Automated Trading Strategy #80: Capital Allocation Based On Signal Strength

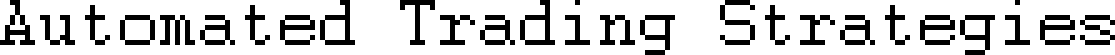

Strategy 80 made $178K using a basket of equity futures in a one year backtest. Total trade count is 280, average profit factor is 41x and the percent of profitable trades is 85%.

Important: There is no guarantee that these strategies will have the same performance in the future. I use backtests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. Even with forward tests, there is no guarantee that performance will continue in the future. Trading futures is extremely risky. If you trade futures live, be prepared to lose your entire account. I recommend using these strategies in simulated trading until you/we find the holy grail of trade strategy.

“If it were to all end tomorrow, I didn’t get short-changed.”

-Billy Walters

I believe in synchronicities so I wasn’t that surprised when Billy Walters popped up on Joe Rogan last week. I happened to be reading his book, “Gambler: Secrets From a Life at Risk” because in addition to studying traders, I also like to study professional gamblers. In terms of risk management, there is no better group of people to learn from and Billy Walters did not disappoint.

Walters started gambling when he was only 6 years old in a pool hall. At 75 he was convicted of insider trading and received a 5 year prison sentence (later commuted). From age 6 to 77, the man has seen it all— including the long end of a gun and the trunk of a car (as the story goes, he was asked to get in the trunk after being robbed). From one year to the next, his life is one crazy story after another.

I don’t know anything about playing pool or sports betting in general, so much of what he said went over my head, but I did notice there were two best practices that Walters shares with successful traders:

he gathers as much information as possible,

he bets big when the odds are in his favor.

The first practice was shared by the father of candlesticks, Sokyu (Munehisa) Homma (1716-1803). He hired a small army to stand ~6 km apart (the distance between Sakata and Osaka is 600 km) to communicate market prices and eventually cornered the market because he had the best information. Like Walters, he was willing to use unconventional means to obtain it.

According to Walters, at one point he was spending $6-$7 million a year in R&D. That’s a lot of information gathering. It made me start thinking about better ways of showing data, better ways of looking at data, and better metrics for understanding how strategies in a portfolio relate. I won’t get into this more here because it’s the focus of the next Mudder Report. Today, I want to focus on Walters’ second best practice: bet big when the odds are in your favor.

This is probably one of the hardest things to do in trading, especially when you’re down, but it appears to be a part of the successful trader’s repertoire.

Why is this so hard to do? Because most of us want to avoid the feeling that goes along with a bad trading day, even if the trade was based on sound logic. We want to avoid it so badly, that we will gladly lose money to avoid the feeling. To read more about how to recognize these patterns in your own trading, click here. The best way to guard against this irrational behavior is to treat each trade objectively with a lens toward value.

Defining A Value Proposition

One thing Walters does that is fascinating is assign a value to each player. That value is a direct function of player injuries. If a player is injured, his value goes down and vice versa. So the bulk of R&D spending goes toward getting the latest information regarding who’s injured and the nature of those injuries. Here’s a snippet from the interview explaining the process:

In a strange way, this is what I’m trying to do with strategies in the Live Test. I’m trying to assign them a value based on an evolving list of metrics. Those strategies with the highest value get enabled, the others don’t.

What I’m also discovering is the need to have different ‘teams’. I am currently creating both a Core and Non-core portfolio. The Non-core team is composed of high frequency, aggressive (read: high risk) trade strategies, while the Core team is composed of reliable, low-frequency (read: low risk) strategies that I can run every day because they rarely trade.

Strategy 80 is the first strategy I’ve created specifically for the Core portfolio. It has a low trade frequency, but when it trades, it is highly profitable. This is because it allocates more capital to signals with a higher strength. Which is to say, there are times when the signal is stronger than others and this strategy increases the number of contracts traded when the signal is stronger.

Here’s a look at performance stats from a one year backtest of equity futures.

As you can see, both profit factor and drawdown are very attractive at 42x and $407, respectively. Avg MAE is also very low at $222.

The chart above optimizes Strategy 80 based on a minute data series from 1 to 90 minutes. The optimization metric is profit factor, so we have a lower trade count, but a higher overall profit factor in the portfolio above. Net income is still pretty high at $178K, but can we get it any higher?

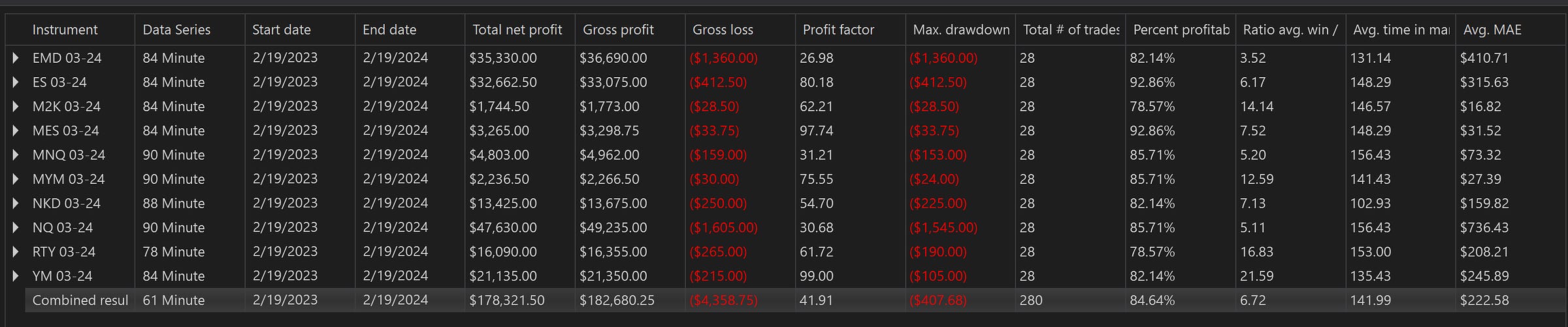

If we optimize on net income instead of profit factor, we get the following chart:

In general, if we want higher net profit using this strategy, we’ll need to run it at lower time intervals (“Data Series”, column 2), which means that the signal is weaker, but you’ll get more trade opportunities. As a result, net income has jumped from $178K to $284K on 704 trades, but profit factor has dropped to 7.67, which is still good.

Here’s a look at the backtest specifically for NQ optimized on profit factor:

Again, you’ll notice high profit factors/win rates across the board. It’s important to note that the win rate is organic; that is, it is NOT forced with a tight take profit.

Now that I’ve shown you what Strategy 80 can do, let’s go over how to recreate it for yourself.

Strategy 80 Description, Command Structure & Download (C#): Strength At The Extremes

Strategy 80 required the use of two indicators: