2

Automated Trading Strategies: Strategy #3

Automated Trading Strategies: Strategy #5 (unlocked)

Automated Trading Strategies: Strategy #6

Automated Trading Strategies: Strategy #7

Automated Trading Strategies: Strategy #8

Automated Trading Strategies: Strategy #9

Automated Trading Strategies: Strategy #10

Automated Trading Strategies: Strategy #11

Automated Trading Strategies: Strategy #12

Automated Trading Strategies: Strategy #13

Automated Trading Strategies: Strategy #14

Automated Trading Strategies: Strategy #23

Automated Trading Strategies: Strategy #24

Automated Trading Strategies: Strategy #25

Automated Trading Strategies: Strategy #26

Automated Trading Strategies: Strategy #28

Automated Trading Strategies: Strategy #29

Automated Trading Strategies: Strategy #30

Automated Trading Strategies: Strategy #31

Automated Trading Strategies: Strategy #32

Automated Trading Strategies: Strategy #33

Automated Trading Strategies: Strategy #34

Automated Trading Strategies: Strategy #35

Automated Trading Strategies: Strategy #36

Automated Trading Strategies: Strategy #37

Automated Trading Strategies: Strategy #38

Automated Trading Strategies: Strategy #39

Automated Trading Strategies: Strategy #40

Automated Trading Strategies: Strategy #41 and 41a

Automated Trading Strategies: Strategy #42

Automated Trading Strategies: Strategy #43

Automated Trading Strategies: Strategy #45

Automated Trading Strategies: Strategy #46

Automated Trading Strategies: Strategy #47

Automated Trading Strategies: Strategy #48

Automated Trading Strategies: Strategy #49

Automated Trading Strategies: Strategy #0

Automated Trading Strategies: Strategy #50

Automated Trading Strategies: Strategy #51

Automated Trading Strategies: Strategy #52

Automated Trading Strategies: Strategy #53

Automated Trading Strategies: Strategy #54

Automated Trading Strategies: Strategy #55

Automated Trading Strategies: Strategy #56

Automated Trading Strategies: Strategy #57

Automated Trading Strategies: Strategy #58

Automated Trading Strategies: Strategy #59

Automated Trading Strategies: Strategy #60

Automated Trading Strategies: Strategy #61

Automated Trading Strategies: Strategy #62

Automated Trading Strategies: Strategy #63

Automated Trading Strategies: Strategy #64

Automated Trading Strategies: Strategy #65

Automated Trading Strategies: Strategy #66

Automated Trading Strategies: Strategy #67

Automated Trading Strategies: Strategy #68

Automated Trading Strategies: Strategy #00

Automated Trading Strategies: Strategy #69

Automated Trading Strategies: Strategy #70

Automated Trading Strategies: Strategy #71

Automated Trading Strategies: Strategy #72

Automated Trading Strategies: Strategy #73

Automated Trading Strategies: Strategy #74

Automated Trading Strategies: Strategy #X

Automated Trading Strategies: Strategy #75 (Part 1)

Automated Trading Strategies: Strategy #75 (Part 2)

Automated Trading Strategies: Strategy #76 (Part 1)

Automated Trading Strategies: Strategy #76 (Part 2)

Automated Trading Strategies: Strategy #78

Automated Trading Strategies: Strategy #79

Automated Trading Strategies: Strategy #80

Automated Trading Strategies: Strategy #81

Automated Trading Strategies: Strategy #82

Automated Trading Strategies: Strategy #84

Automated Trading Strategies: Strategy #40_rev

Automated Trading Strategies: Strategy #85

Automated Trading Strategies: Strategy #86

Automated Trading Strategies: Strategy #87

Automated Trading Strategies: Strategy #88

Automated Trading Strategies: Strategy #89

Automated Trading Strategies: Strategy #90

Automated Trading Strategies: Strategy #91

Automated Trading Strategies: Strategy #92

Automated Trading Strategies: Strategy #93

Automated Trading Strategies: Strategy #94

Automated Trading Strategies: Strategy #94v2

Automated Trading Strategies: Strategy #95

Automated Trading Strategies: Strategy #96

Automated Trading Strategies: Strategy #101