Automated Trading Strategy #71: Equity, Energy & Metal Futures

On The Hunt For Exotic Price Patterns

Important: There is no guarantee that these strategies will have the same performance in the future. I use backtests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. There are no guarantees that this performance will continue in the future. Trading futures is extremely risky. If you trade futures live, be prepared to lose your entire account. I recommend using these strategies in simulated trading until you/we find the holy grail of trade strategy.

As a quick reminder, our goal is to find the holy grail of automated trade strategy. We haven’t found the holy grail yet, but we get closer with every strategy. Click here for the most recent performance chart. The Q3 update will be published in late September.

I had a great vacation, which included some beach time on the Carolina coast. It was really a great trip, so I’m highly motivated and it’s good to be back!

First, a little housekeeping:

I majored in finance with a double minor in writing and dance, which is to say I’ve always been conflicted about how I wanted to spend my life and I had no idea it would lead me here. Technical analysis is many things, but I see it as the study of market movement. The speed or tempo of the movement contains a rhythm and if studied you can see this rhythm. It’s subtle at first, akin to the iambic pentameter that Shakespeare used in his plays, but once you hear it, the difference is palpable—like the difference between Vivaldi’s Summer played allegro vs presto.

(I hope you enjoyed that as much as I did.) Whatever the case, I find the ability to write about technical analysis—the dance of the market—and to share this amazing adventure with others, to be a dream come true and I am truly grateful for your support in this effort.

If you’ve tried to reach me and I have not responded, please resend to the following email address: AutomatedTradingStrategies@protonmail.com. Do not use automatedtradingstrategies@substack.com. If you do, I may not receive it. I’ve reached out to Substack about this, but it is not a known issue.

Some of you have asked for more purchase options and I’ve passed that feedback along to Substack. I’m happy to say, as both a writer for, and an investor in, Substack, that the product development team is on it. Click here to read more.

ATS started off as a small group of traders getting together to share ideas during COVID. Over time it has evolved into a solo effort with occasional input from those original founding traders; in part, because COVID is no longer a threat, and in part due to a disagreement on the impact of sharing strategies with others. I could write an entire post about this, but in a nutshell, I don’t believe sharing strategies with a limited number of people hinders the hunt, especially when trading futures. That said, and perhaps this is due to small thinking, it never dawned on me that anyone would use these strategies to trade real size. It’s hard to know, but I do know the following:

I’ve been creating automated trading strategies for about 8 years now. The performance improved dramatically soon after I started this publication so I have no regrets. To be clear, sharing strategies has improved backtest performance, not hindered it. The jury is still out on the forward test, which is the real concern—I get it. I also believe that the potential for viable strategies is virtually unlimited, so the skill is in knowing how to find them, not hoarding them.

That said, there has been some deterioration in the portfolio and that deterioration always comes after I announce which strategies I’m trading. As a result, I will continue to post forward results, but I will not share the strategies I’m trading or the selection process used. I think this is a good middle ground.

I’ll be sharing the forward test for the month of August with subscribers on September 10; the results are quite interesting especially after updating parameters and adding new strategies to the portfolio.

I’ve already noticed a significant improvement over the month of August. With further analysis, I realized there ARE a few strategies that appear stronger (characterized by the need for less re-tooling/babysitting) than others. These strategies are primarily based on price patterns.

I was 27 when I received my first bribe. I was given a check for $500K in exchange for ‘consideration’ on an RFP. I gave it back with haste, but it stands out as an inflection point in my life. The panic attacks I had been having ceased. Needless to say, I don’t do well with stress and I’ve made it a priority to know myself well enough to identify, and stay away from, the triggers, however alluring the prospect may be. One thing that stresses me out is trading someone else’s money. While I am not interested in starting a fund (at this time), I am open to being a senior advisor. Send me your proposal.

I am not interested in joining any “mastermind” trading groups. If you are interested in joining the ATS working group, please send a quick note explaining why.

Another question I’ve received more than often lately is: Why futures?

Futures are highly liquid, which increases price action, which increases trade opportunities.

Margin requirements are also fairly low compared to the assets you have control over, which means you have considerable leverage.

Short selling is much easier in futures and you can trade 23 hours a day, six days a week.

Last but not least, from a tax perspective, capital gains follow the 60/40 rule and there is no wash sale rule—all your trades are combined and you either make a gain or loss at the end of the year. Note: I am not a financial advisor. Please seek the advice of your tax and/or financial advisor before taking action.

Finally, I want to discuss return. I receive many questions asking ‘how much can I make with $100K’? This is hard to say, but I can give you the information you need to figure this out for yourself.

You can think of the cost of entering a strategy (the minimum investment) as the drawdown and the net profit as the gain. If you’re looking to trade a $100K simulated account, you might want to start with 5 strategies on one contract (trade no more than 5 contracts at a time). Those five strategies should have a combined backtested annual drawdown of no more than $50K. This gives a nice cushion of protection for intraday drawdowns, commissions, etc.

In the general marketplace for alpha, 15% return is decent and 30% is phenomenal. I think it’s hard for people to understand the kind of ROI that’s possible with a viable automated trading strategy. Surely I can’t be saying that the model for a strategy shows a profit factor of 4.34, which translates into a ~434% return. I’m not. I’m saying that it translates into a 434% return on losses, not drawdown.

In general, the net loss is much higher than the drawdown, so actual ROI is much higher than 434%. I think this is the secret sauce behind the success of most quant funds, ridiculous margins. It’s really one of the best business models on the planet: 1) find a strategy that works, 2) ride it until it doesn’t 3) find another to replace it before returns drop below a certain point. I’m grossly oversimplifying the process, but that’s the gist.

