Is There An Escape Velocity For Automated Trading?

Plus Six More Strategies From NT8s AI Generate

Important: There is no guarantee that these strategies will have the same performance in the future. I use backtests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. Even with forward tests, there is no guarantee that performance will continue in the future. Trading futures is extremely risky. If you trade futures live, be prepared to lose your entire account. I recommend using these strategies in simulated trading until you/we find the holy grail of trade strategy.

Moore's Law is the observation that the number of transistors in an integrated circuit doubles about every two years. The observation was published in 1965 and is named after Gordon Moore, the co-founder of Intel. As an ex-employee of Intel I can attest to the fact that Moore’s Law, also referred to as “The Law”, is drilled into you at every turn, especially with regard to long-term planning and target setting for R&D.

Fast-forward to 2024 and we’ve got many more ‘laws’. They all coalesce around rates of growth, exponential growth in particular. One thing is certain, technology is advancing at a speed that is non-linear. For example, it is said that storage improvements have outperformed Moore's Law by a factor of 800% and AI is reshaping the world at ever increasing speeds.

Before getting into what impact this has on trading, I want to step back and look at the impact AI is having on society as a whole. I think it may provide clues about what we can expect from AI in the world of trading.

What impact will AI have on your life?

In the book The Singularity Is Near (2005), Ray Kurzweil made two predictions about the impact of AI: first, that it will surpass human intelligence and master the Turing test by 2029 (that’s just 5 years away now), and second, that by 2045, humans will merge with AI. At the heart of Kurzweil’s predictions is Kurzweil’s Law. It states that the rate of technological progress tends to accelerate exponentially over time.

What most don’t know is that Kurzweil’s pursuit of greater intelligence through AI is driven by a hunt for longevity. He refers to it as the hunt for ‘Longevity Escape Velocity’. According to Kurzweil, this will happen in the year that scientific progress is able to give back as much as a human loses (in age).

What exactly does reaching Longevity Escape Velocity mean?

It means that we’ll become ‘static’ in the aging process. So instead of getting perhaps four months, and losing a year on your birthday, you’ll get back the full year (if you’re diligent). Again, Kurzweil expects this to happen by 2029.

It sounds crazy, I know. But there’s a reason Kurzweil is currently serving as Principal Researcher and AI Visionary for Google—he tends to get these things right.

Kurzweil’s goal is to make it to 2029 with the use of nootropics. His current regimen is 80 pills a day. With every year after 2029, the amount that Kurzweil can get back via scientific progress will be even more than he lost, until hopefully he returns to youthfulness.

Of course Kuraweil relies heavily on the exponential growth of AI to make this date a reality. In particular, he is relying on the rate of acceleration on performance. Kurzweil first proposed this in his book, The Age of Spiritual Machines (1999). He said that the rate of growth is not linear, but exponential and that the mechanism driving this growth is the merging of artificial and human intelligence.

According to Kurzweil, it is only a matter of time before AI has enough ‘connections’ to match the human mind. Instead of biological connections, AI gives us access to increased technical connections. For example, supposedly ChatGPT4 has 400 billion connections compared to 1 trillion in the human brain. The speed with which these large ‘event’ models can grow is what dictates our access to this intelligence. So, at some point in the very near future, AI will go beyond human ability (in all fields), and those that are diligent will have access to that knowledge as well.

This is where folks get a bit scared and with good reason. The key, according to Kurzweil, is to not see AI as competition, but rather a complement to human intelligence. He advises merging with AI rather than fearing it.

What does this mean for society?

This is the question Joe Rogan asked Kurzweil last week on his podcast. It was a rigorous interview.

In response to Rogan’s question, Kurzweil said: “Well that’s a big issue, but what we’re actually doing is increasing our intelligence.”

He goes on to say that: “People object to that [AI] because it's competition?”

Rogan: “In what way?”

Kurzweil: “Well Google has 60-70K programmers? How many programmers exist in the world? How much longer is that going to be a viable career? LLM can already code. Not quite as good as a real expert coder, but how long is that going to be? It’s not going to be 100 years, it's going to be a few years. So people see it as competition. I have a slightly different view of that. I see these things as actually adding to our own intelligence and we are merging with these kinds of computers making ourselves smarter by merging with it.”

So the key is to embrace the merge because it’s inevitable?

If merging with AI means I have to get some sort of brain implant, I’ll be the first to say it’s not happening, but if it means finding the best trading platform that incorporates the full advantages of AI, I’m all for it. In my research, I’m finding that the tools are usually there before I ask for them. It’s just a matter of getting to the proper question. The trading platform I’m looking at now is roughly two years ahead of me.

But the big feature of human-level intelligence is not what it does when it works but what it does when it’s stuck.

- Marvin Minksy, co-founded Massachusetts Institute of Technology's AI Laboratory

ISO Trading Escape Velocity

Currently, when large language models like ChatGPT get “stuck” they produce a ‘best guess’, which is often wrong. These guesses are referred to as ‘hallucinations’. This occurs because it cannot say “I don’t know”. So the reason for these hallucinations is due more so to a ‘lack of information’ than an error in programming. It occurred to me that this must be the case for any simulation. There will always be a gap between the simulation and reality, and that gap is ultimately a ‘lack of information’.

According to theorists like Kurzweil, this gap will be closed by the year 2029. So while Kurzweil is chasing Longevity Escape Velocity, I’ll be chasing Trading Escape Velocity.

What is trading escape velocity?

Financial escape velocity is obtained when your wealth is secured and you can enjoy it, but what does escape velocity look like for those of us on the hunt for the holy grail of automated trading systems? To me, this is the day when there is no gap between the simulation and reality. And, every year after 2029, the simulation will actually be better than reality. It’s hard to get my head around what that looks like right now, but it’s coming and we need to be on the look out. As you read this, someone (or something) is in the process of creating it.

Needless to say, I’m on the hunt. Every week I discover a new tool or application that does something I hadn’t thought of before. The key is understanding how it fits into the lexicon of what has already been published.

In my search for new trading applications, I’ve also found a new group of artists—these are traders that use AI trading platforms as a kind of medium by which to paint. They know which ones are better than others and at what. The best are those that can switch seamlessly from one simulation or platform to another. They know the limitations and advantages of each. They have merged a love for trading with AI.

To that end, I’ve been doing a lot of research on new programs/platforms in this space, and I think I’ve found one. I will be unveiling that application in May. It is unlike anything I’ve ever seen before and I think you will feel the same way.

For those of you like myself that cling to NT8, don’t fret. Many of these platforms work with NT8. The one I’m talking about, however, goes far beyond anything that we can do with NT8.

AI Generate: Difficult To Use, But Worth It

At least once a month I get asked the question:

“How do you come up with your strategies?”

The easy answer is: trial and error. The hard part is gaining an understanding for the limitations and strengths of the simulation. Where does the simulation allow me to fly, and where do I feel like I’m on my knees? Where is the information gap and where does the gap have the biggest impact? What strategies and parameters are more prone to the creation of ‘hallucinations’? In other words, I come up with strategies within the confines of the simulation.

It’s important to note that I’m not saying NT8 is bad. It has advantages and disadvantages like any platform, and we will use these as a baseline for judging future applications.

One area that NT8 excels in is the creation of strategies by AI Generate. This is a tool that actually generates something new based on the indicators you select for it. For reference, you can find Batch 1 here, and Batch 2 here, along with a better explanation for what AI Generate is and how to use it.

To be clear, using AI Generate is not easy. Like any tool, it takes some getting used to. I provide a quick tutorial and a few tips here, but the hard part is forward testing because there are ‘hallucinations’, which is to say there are times when the backtest is completely different from the forward test.

I took about 100 strategies that AI Generate created, backtested them, and found about 30 that performed well. I then forward tested those and found the following 6 strategies, which I refer to as Batch 3. It is important to note, that I haven’t made any changes to these strategies.

The next step is to see how you can add to these strategies. How can you make them better? How can you make them your own?

It’s worth mentioning that only one AI generated strategy made it to the core portfolio in the live test, but all strategies in the non-core portfolio are AI generated. This is because most AI based strategies tend to be high risk, high reward. They also tend to have a higher average trade time. I provide a framework for how to value these strategies in the last post.

