YWe are constantly looking for ways to improve strategy performance. So, when we received a question from R8 (thank you R8) asking us to provide MFE, MAE and ETD stats, we jumped at it. In this post, we’re going to look at how these three metrics can be used to tell us which strategies have the best entry, exit and run-up statistics. In particular, we’re looking for best practices to apply to all strategies going forward.

Let’s start by looking at some definitions:

Average MAE (Maximum Adverse Excursion)

MAE or Maximum Adverse Excursion tells us how far back in price a trade tends to go using a particular strategy. In other words, once you’ve entered a trade, how far does it move in the opposite direction. A trade with a low MAE suggests you have a poor entry command and vice versa.

It is defined as worst price trade reached – entry price.

The higher the number, the worse your entries are. So, the best trades have a low MAE. The lower, the better. A strategy with a high number might benefit from the use of limit orders as long as it doesn’t throw off the flow of the trade.

Average MFE (Maximum Favorable Excursion)

The MFE or the Maximum Favorable Excursion is the opposite of MAE. It tells us how far (in a positive direction) a trade tends to go after entry. A trade with a low MFE suggests you have a poor entry command and vice versa.

It is defined as best price trade reached – entry price.

The higher the number, the better your entries are. In other words, strategies with a high MFE should be highly profitable, but it’s up to you to capture that profit with the trade strategy. The higher, the better. A strategy with a high number might benefit from the use of take profit orders as long as it doesn’t throw off the flow of the trade.

Average ETD (End Trade Drawdown)

The ETD or End Trade Drawdown tells you how much you give back from the high of each trade.

It is defined as best price trade reached – exit price.

The lower, the better. You want a low number because it means the strategy captures the full price movement. This is especially the case for high MFE strategies. If it’s a high number, however, it’s a great opportunity to make use of take profit orders to take advantage of the price movement. For example, a good way to mine for diamonds in the rough might be to find a strategy with a high MFE and a high ETD. This is a poorly performing strategy that has great potential. You might be able to capture that potential with a take profit command at the average MFE or ETD.

Finding The Best Pathway

Trading is a dark scary forest and we’re on the hunt for something few have ever witnessed — the holy grail of trade strategy. Specifically, we are in search of the perfect pathway that can get us to the other end of the forest without being eaten.

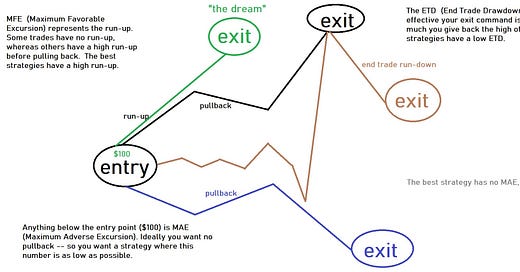

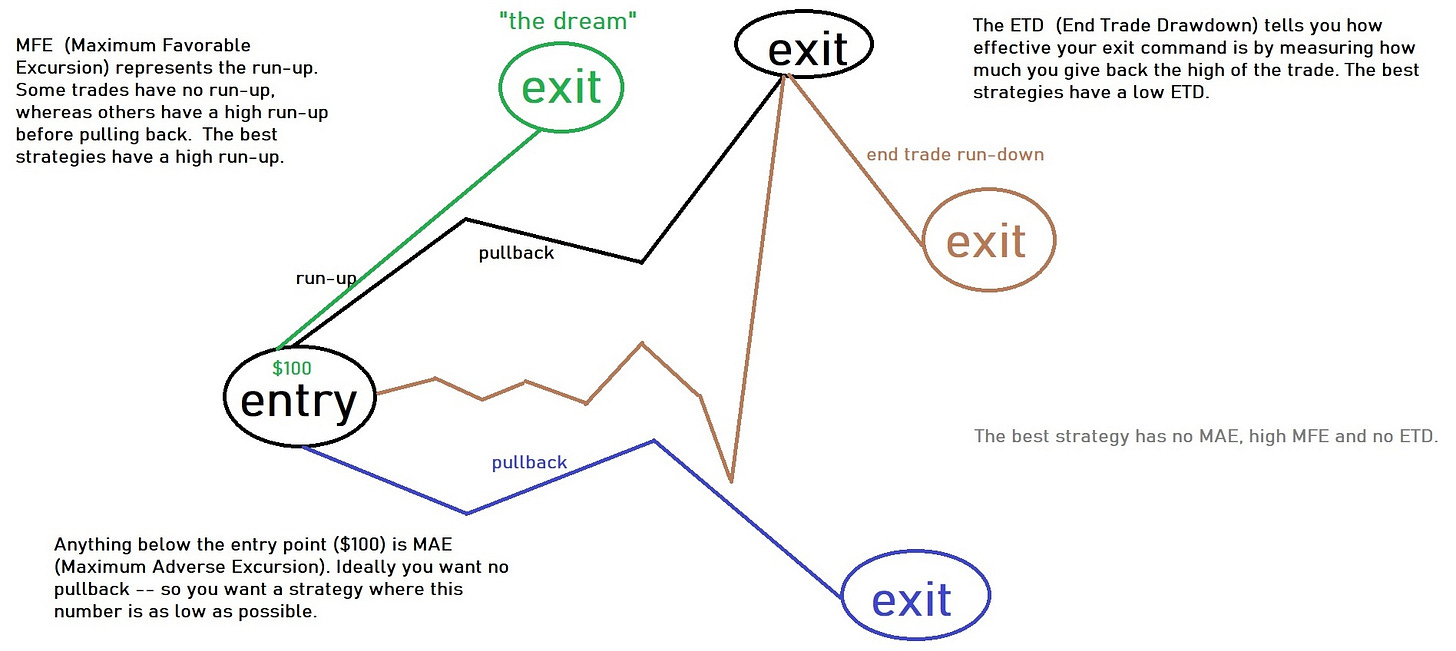

In the picture below, the best pathway of all is a trade with no MAE or ETD — marked in green. This is the “'dream trade”. It has no pullback. It just goes from entry to exit with ease. The only true trending market is “the dream”, which rarely happens. All other pathways are endemic of a choppy market. Choppy markets also tend to have higher pullback and run-up statistics — this is why traders have a love/hate relationship with volatility. In general, the longer the wicks on the candlestick bar, the choppier the market. We’ll be talking about this more in future posts, especially now that the VIX (INDEXCBOE: VIX) has crossed above its 180-day moving average.

Now, let’s talk a little more about the best pathway to take. We know “the dream” trade is the best pathway to take so we can either create a strategy that only enters “the dream” trade, or we can create a strategy that can trade well regardless of market chop.

The picture above shows four pathways for the same entry. The average trade of any one strategy looks like one these four pathways.

The initial pullback is the MAE. If your trade never drops below $0, it has an MAE of $0. This is ideal.

Your last pullback is your ETD. If your trade never drops below $0 after reaching the trade high, it has an ETD of $0. This is ideal.

The dream trade has the following profile:

MFE = Unlimited

MAE = $0

ETD = $0

So, if you’re trying to hire someone to create a strategy for you, tell them that you want a strategy that mirrors this equation:

Holy Grail Strategy = Unlimited Average MFE + $0 Average MAE + Average $0 ETD

Trade strategy never works this way, however, so this calculation is akin to drawing a picture of a unicorn. The best we can do is try to gain a better understanding for what it is we’re looking for, even if we’ve never seen it.

Maximize MFE, Minimize MAE and ETD

Let’s talk about some ways to use trade orders to maximize MFE, while minimizing MAE and ETD:

If a trade has two major pullbacks, your second major pullback is the end-trade pullback. In general, the only trades that have a $0 end-trade pullback make use of take profit orders. So, the best way to reduce your average ETD, while increasing your MFE, is with the use of take profit orders.

Likewise, the best way to decrease your MAE is with the use of limit orders.

You can also limit the ETD and MAE with the use of stops and trailing stops. The closer the stop, the lower the ETD, but it will also restrict trade potential.

We’re going to focus on the application of 1 & 2:

take profit orders to reduce ETD and extend MFE,

limit orders to reduce MAE.

We’re going to do this for the top 3 strategies with the highest (run-up) MFE. Our goal is to take the strategy with the longest MFE and extend it by adding a limit order on entry command and a take profit on exit command.