I have a great deal of respect for quants—it is truly a multi-disciplinary field—but they don’t know what they don’t know. In many respects this is a good thing because it allows for an extreme level of objectivity, which has been proven to work. When things go wrong, however, I suspect they go wrong very quickly as some of our more ‘algorithmic’ strategies tend to do. When I say algorithmic, I mean strategies that aren’t backed by a trade set up or price pattern. I believe automated trading strategies based on trade set ups and price patterns are stronger (have a longer shelf life). These tend to be simple and based on highly unusual or exotic price events. The strength of the strategy can be measured in many ways, but among the best measures is its performance across markets AND frequencies.

In the coming year, as I transition ATS away from strategy creation and toward strategy research, I’d like to develop a nomenclature for grouping strategies with specific attributes to better gauge and track which attributes lead to stronger/more robust strategies. As I’ve said before, it might be possible to reverse engineer the holy grail. Meanwhile, another approach is to leverage our knowledge of trading to create strategies based on exotic price patterns that work at least 70% of the time, even more if you isolate the time period. Strategy 71 is an example of how to do this.

Strategy 71: On The Hunt For Exotic Price Patterns

Strategy 71 is based on an exotic price pattern. I had some difficulty pulling it off at first, but figured it out (with help — thank you Xa) in the end. I look forward to sharing it with you because it uses an indicator and calculation technique that I’ve never used before. It is also one of the most deceptively simple strategies I’ve published. Let’s take a look at the 1 year backtest results from Strategy 71.

What follows are the 1 year backtest results for a basket of equity futures: the 1st column is the list of equity futures used in the backtest; the 2nd column is profit factor; the 3rd column provides the parameters (the first # is the frequency of the data series in minutes), the 4th is net profit, the 8th is drawdown and the last is the percent of profitable trades.

As you can see, the average profit factor is 3.82 (4.67 for NQ; 4.79 for MNQ) and the trade is profitable ~68% of the time based on a backtest over the last year. The portfolio is based on trading 1 contract on each instrument; 5 contracts would scale to ~$500K, 10 contracts to ~$1 million, and so on.

It’s important to remember that these are only backtest results, and we all know that backtests are the value equivalent of two birds in the bush; the bird in the hand is the forward test. The hope is, however, that when backtest results are this good it leaves room for error, i.e., instead of making a 382% return on the forward test, you’ll make a 200% return—this is the beauty of wide margins with extremely low variable costs.

If we just look at NQ, which has the highest profit factor, we get a strategy that made $30K on 1 contract based on 45 trades throughout the year. Those trades were profitable 75% of the time. We see a similar performance for NQ’s baby sister, MNQ. In fact, the performance is actually better. Here’s the performance chart for NQ:

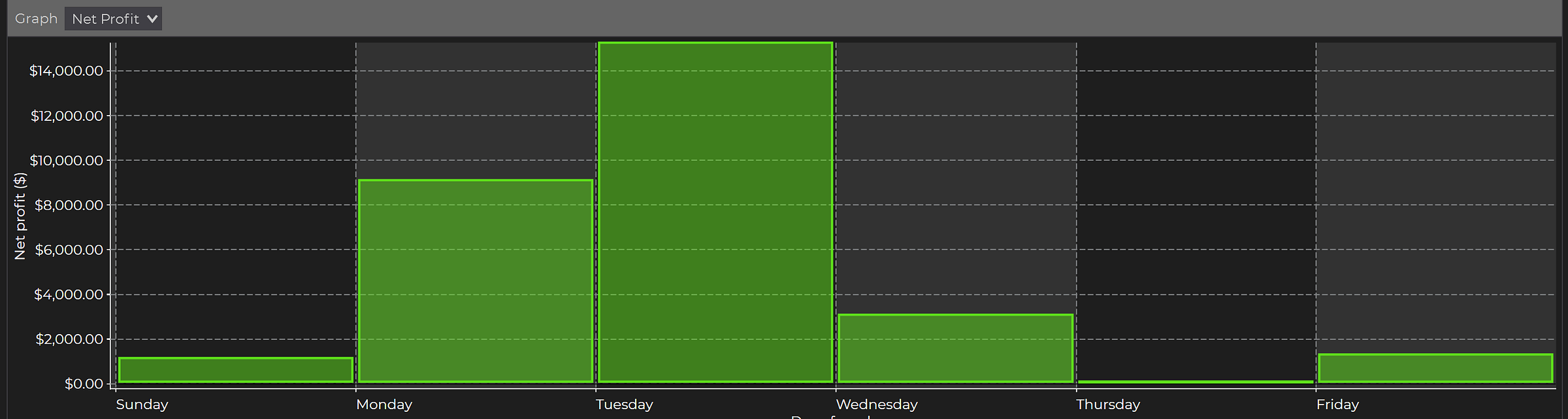

Here’s a breakdown by day of week:

…and by time of day based on trade entry not exit.

Based on these charts, there are additional opportunities to improve the performance of the strategy by isolating trades to Monday, Tuesday and Wednesday between the hours of 6pm EST and 6am EST, and 11am EST to 3pm EST.

As I said above, the strength of the strategy can be measured in many ways, but among the best measures is its performance across markets. A strong strategy should work across markets AND frequencies. This is how the strategy performed with metal futures:

And this is how the strategy performed when run on energy futures:

Now let’s get into how to recreate and/or download Strategy 71 for yourself.