Strategy Links, The Forward Test, & What's Coming In 2026

An updated list of links to all published strategies

Important: There is no guarantee that ATS strategies will have the same performance in the future. I use backtests and forward tests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. The best way to trade is with a simulated account on live data. I recommend using ATS strategies in simulated trading until you/we find the holy grail of trade strategy. This material is for educational purposes only and should not be viewed as investment or financial advice.

SCROLL DOWN FOR STRATEGY LINKS

How does the process work?

As a subscriber you get instant access to the strategies (code included) below. If the strategy is not listed below, it is NOT included in the subscription. You can use the strategies as they are OR to create something new. You can build the strategy yourself using the description provided or you can import the download from Google Drive into Ninjatrader (code is in C#).

The evolution of the Forward Test

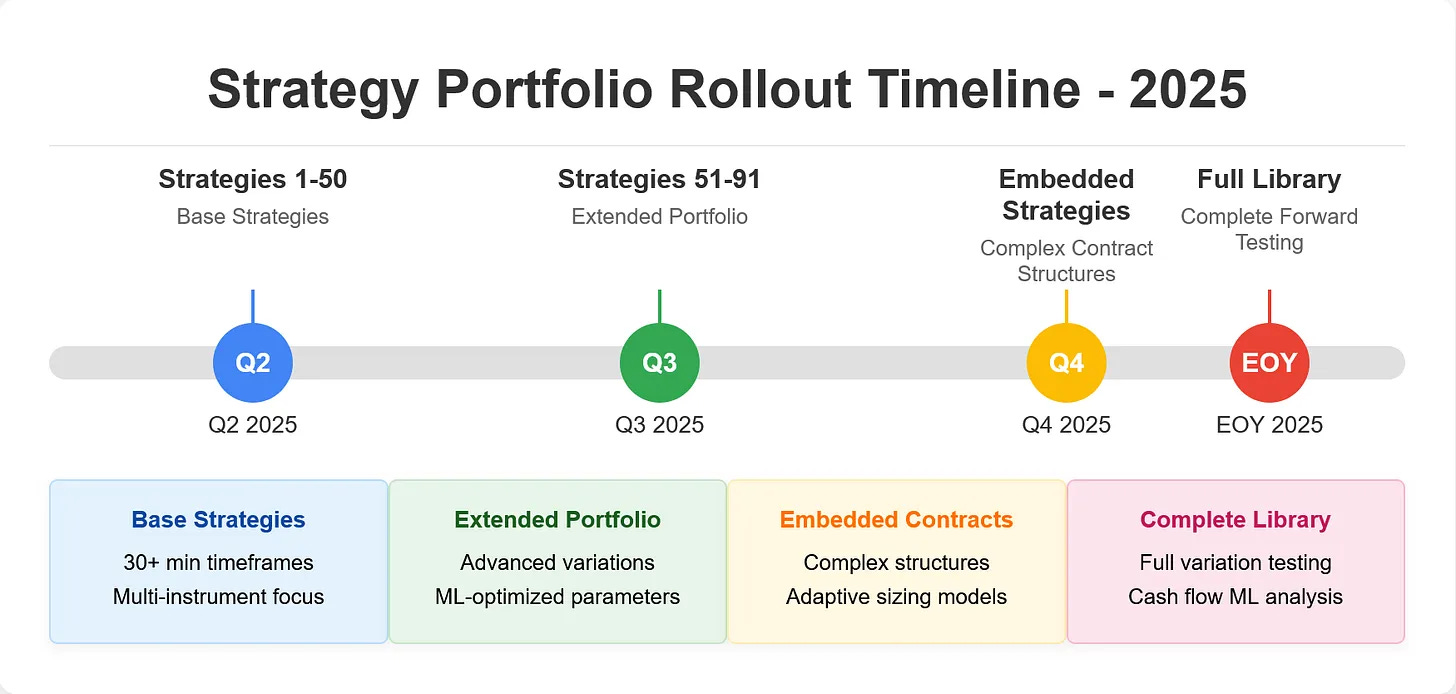

2023: Initial serious commitment to live forward testing

2024: Methodology upgrade—tracking individual variations instead of strategy groups

2025: Next-level alpha hunting through ML pattern recognition, optimal portfolio allocation, and advanced risk management.

2026: HMM Live Test and Introduction to DeFi

Q4 2025 Portfolio Composition

The portfolio contains ~20 ATS trading strategies deployed on various instruments and timeframes.

Instruments Traded

NQ (Nasdaq futures)

MNQ (Micro Nasdaq)

ES (E-mini S&P 500)

ZN (10-Year Treasury Note)

ZB (30-Year Treasury Bond)

Account Structure

All strategies run on simulated accounts

Some accounts run multiple instruments or timeframes

At the end of each quarter, I remove poor performers and replace with standouts from the Incubator.

The Incubator is running variations of the first 100 strategies. In Q4, I’m adding embedded strategies.

The hope is to obtain as much actual data as possible for ML pattern recognition analysis by year’s end.

Strategy Links

Automated Trading Strategies: Strategy #1 (unlocked)

Automated Trading Strategies: Strategy #2

Automated Trading Strategies: Strategy #3

Automated Trading Strategies: Strategy #5 (unlocked)

Automated Trading Strategies: Strategy #6

Automated Trading Strategies: Strategy #7

Automated Trading Strategies: Strategy #8

Automated Trading Strategies: Strategy #9

Automated Trading Strategies: Strategy #10

Automated Trading Strategies: Strategy #11

Automated Trading Strategies: Strategy #12

Automated Trading Strategies: Strategy #13

Automated Trading Strategies: Strategy #14

Automated Trading Strategies: Strategy #23

Automated Trading Strategies: Strategy #24

Automated Trading Strategies: Strategy #25

Automated Trading Strategies: Strategy #26

Automated Trading Strategies: Strategy #28

Automated Trading Strategies: Strategy #29

Automated Trading Strategies: Strategy #30

Automated Trading Strategies: Strategy #31

Automated Trading Strategies: Strategy #32

Automated Trading Strategies: Strategy #33

Automated Trading Strategies: Strategy #34

Automated Trading Strategies: Strategy #35

Automated Trading Strategies: Strategy #36

Automated Trading Strategies: Strategy #37

Automated Trading Strategies: Strategy #38

Automated Trading Strategies: Strategy #39

Automated Trading Strategies: Strategy #40

Automated Trading Strategies: Strategy #41 and 41a

Automated Trading Strategies: Strategy #42

Automated Trading Strategies: Strategy #43

Automated Trading Strategies: Strategy #45

Automated Trading Strategies: Strategy #46

Automated Trading Strategies: Strategy #47

Automated Trading Strategies: Strategy #48

Automated Trading Strategies: Strategy #49

Automated Trading Strategies: Strategy #0

Automated Trading Strategies: Strategy #50

Automated Trading Strategies: Strategy #51

Automated Trading Strategies: Strategy #52

Automated Trading Strategies: Strategy #53

Automated Trading Strategies: Strategy #54

Automated Trading Strategies: Strategy #55

Automated Trading Strategies: Strategy #56

Automated Trading Strategies: Strategy #57

Automated Trading Strategies: Strategy #58

Automated Trading Strategies: Strategy #59

Automated Trading Strategies: Strategy #60

Automated Trading Strategies: Strategy #61

Automated Trading Strategies: Strategy #62

Automated Trading Strategies: Strategy #63

Automated Trading Strategies: Strategy #64

Automated Trading Strategies: Strategy #65

Automated Trading Strategies: Strategy #66

Automated Trading Strategies: Strategy #67

Automated Trading Strategies: Strategy #68

Automated Trading Strategies: Strategy #00

Automated Trading Strategies: Strategy #69

Automated Trading Strategies: Strategy #70

Automated Trading Strategies: Strategy #71

Automated Trading Strategies: Strategy #72

Automated Trading Strategies: Strategy #73

Automated Trading Strategies: Strategy #74

Automated Trading Strategies: Strategy #X

Automated Trading Strategies: Strategy #75 (Part 1)

Automated Trading Strategies: Strategy #75 (Part 2)

Automated Trading Strategies: Strategy #76 (Part 1)

Automated Trading Strategies: Strategy #76 (Part 2)

Automated Trading Strategies: Strategy #78

Automated Trading Strategies: Strategy #79

Automated Trading Strategies: Strategy #80

Automated Trading Strategies: Strategy #81

Automated Trading Strategies: Strategy #82

Automated Trading Strategies: Strategy #84

Automated Trading Strategies: Strategy #40_rev

Automated Trading Strategies: Strategy #85

Automated Trading Strategies: Strategy #86

Automated Trading Strategies: Strategy #87

Automated Trading Strategies: Strategy #88

Automated Trading Strategies: Strategy #89

Automated Trading Strategies: Strategy #90

Automated Trading Strategies: Strategy #91

Automated Trading Strategies: Strategy #92

Automated Trading Strategies: Strategy #93

Automated Trading Strategies: Strategy #94

Automated Trading Strategies: Strategy #94v2

Automated Trading Strategies: Strategy #95

Automated Trading Strategies: Strategy #96

Automated Trading Strategies: Strategy #101

Dollar Volume and Adaptive Dollar Volume Bar Type

LLM Generated Evaluation Strategies

Automated Trading Strategies: Strategy #102 (a, b, c)

Automated Trading Strategies: Strategy #103

Big Things Coming For ATS

When ATS first started, the goal sounded naive: find the holy grail of automated trading strategies. Over time I came to realize that I was looking for a process, rather than a strategy. Not one silver bullet, but a repeatable way to discover robust pieces—signals, regime filters, risk frameworks—and assemble them into something that survives contact with reality. It felt impossible. It feels less impossible now, especially with help of hidden regimes. So it’s time for another Live Test! You can read more about the results of the first live test here: https://automatedtradingstrategies.substack.com/p/we-found-some-champions-whats-next

January 4, 2026: Live Test #2

Live Test #2 will start on Sunday, January 4th, 2026. This round centers on a family of Hidden Markov Model (HMM) strategies and an HMM‑based portfolio. In plain terms, HMMs help infer “hidden regimes” in the tape—quiet vs. volatile, trending vs. mean‑reverting—and adapt entries and position sizing accordingly. You can read more about HMM theory and how I’ll be applying it in the following series:

From Codebreaking to Market Mastery: How Jim Simons Used Markov States To Find Hidden Patterns (Part 1)

Predicting People, Not Prices (Part 2)

What I’ll do:

Run on a focused set of futures contracts

Declare rules up front

Track live slippage, fees, heat (MAE), and drawdown

Publish periodic field notes: what held up, what cracked, what we iterate next

I skipped a live test last year—Hurricane Helene and a devastating loss in my family made it difficult to focus. But here I am, one year later. This matters to me.

Why Futures?

Early on I had to narrow from “all assets” to one arena. I chose futures because:

Liquidity & microstructure: tight markets, near 24/5 sessions, standardized contracts.

Built‑in shorting & leverage: no borrow mechanics; cleaner execution.

Comparable canvases: many contracts share similar mechanics, which helps methodical testing.

Can these ideas run elsewhere? Often yes—markets are markets if volume and execution quality are there. That said, translation isn’t copy‑paste; each market has its own frictions and anomalies.

What’s Coming In 2026

The first part of 2026 will be dedicated to the HMM Live Test and then in Late 2026 I’m going to start sharing surveys of a new and emerging landscape—the DeFi world—especially stablecoin pairs. Trump’s Genius Act is set to unleash this market in 2027 and I want us to be ready for it.

It’s a wild frontier: open mempools, MEV behaviors (priority auctions, back‑running, sandwiching), flash loans that allow no‑collateral leverage within a single transaction, and liquidators that help protocols self‑correct. These are proto‑markets—small constellations that sometimes look like the Orion’s Belt of market design, but the volume is massive.

I’m not advocating for illegal activity in any way, but one of the most interesting aspects of DeFi is that behaviors which are mechanically possible (and sometimes even expected) are considered illegal or at the very least unethical in traditional venues. Any translation between the two requires care and compliance, which will be the goal.

I study these markets not primarily for profit (though that’s a side benefit), but to understand how incentives—and the human/digital agents responding to them—shape order, volatility, and resilience. Some lessons may loop back to futures; some will stay uniquely on‑chain.

Thank you

Exploration takes time, capital, and patience. Your support turns curiosity into hard data. I’ll keep doing what I do best: go out, test, and return with a better map. See below for a list of all published strategies.

Onward to Live Test #2!

Click here for a list of FAQs.

Please let me know if you have any questions: Celan at AutomatedTradingStrategies@protonmail.com

Subscribers, see below for more information on AI Generated Strategies and where to find them.