Automated Trading Strategy #74: Hunting The Immortal Goose

The Goal Is To Never Reach 100 Strategies

Important: There is no guarantee that these strategies will have the same performance in the future. I use backtests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. There are no guarantees that this performance will continue in the future. Trading futures is extremely risky. If you trade futures live, be prepared to lose your entire account. I recommend using these strategies in simulated trading until you/we find the holy grail of trade strategy.

The Immortal Goose With The Golden Eggs

“There's no such thing as the goose that lays the golden egg forever.”

-Jim Simons

This quote by Jim Simons plagues me. Just thinking about it feels like an act of betrayal to the cause, but we have to ask: Is Jim Simons right? Is the notion of an immortal goose that lays gold eggs ridiculous? One day I think the answer is yes, and the next day no.

It’s important to note that Simons is not denying the existence of the goose, he’s just saying it’s mortal, which is fair. We are constantly reminded of the mortality of the goose, but does that mean immortality can never be found?

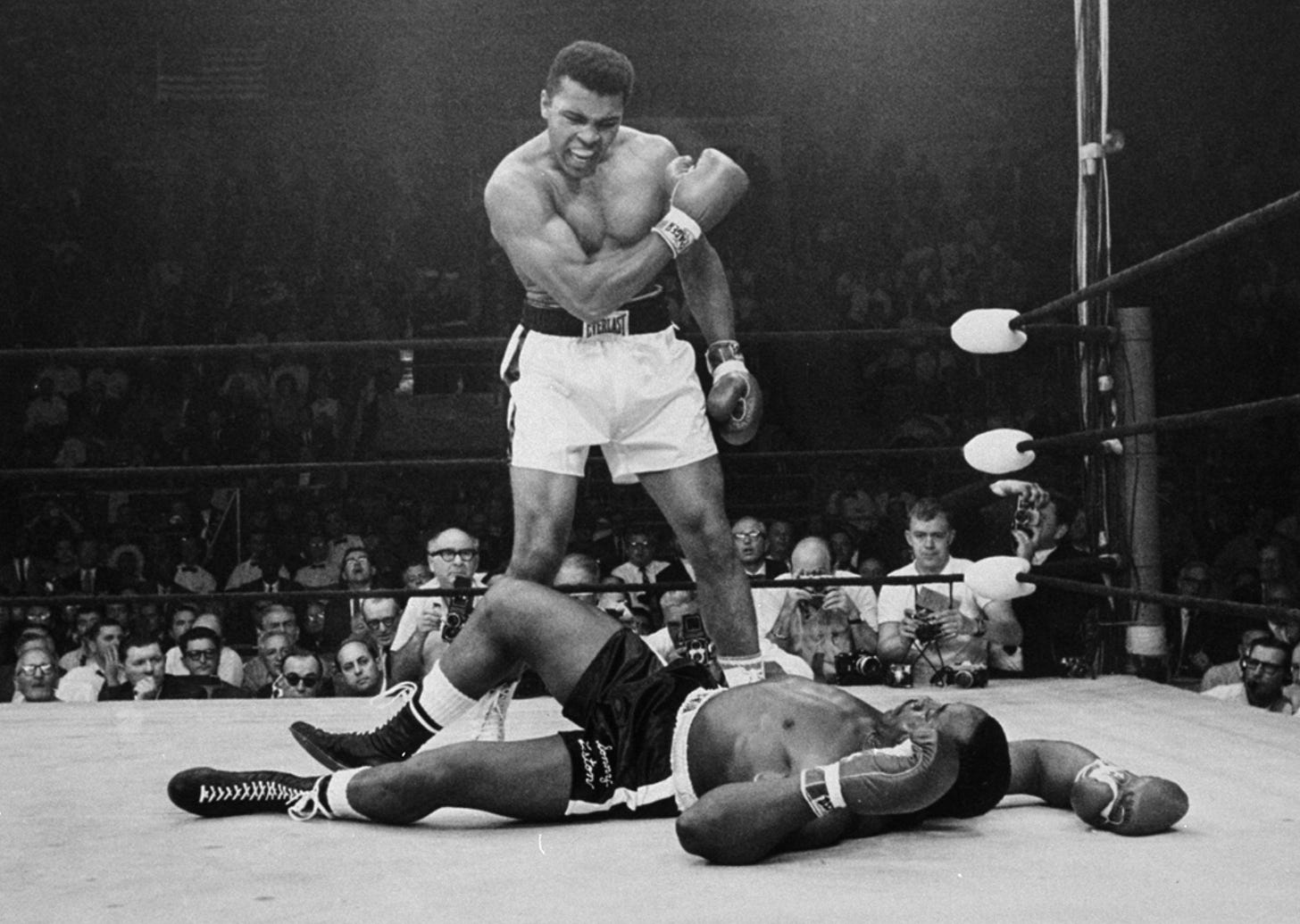

As I’ve said before, I will be ending the strategy development portion of this experiment at 100 strategies, but my true goal is to never reach 100 strategies. If I do, in a strange way, it will be a kind of technical knockout. An admission that there is no magical unicorn; that there is no immortal goose.

The good news is that second prize can still make you millions. So those without a personal stake in the matter might find this quest amusing, but to those of us on the hunt it’s the difference between a technical knockout and the undisputed bragging rights of a champion. Can the market be conquered or not?

I intend to give it my best shot. Today, I pledge to use the next 12 months to find the holy grail, the true holy grail. I’ll be happy to turn my attention towards the development of some million dollar stars if I don’t find this elusive creature by then, but in the interim let’s shoot for the billion dollar moon.

“There are a million ways to make money in the markets. The irony is that they are all very difficult to find.”

-Jack Schwager

I’ve been asked to create many different types of strategies. Each one is its own little holy grail for the person making the request. Personally, I’m looking for a simple scalping strategy that works religiously at least once a week.

The holy grail can be defined in any way you like, but one thing we all agree on is that it is highly profitable. Some may even say it is always profitable.

For almost three years now I’ve defined the holy grail of trade strategy to be the following (based on annual performance):

Profit factor greater than 3

Annual drawdown less than 3%

Annual return on max drawdown greater than 500%

Maximum daily loss is -$1,000

Avg Daily profit greater than $1,000

Less than 5,000 trades annually

More than 253 trades annually

Click here for the most recent performance chart.

I’d like to update the holy grail definition to the following:

90%+ win rate

Ratio of Average MFE (Max Favorable Excursion) to Average MAE (Max Adverse Excursion) greater than or equal to 2

That’s it. It is deceptively simple and highly inclusive of all attributes without being elusive. It also takes the limitations of the simulation in mind.

Now that we’ve reached a certain level of performance we need to turn our attention to the needs of the simulation. Based on my research, unless you have the ability to create your own simulator, you have to learn how to think like the one you’ve got to get the best output. We have to meet the simulator where it is. I had thought this effort would begin and end with changing the data series from range to minutes, but there’s much more. There’s the simulation and then there’s what really happened. At the end of the day, however, price is price. It isn’t that the historical data is wrong (though we’re about to study the effect of using filtered vs unfiltered data), but the simulation can process it in the wrong way/sequence.

So you can use the simulation to define the hunt for you. Rather than creating code for the Matrix, we can study the output of the simulation to define the pattern. Admittedly, it’s a bit of a rabbit hole, but instead of looking for the woman in the red dress, we’re looking for the trend reversal and then seeing what color dress the woman had on at that time. In this way, it’s a different hunt altogether. We’re not really hunting at all, we’re singing opera to cows to get the best milk. I’ll give you an example of what I mean by this with Strategy 74.

Strategy 74 Description, Command Structure & Download (C#)

Strategy 74 builds on the idea of finding strong signals. A strong signal is defined as one that has a high rate of profitability across instruments. Strategy 74 has a portfolio profit factor of ~9.24 on equity futures and is profitable ~78% of the time. It uses no stop loss or take profit, but has an average unweighted drawdown of only $610 for the year.

Strategy 74 is based on a breakout strategy from Mark Minervini, winner of the U.S. Investing Championship for three years in a row. His process is as follows: