Automated Trading Strategy #88: A New Framework For Automated Trading Strategy Development

LLMs are taking automated trading strategy development to a new level...

Important: There is no guarantee that ATS strategies will have the same performance in the future. I use backtests and forward tests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. Forward tests are based on live data, however, they use a simulated account. Any success I have with live trading is untypical. Trading futures is extremely risky. You should only use risk capital to fund live futures accounts and if you do trade live, be prepared to lose your entire account. There are no guarantees that any performance you see here will continue in the future. This is why the best way to trade is with a simulated account on live data. I recommend using ATS strategies in simulated trading until you/we find the holy grail of trade strategy.

As a quick reminder, we’re on the hunt for the holy grail of automated trading strategy. If you have any questions, start with the FAQs and if you still have questions, feel free to reach out to me directly (AutomatedTradingStrategies@protonmail.com).

A list of all published strategies is available here.

The Q4 Forward Test Results for the week ending November 15th was published via ATS Chat on the 17th. Look for results for the most recent week to be published shortly. Subscribers, if you aren’t receiving these updates, please make sure ATS Chat is enabled on your account.

Let’s get into it…

In Part 1 of this series, we explored an intriguing parallel between machine learning research and trading strategies. Drawing insights from the paper "Are Emergent Abilities of Large Language Models a Mirage?", the discussion centered around the limitations of binary trading signals, such as crossing above or below a threshold, and how they might inadvertently generate "sudden" signals. These signals often misrepresent the gradual nature of underlying market movements, leading to two key problems:

False signals, resulting in direct trading losses.

Missed moves, causing opportunity costs.

Both scenarios can put a dent in your trading account. So, what can we do to mitigate these issues?

I conducted a literature review of effective indicators for automated trading strategies. This review led to five essential factors for building more robust indicator pairs:

Embracing continuous movement: Recognizing gradual trends rather than reacting to abrupt changes.

Implementing range-based signals: Avoiding rigid binary thresholds in favor of dynamic ranges.

Trading probabilistically: Shifting from deterministic signals to probabilistic frameworks.

Using smart smoothing techniques: Balancing signal noise with responsiveness.

Focusing on market structure: Prioritizing indicators that align with the underlying market behavior.

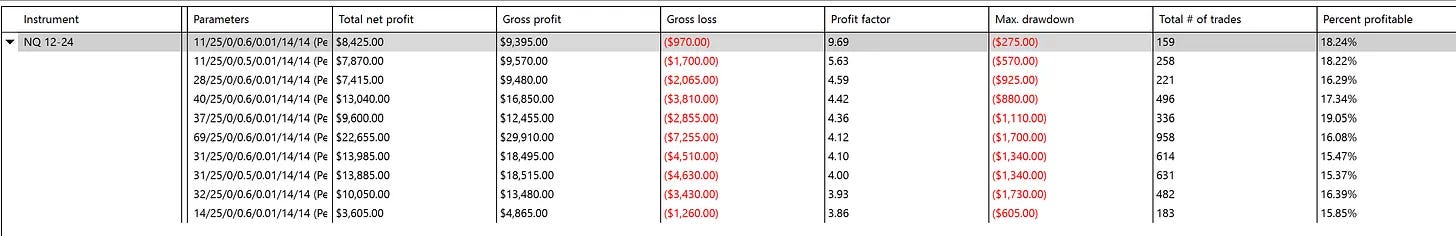

With these principles in mind, I’ve developed a new framework. I used this new framework to develop Strategy 88 (available for download below). Here’s a snapshot of final performance results from the backtest.

While the net profit is modest, the low drawdown makes this strategy highly scalable for trading multiple contracts and instruments. Impressively, the highest Maximum Adverse Excursion (MAE) is just $45, and the longest trade duration is only 7 minutes. Strategy 88's core focus is executing numerous small trades to capture that one big winner. In general, the strategy hits a ball every five tries, and every now and then one of those hits turns into a home run. If you’ve been following ATS, you know this is the profile I’ve been hunting for. Needless to say, I’m eager to see how it performs in forward testing!

I believe this evolving framework is leading us into rich hunting ground. In this post, I’ll walk you through the entire process so you can not only replicate my results, but apply this framework to your own strategies.

A New Framework Is Developing

A more structured approach to automated trading development is taking shape for ATS. This emerging framework follows six key steps: