Important: There is no guarantee that these strategies will have the same performance in the future. I use backtests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. Even with forward tests, there is no guarantee that performance will continue in the future. Trading futures is extremely risky. If you trade futures live, be prepared to lose your entire account. I recommend using these strategies in simulated trading until you/we find the holy grail of trade strategy.

About once a month I receive an email from someone who is concerned about front-running. Front-running is when a broker/agent makes an order based on information from the client. In other words, it’s a form of insider trading.

What I tell people is to always assume the market is full of sharks, because it is. There will always be sharks and there will always be front-running. The trick is to learn how to take advantage of shark activity—become the Remora.

Channel Your Inner Remora

The hardest part about becoming a Remora is finding the sharks. Who are the major players and how do they operate? My favorite resource for studying sharks is SEC enforcement actions.

One of the most interesting cases was filed in January of this year. It was interesting for many reasons, but most notably because of the depth of the phone transcripts included in the brief. What’s truly interesting is that the government doesn’t say how it obtained the calls (which scared the hell out of Wall Street), but if I had to guess I would say that the SEC was already investigating suspicious trades by hedge funds. No doubt the clients (also sharks) suspected leaks as well and you never want to piss off a shark. Someone had to take the blame. The investigation led to a $250 million fine for Morgan Stanley—drops in a bucket.

Who are the sharks?

Sharks are portfolio managers at hedge funds, investment companies, advisors for major investment management companies, exchange members and member firms, broker/dealers, pension funds, commodity pools, corporations, insurance companies, depository institutions, high net-worth individuals and politicians like Nancy Pelosi (yes I went there). They are very good at finding low-risk, high-alpha opportunities because they generally have access to insider information.

Perhaps the most knowledgeable sharks are those that bid on block trades like Pawan Passi, former head of the equity syndicate desk at Morgan Stanley. I say former because Passi is one of two employees named and censured in the case against Morgan Stanley. Before getting into the details of Passi’s ‘scheme’, let’s review what a block trade is.

What are block trades?

Block trades involve the sale of large quantities of shares or contracts. They are often privately arranged and executed outside of public markets. So instead of having to worry about a price change if you need to sell 10,000 shares, you can go to a shark and negotiate a deal to buy those shares. They get a discount and you get to offload those shares without risk.

You can learn more about how the CME handles block trades here.

In general, there are three different time stamps associated with a block trade:

When a firm order is received;

When the block trade is executed; and

When the trade was reported to the exchange.

The closer you are to #1, the more the information is worth and the more leverage you have. The information that sharks carry is so valuable that it is considered ‘material, non-public’ information, which is the equivalent of a gag order in the financial world. On a chessboard, these people are rooks or queens. People watch their actions. When they talk, people listen. If they do trade or make money on this information, it is a type of front-running (legal or not), and this is what Morgan Stanley was accused of with several hedge funds.

According to the SEC’s order, Passi and a subordinate on Morgan Stanley’s equity syndicate desk engaged in front-running from June 2018 through August 2021. It is curious that Passi was the only domino to fall, but I have no doubt he received at least 10 job offers after the announcement was made. I’m not saying that what he did was okay, but on Wall Street the dialogue/exchange below is quite normal. Now that they know the SEC is tapping phones, the communication might change, but the activity will always be there.

This next part gets a bit tedious, but it provides a great deal of insight into a day in the life of a shark.

In the financial crimes and civil justice system, the people are represented by two separate yet equally important groups: the Securities and Exchange Commission (SEC) who investigates crime and The Enforcement Division that assists the Commission to prosecute the offenders. This is one of their stories.

Dun-Dun

According to the SEC, on March, 19, 2019 an investment management company decided to sell a large block of Invitation Homes Inc. (INVH). At 1:35 pm the company sent Morgan Stanley an invitation to bid on the shares in what is referred to as a ‘bid-wanted-in-competition (BWIC)’ email. BWICs are considered a legal document which pre-conditions a firm’s participation in the bid process on confidentiality.

The BWIC email went as follows:

As we just discussed, we appreciate your protecting the confidentiality of this discussion from the marketplace, as well as your consideration and thoughts.

The email then asked Morgan Stanley to submit bids on INVH. At the same time, in the exact same minute (1:35 pm), Passi called a portfolio manager of a hedge fund based in Hong Kong. Between 2:10 pm and 4:03 pm the portfolio manager at the hedge fund sold 950,000 shares or approximately $22.2 million of INVH. INVH closed at $23.30, down 1.3% from its price at 2:10 pm.

At 4:18 pm, Morgan Stanley submitted a bid of $23.22 on 43 million shares of INVH, which was accepted. The hedge fund was then allocated 2.5 million of those INVH shares obtained by Morgan Stanley at a total cost of $58.25 million. In the end, Morgan Stanley made $3.5 million on the deal.

Not bad for a day’s work.

What is the Remora doing while all of this is going on? The Remora waits for a signal. From a timestamp perspective, that signal occurs when block trades are reported to the exchange. You can sign up to receive block alerts from the CME directly here. Most platforms have block trade indicators as well. Here’s a screenshot of a 30 minute NQ chart showing block trades from 3/28 to 4/2:

The top is by volume and the bottom is by the number of trades. The former focuses on total volume, while the latter focuses on units per transaction. The number of trades can tell you how consolidated the block is.

For example, if a block trade involves 10 transactions at 100 contracts each, the number of units is 1,000, but the number of trades is 10. Using the same example, the volume of this block trade would be 1,000.

It took a while, but eventually I came up with a strategy based on block trades that has the following backtest results over the last year:

As you can see: 1) profit factor, 2) the percentage of profitable trades, and 3) the MAE to MFE ratio are very attractive given the number of trades. The MFE can be attributed to the strength of the block trade. Also note that less than 10% of the trades closed at the end of the session, which is a testament to the strength of the exit signal.

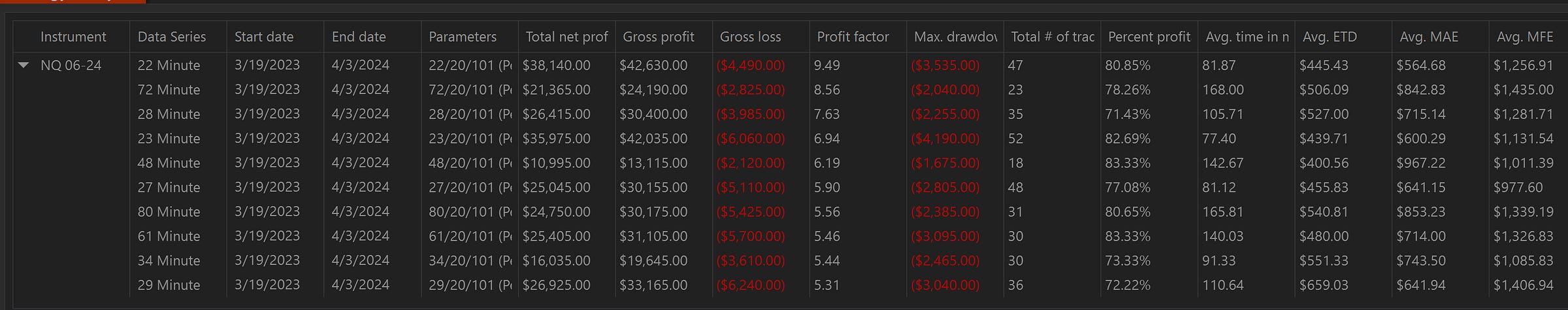

I’ve also included four slightly different variations of the same entry command for this strategy. If we assign contract quantity based on the strength of each variation, the backtest looks like this:

Instead of just increasing net profit, we’ve also increased the profit factor with this technique. I’ll show you how I calculated the number of contracts to allocate to each variation in a moment. You can also start off by just trading the strongest signal.

Strategy 81 Description, Command Structure & Download (C#): Block Trades Rock

Strategy 81 requires the use of four indicators: