Automated Trading Strategy #84: Dormancy Mechanisms

What can we learn from seed strategy?

Important: There is no guarantee that our strategies will have the same performance in the future. We use backtests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results we share are hypothetical, not real. Forward tests are based on live data, however, they use a simulated account. Any success I have with live trading is untypical. Trading futures is extremely risky. You should only use risk capital to fund live futures accounts and if you do trade live, be prepared to lose your entire account. There are no guarantees that any performance you see here will continue in the future (good or bad)—that’s what makes the hunt for the holy grail so difficult. This is why the best way to trade is with a simulated account on live data. I recommend using ATS strategies in simulated trading until you/we find the holy grail of trade strategy.

We’re on the hunt for the holy grail of automated trade strategy. We haven’t found it yet, but we get closer every day. Click here for links to all strategy descriptions and here for answers to some frequently asked questions.

Animals are something invented by plants to move seeds around.

Terence McKenna

Automated Seed Strategies

Squirrels are fascinating creatures. If I did have a personal mascot, it would be the squirrel. My first pet was a flying squirrel. One of my dogs is named Squirrel. I sponsor several video feeds across the world to study squirrels. If, as the late Terrence McKenna postulated, animals were designed by plant-life to help with seed distribution, I have no doubt that the squirrel would be their holy grail. Studies suggest that ground squirrels fail to recover about 26-74% of the nuts they bury.

On March 6, 2012, Russian scientists published a paper that shocked the world. They announced the discovery of a stash of seeds buried in the permafrost of northeastern Siberia. According to the paper, the seeds were buried some 31,800 ±300 years ago by Arctic ground squirrels in ancient, fossilized burrows buried 38 meters below the surface. The fruit found was undisturbed and had never been thawed from a temperature of −7 °C—they were preserved in pristine condition. Amazingly, scientists were able to extract some of the seeds from the fruit. The plant that emerged was identified as Silene stenophylla, a flowering plant native to Siberia.

Some plants have seeds that sail with the wind. Other plants have developed ways to use time as a measure of distance. The latter developed seed coats and dormancy mechanisms to protect the genetic material of each seed from environmental factors—these seeds developed an evolutionary edge over those that had no protective coating.

There are many different types of seed dormancy mechanisms: Cyclamen seeds exhibit morphophysiological dormancy, where both embryo and physiological factors play a role. Serotinous plants have cones or fruits that remain closed and protect the seeds until they are exposed to the intense heat of a fire ensuring that seeds are released onto nutrient-rich ash soil. It also eliminates competition in the process — the Jack Pine, Lodgepole Pine and Banksia shrub have serotinous cones that open and release seeds when exposed to wildfire. Many fruit seeds, such as those of berries, cherries, and tomatoes, can only germinate after being eaten and excreted by animals. In this way the animal acts as both taxi and fertilizing agent.

The diversity of dormancy mechanisms across different plant species highlights the brilliant and enduring strategies plants have employed across millenniums to survive and thrive in diverse ecological niches. Perhaps we can use nature as a guide to help develop our own dormancy mechanisms to improve the robustness of automated trading strategies in diverse market regimes.

Can Seed Dormancy Mechanisms Help Us Find The Holy Grail

Sometimes big trees grow out of acorns - I think I heard that from a squirrel.

Jerry Coleman

There are some interesting similarities between the concepts of seed dormancy and creating a profitable automated trading strategy. Both processes involve improving the viability of an automated program (one is biological and the other artificial).

If there’s anything I’ve learned from the live test and the forward test, it’s that most strategies do well under the right market conditions. The conundrum is identifying those conditions. Likewise, the seeds of the Silene stenophylla had no way to predict the future, but they could use a dormancy trigger to enable the seed’s program when optimal environmental conditions emerged. If time is on your side, an intrinsic attribute of automated systems, the seed does not need to adapt itself to all market conditions, only the best one.

Strategy 84 is a simple strategy, but it has a filter that can be applied to all automated strategies. I’ve been playing around with it myself over the last three months and I think it’s a real game changer in the hunt.

How much of a game changer?

I was able to take the most basic strategy and make it highly profitable. For example, here’s an example of a simple strategy that anyone could make:

Enter Long when MACD crosses above the MACD average

Exit Long when MACD crosses below the MACD average

These are the backtest performance results from this strategy if run over the last two months:

The strategy is profitable, but not as much as I like to see in backtests. It also requires large drawdowns. On average it made ~60 trades or 1.5 trades per day, and has an average percent profitability of less than 50%. What happens if we add a dormancy mechanism?

This is the same strategy, but it uses a dormancy mechanism to help focus on the most profitable trade opportunities. Average profit factor is up considerably from a median average of 1.86 to 8.48. The average percentage of profitable trades has increased significantly as well. Perhaps the most dramatic difference from a risk management perspective is the considerable decline in drawdown.

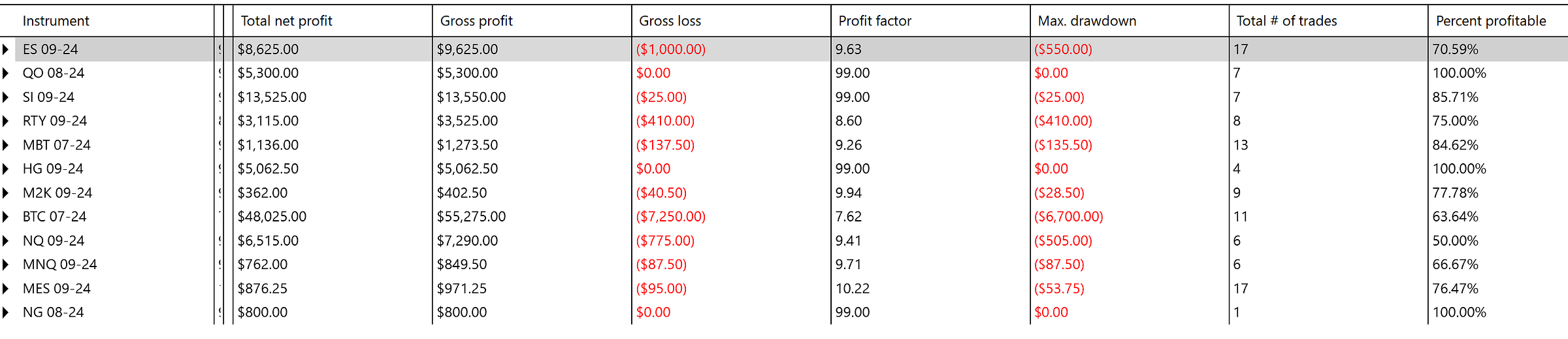

Low trade count is an issue, but you can use this dormancy mechanism across instruments. These are the results after running the same strategy and filter across a basket of futures instruments over the last two months:

Again, I’m not changing the strategy. The strategy itself is still very simple, but the filter allows us to focus attention on the most profitable trade opportunities.

I truly believe this filter is a game changer for the hunt. I hope you enjoy using it as much as I do.

Now, let’s get into how to create this filter for your own seeds.