AI Generate: Batch 3

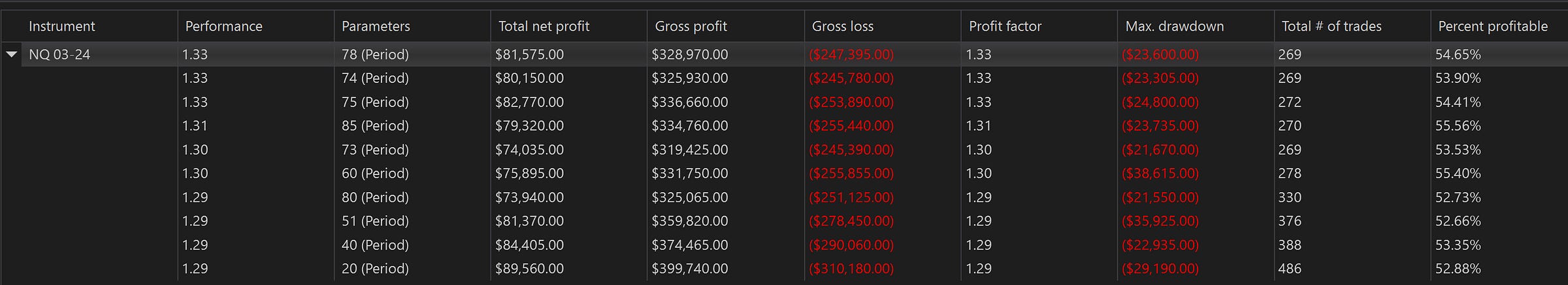

These are the results of a 1 year backtest for Batch 3. The backtest is a result of an optimization over the time interval 1 to 90 minutes.

These are the results for AutoStrategy 94. Granted, these are not the best results, but profit factor has a low standard deviation regardless of time interval—there’s an edge there.

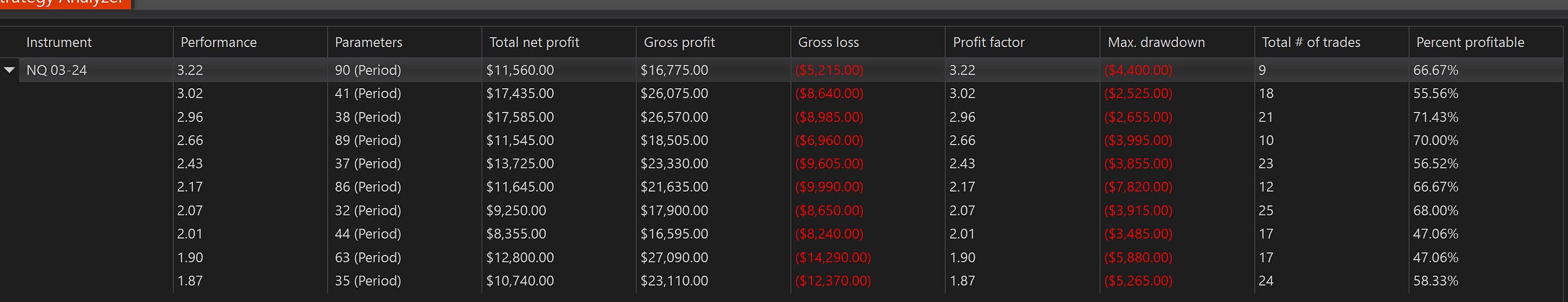

These are the results for AutoStrategy 93. Well, the results are better, but the trade is low until the profit factor drops to 3.60. Unlike most strategies, this strategy performed better at lower time intervals, which warrants further study.

These are the results for AutoStrategy 79. Like AutoStrategy 93, this strategy performs better at lower time intervals.

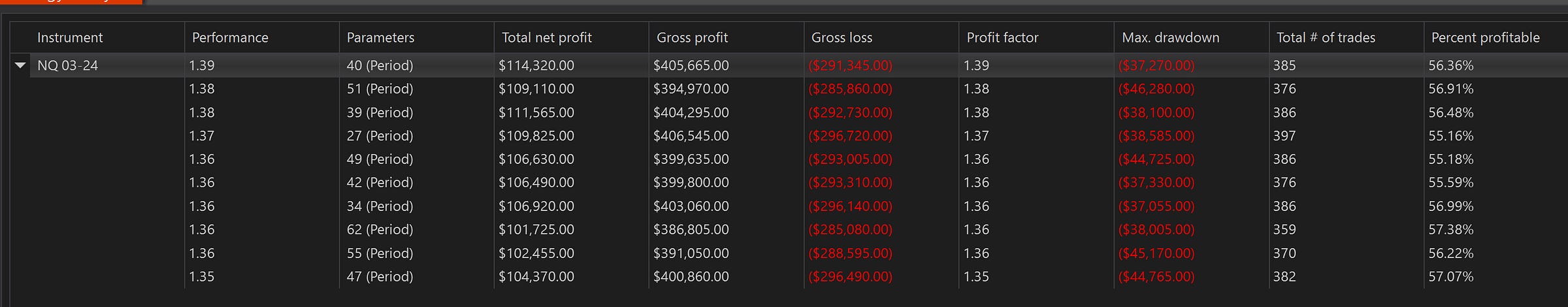

These are the results for AutoStrategy 98. I think this is one of the most interesting strategies of the batch. Since the beginning of the 2024 the strategy has an average duration of only 37 min, and makes roughly $30 per trade.

These are the results for AutoStrategy 97.

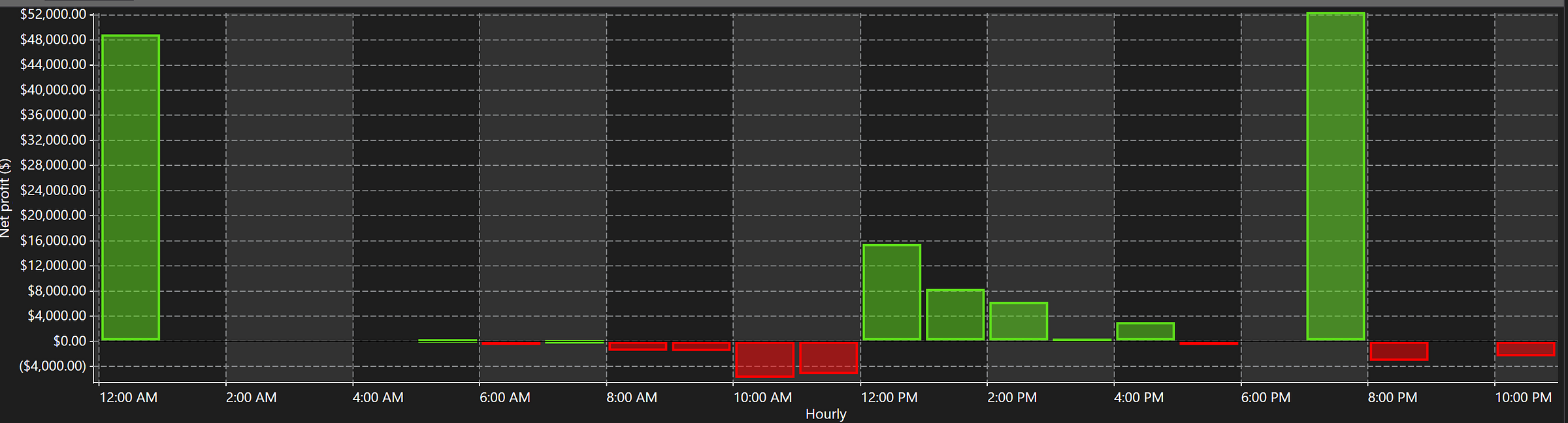

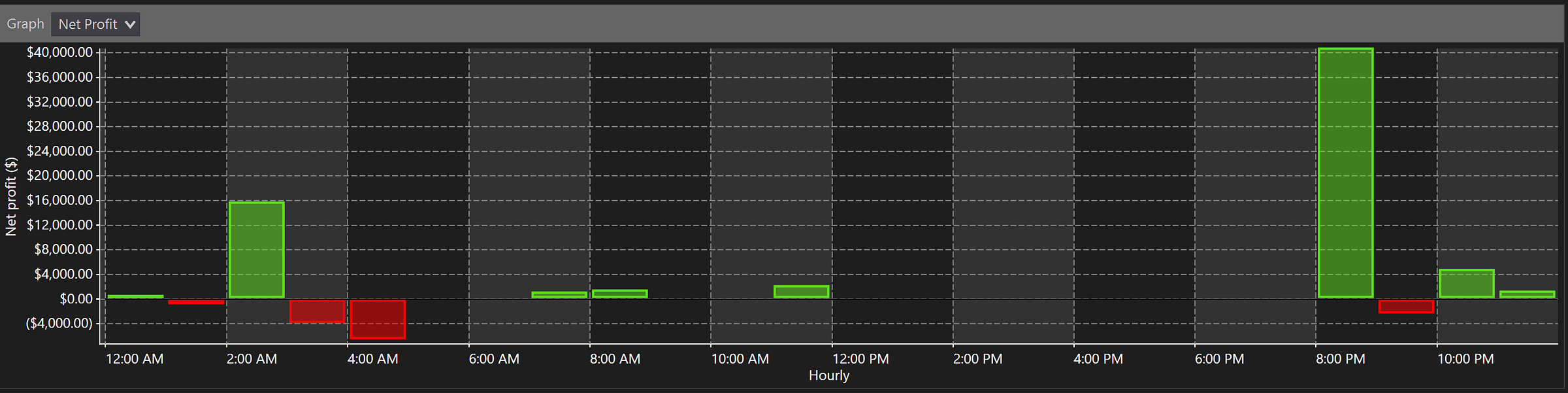

These aren’t the best results, but as you can see from the chart below, the bulk of trades enter in the 12am and 7pm hour. Restricting trade entry to these time periods would definitely increase the profit factor. And, there are over 300 trades taken for the strategy throughout the year, regardless of the time interval, so you have some room to play with.

Since the beginning of the year, the strategy has an average duration of 9h and 30min, but it makes roughly $97 per trade, which is 3x higher than AutoStrategy98.

These are the results for AutoStrategy 101.

Autostrategy 101 is a lot like 97 in that there are opportunities to improve the profit factor and % of profitable trades just by focusing on trades that enter in the 8pm and 2am hour.

All of these strategies are available as a batch download at the bottom of the post. You can use these strategies as they are or you can adjust them to your liking. If you have any other ideas you would like to share with the group, please post them below.

What’s Next

Ultimately, Kurzweil believes that we are entering a period of time where the only obstacle will be in our ability to use ‘technical’ connections to our advantage—that will be the new art form.

“Human beings have only a weak ability to process logic, but a very deep core capability of recognizing patterns. To do logical thinking, we need to use the neocortex, which is basically a large pattern recognizer. It is not an ideal mechanism for performing logical transformations, but it is the only facility we have for the job. Compare, for example, how a human plays chess to how a typical computer chess program works. Deep Blue, the computer that defeated Garry Kasparov, the human world chess champion, in 1997 was capable of analyzing the logical implications of 200 million board positions (representing different move-countermove sequences) every second. (That can now be done, by the way, on a few personal computers.) Kasparov was asked how many positions he could analyze each second, and he said it was less than one. How is it, then, that he was able to hold up to Deep Blue at all? The answer is the very strong ability humans have to recognize patterns. However, we need to train this facility, which is why not everyone can play master chess.”

― Ray Kurzweil, How to Create a Mind: The Secret of Human Thought Revealed

I welcome the merger of human and artificial intelligence, especially as it relates to trading, which is ultimately the recognition of patterns. The fusion of human and artificial intelligence in the identification and exploitation of trading opportunities is a match made in heaven. This is a golden age in trading and I intend on taking advantage of it.

The hunt continues…

Q2 Backtest update: To be published by EOM.

Q2 2024 Forward Test Start: 3/18, added new instruments, new time period and a few new strategies

Live Test starts back-up: 3/18-25

New application/program: 5/1

Strategy 81, based on block trades: 4/1-5

Restructuring announcement: 5/5

There’s a lot going on. If you have any questions, please let me know or comment below. If I haven’t responded to you, please resend your email to the following address:

Contact: AutomatedTradingStrategies@protonmail.com