Automated Trading Strategy #65

This portfolio has a backtested win rate of 91.86% on 639 trades over a one year period from April 1, 2022 to April 1, 2023. It made $61K and has a combined profit factor of 2.54.

Important: There is no guarantee that our strategies will have the same performance in the future. We use backtests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results we share are hypothetical, not real. There are no guarantees that this performance will continue in the future. Trading futures is extremely risky. If you trade futures live, be prepared to lose your entire account. We recommend using our strategies in simulated trading until you/we find the holy grail of trade strategy.

As a quick reminder, our goal is to find the holy grail of automated trade strategy.

We haven’t found the holy grail yet, but we get closer with every strategy. Click here for the most recent performance chart.

Strategy 65

I’ve become mildly obsessed with Chat GPT. If you ask it questions about the market, you’ll get a boilerplate response about how it, as AI, can’t make determinations about the market along with all the obligatory warnings regarding market risk. So, I decided to ask it about something that—on its face—has nothing to do with “the market”, but rather auction mechanics.

The futures market is actually a Dutch auction; the result of tulip auctions conducted by Dutch traders in the 1600’s. They wanted to buy and sell tulips year round, not just for 3 months of the year, and the futures market was born. For more on the impact of Dutch auctions on price movement in the futures market click here.

So I decided to ask Chat GPT a question about Dutch auctions:

What is the best strategy to win a Dutch auction?

This was the answer:

A Dutch auction is a type of auction in which the auctioneer starts with a high asking price and gradually lowers it until a bidder accepts the price. In a Dutch auction, the winner is the first bidder to accept the current price.

To increase your chances of winning a Dutch auction, you can consider using the following strategies:

Research the product: Before the auction starts, do your research on the product you're interested in. Know its market value and set a maximum price that you're willing to pay for it.

Wait for the right time: In a Dutch auction, the price drops as time passes. It's important to wait for the right moment to bid, when the price is in your desired range.

Be patient: In a Dutch auction, it's important to be patient and wait for the price to drop to your desired level. Don't be tempted to bid too early, as you may end up paying more than you need to.

Be decisive: Once the price drops to your desired level, be decisive and make your bid. Remember that the first bidder to accept the current price wins the auction, so don't hesitate or wait too long.

Set a limit: Set a limit for yourself and stick to it. Don't get carried away and bid beyond your maximum price, as this can lead to overpaying for the product.

Overall, the key to winning a Dutch auction is to be well-informed, patient, and strategic.

I was struck by the answer. It’s a bit general, but it hit on some very important points.

In trading, being strategic means developing a trade plan and then waiting for the market to come to you. Human nature complicates strategic thinking with FOMO related noise, so many of us use automated trading systems as a way to force some degree of patience into the decision making process.

What we’ve found over the years is that there are many barriers to finding a successful automated trading system, i.e. simulation error, alpha decay, bias of one kind or another. The only way to know for certain is to forward test each strategy and note the critical success factors of those strategies that produce the best (most consistent) results, which is what we’re doing in the Mudder Report on a weekly basis. For Strategy 65 we’ve applied what we’ve learned from the Mudder Report with one of my favorite indicators. We’re also using a new chart type inspired (in part) by Chat GPT.

With Strategy 65, we’re using various strategies learned over the last two years to not only boost profit factor, but increase the win rate. Win rate is one of the most important determinants of success based on our research.

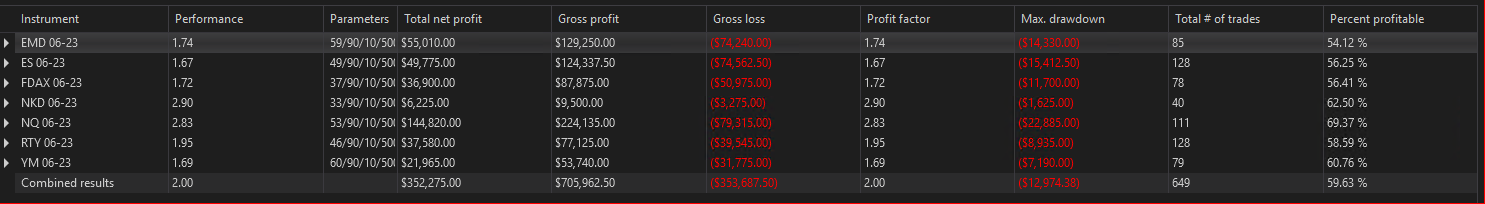

These are the results of Strategy 65 over the time period: April 1, 2022 to April 1, 2023 for equity futures:

The strategy has a profit factor of 2 on 649 trades and a win rate of 60%. It also made $352K for the year, $144K of which came from one NQ contract. NQ also has one of the highest profit factors and win rates at 2.83 and 69%, respectively.

I wanted to boost the win rate even higher so we added a few restrictions. I will explain what those restrictions are in a moment. These were the results:

You’ll notice that net profit has gone down considerably, but the win rate is now at 91.86%. Drawdown has also dropped from $13K to $2,579, and we still have approximately the same number of trades. This is a portfolio with a lower net profit, but a higher win rate, which limits risk.

Risk: Drawdown Vs. MAE

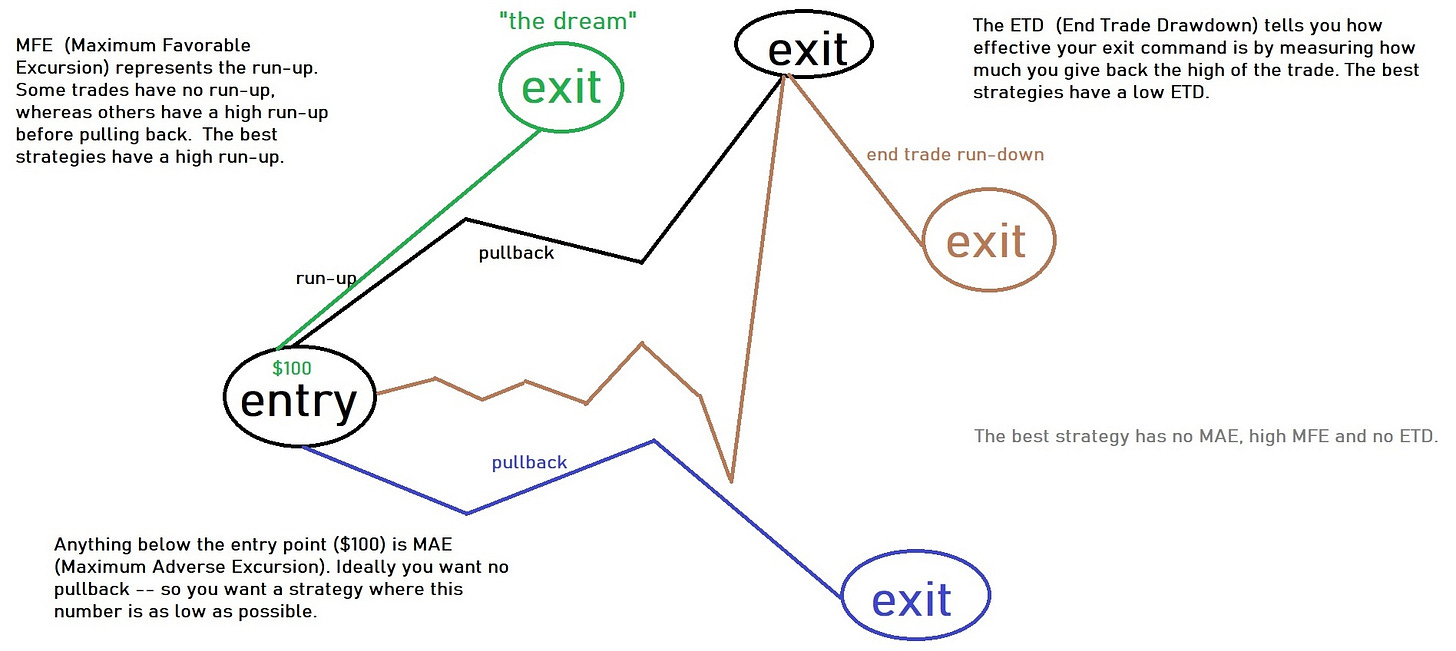

Let’s take a few minutes to discuss risk. Drawdown is one type of risk. It is the lowest the account balance has ever gone after hitting a high and after all trades are closed. It does not tell you how low the account balance fell while trades were open. In this way, strategies with high win rates can be deceptive. The only metric that can give you the max drawdown while the trade is open is the max adverse excursion (MAE). Here’s an illustration I created for a previous post explaining how to think about and use MAE, MFE and ETD:

Ideally, you want no pullback. This is especially important for those of you applying for funding. Most tests also have an intraday/trade trailing stop, so it’s more important to look at the lowest MAE for a strategy rather than drawdown.

For Strategy 65 (NQ), we have a drawdown of $1,520, but the highest MAE is $1,930. As you can see from the chart below, that happened on 6/15/2022.

You’ll also notice that it’s the worse performing day of the year. In fact, it is one of only three trades with a negative net profit. To be clear, only three of the 129 trades made by the strategy were unprofitable and the average MAE is less than $500.

The implications for this are amazing, especially when it comes to using more than one contract on more than one instrument. For example HO and RB appear to have high win rates as well. I’ve provided the performance results on Strategy 65 for metal, fx, rate, ag and energy futures at the end of this post.

Strategy 65 Description, Command Structure & Download (C#)

Before I provide a description of the strategy, screenshots of the strategy builder in NT8, and a download, I want to take a moment to explain why I decided to use this new data series.

As stated above, I’m obsessed with Chat GPT. In addition to asking about auction strategy, I also wanted to know what its thoughts were regarding price. In particular, the ability to predict the direction of price. This is the question I asked and the answer that followed: