Automated Trading Strategy #90: A Systematic Approach To Solving The Market's Daily Riddles

It's a Wonderful Trade: The Adaptive Life

Important: There is no guarantee that ATS strategies will have the same performance in the future. I use backtests and forward tests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. Forward tests are based on live data, however, they use a simulated account. Any success I have with live trading is untypical. Trading futures is extremely risky. You should only use risk capital to fund live futures accounts and if you do trade live, be prepared to lose your entire account. There are no guarantees that any performance you see here will continue in the future. The best way to trade is with a simulated account on live data. I recommend using ATS strategies in simulated trading until you/we find the holy grail of trade strategy.

As a quick reminder, we’re on the hunt for the holy grail of automated trading strategies. If you have any questions, start with the FAQs and if you still have questions, feel free to reach out to me directly (AutomatedTradingStrategies@protonmail.com).

All published strategies are linked here.

Let’s get into it…

"The real voyage of discovery consists not in seeking new landscapes, but in having new eyes."

Marcel Proust

In Part 1 of this series, we explored a parallel between machine learning research and trading strategies. We examined how binary trading signals—like crossing above or below a threshold—can create deceptive "sudden" signals. These signals often mask the true gradual nature of market movements, leading to false signals and missed opportunities. Through extensive research into automated trading indicators, I developed a framework to address these issues. This framework led to Strategy 88—elegant in theory, but not the best in practice.

Strategy 89 was an attempt to fix Strategy 88. In particular, the challenges created when developing high frequency trading strategies—namely poor backtest results. So today, in Part 3, I want to pivot back to using this framework to develop strategies that produce the most reliable backtests.

Which strategies tend to have the most reliable backtests?

After four years of documented backtests, two years of forward tests, and live trading across personal and funded accounts, here's the golden rule for getting a more reliable backtest: focus on low frequency (15 or higher), minute based charts that calculate on bar close.

It’s no surprise that 95% of all strategies in the ATS 2024 Q4 Forward Test (for the latest Mudder Report click here) operate on extended minute bars. Put simply: low-frequency, single time series analysis is our target zone because it produces more reliable backtest results.

Enter Strategy 90—the culmination of this work.

Strategy 90: Same Players, New Angles

Our framework has evolved like a chess game, with each move building on the last:

Part 1: Continuous vs. discrete indicators (the opening moves)

Part 2: Trending vs. range-bound indicators (the middle game)

Part 3: Reactionary vs. predictive signals (the endgame)

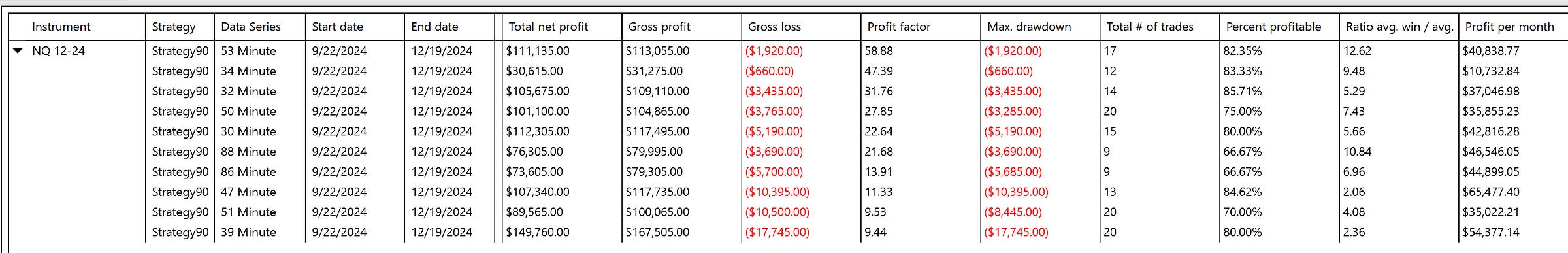

Strategy 90 recently completed its initial backtesting phase. I like to backtest strategies on NT8 using the most recent contract when using NT’s historical data. The end of a contract expiration is the best time to run a backtest as I’ve found many data issues tend to occur just before, during and just after contract roll. Using a 53-minute NQ chart with 3 contracts per trade, Strategy 90 generated $111K in profits during the September contract (9/22/2024 to 12/19/2024). From a net profit perspective, the 30 minute chart shows the best results.

With 30 parameters, the optimization of this strategy is on only two variables: the data series and position sizing. All other parameters are default. Here’s a look at the top ten optimizations by profit factor.

The profitability metrics look great, but like any trading system, there's room for growth and refinement—specifically in trade frequency and drawdown management. But, this is a solid foundation to build on and I’ll definitely be adding it the Q1 2025 Forward Test.

Quick side-note: I didn’t come up with this strategy by myself. I had some help from the LLM ChatGPT using the new Open o1 Pro mode model. I’m looking forward to seeing what the o3 model can do with Strategy 90 in January because, as I think you’ll agree, some of the structures used in this version are truly out of the box. Working with LLMs is expanding my awareness with a completely different possibility set.

Using Conventional Indicators In Unconventional Ways

Strategy 90 is unconventional, at least from anything I’ve seen. It steps outside the Cartesian cage of NT8s trading environment. It’s still a code-bound logic system, which can be easily backtested, but it is configured to observe, detect, and limit exposure when conditions become chaotic. It does so using conventional indicators in unconventional ways. That self-awareness mirrors the idea of momentarily escaping the cage of limitations. For example, Strategy 90 uses:

Hysteresis/Confirmation Logic to avoid reacting to every data point, acknowledging the system’s potential illusions.

Adaptive Sizing in the form of a feedback loop (mini–machine-learning concept) to allocate resources.

This framework didn't emerge fully formed. It evolved through many iterations and three distinct research phases, each revealing something crucial about market behavior.