From Sand Piles to Trading Piles: Applying Complex Systems Theory to Automated Trading (Automated Trading Strategy #91)

What can wild fires teach us about market behavior?

Important: There is no guarantee that ATS strategies will have the same performance in the future. I use backtests and forward tests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. Forward tests are based on live data, however, they use a simulated account. Any success I have with live trading is untypical. Trading futures is extremely risky. You should only use risk capital to fund live futures accounts and if you do trade live, be prepared to lose your entire account. There are no guarantees that any performance you see here will continue in the future. This is for educational purposes only. I recommend using ATS strategies in simulated trading until you/we find the holy grail of trade strategy.

If you have any questions, please contact Celan at AutomatedTradingStrategies@protonmail.com

If you’ve spent any time watching price charts you’ve probably seen how a single piece of news can send the market into a frenzy—or how prices can inch along steadily one moment and collapse the next. As traders, we sense that even among all the chaos, there’s an underlying order to these unexpected moves. One methodology being used to model these moves involves Complex Systems Theory or CST.

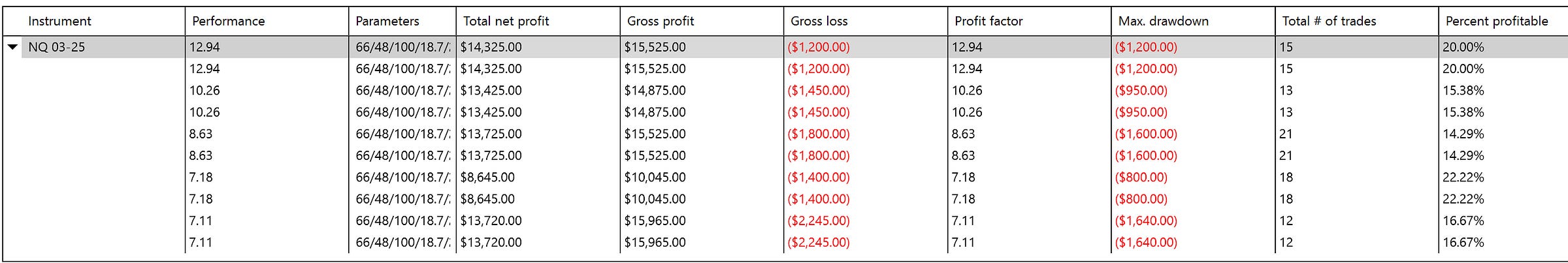

CST is the academic way of saying “markets can be complicated” and Self-Organized Criticality (SOC) is the name given to the physics concept that suggests these complex systems—like sandpiles—often wind up teetering at a tipping point. In this post, I’ll talk about how we might be able to use CST and SOC in strategy development. I’ll also introduce Strategy 91—my attempt at encoding SOC concepts into a trading strategy that produced the following results over a 5 month period:

Net income is low, but this is based on 1 contract.

I will show you the filters I used to narrow in on these variations and how I use these filters to make surgical decisions about which strategies to trade during prime hours and how much to allocate. As you can see, it is the nature of this system to make small losses on the hunt for big trends.

First, let’s talk a bit more about CST and why it is being used to help understand market structure.