Important: There is no guarantee that our strategies will have the same performance in the future. We use backtests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results we share are hypothetical, not real. Forward tests are based on live data, however, they use a simulated account. Any success I have with live trading is untypical. Trading futures is extremely risky. You should only use risk capital to fund live futures accounts and if you do trade live, be prepared to lose your entire account. There are no guarantees that any performance you see here will continue in the future (good or bad)—that’s what makes the hunt for the holy grail so difficult. This is why the best way to trade is with a simulated account on live data. I recommend using ATS strategies in simulated trading until you/we find the holy grail of trade strategy.

We haven’t found the holy grail of automated trade strategy yet, but we get closer with every strategy. Click here for links to all strategy descriptions.

Last week I shared the Mudder Report with you. That report included an analysis of forward test performance by strategy, instrument, and net profit.

Now, what I would normally do is create a new forward test based on a backtest of strategies over the last 12 months. That’s what I’ve done every quarter for the last ~24 months. This quarter, however, instead of running a backtest over the last 12 months (6/15/2023 to 6/21/2024) we have enough data to create a forward test based almost entirely on forward test data. Note: there are several strategy variations in the forward test that are based on backtest data because we have no forward test data on them. These strategies are highlighted in yellow. I will likely be adding more backtested strategies throughout the week.

What other changes were made to the Q3 Portfolio?

Removed all strategies that did not perform well over the last 6 months.

Created individual accounts for each strategy variation (Strategy/Instrument/Data Series/Parameters). Unfortunately NT8’s trade performance data does not have data series and parameter data so we lose that data every quarter. The only way to make sure we collect this very important information is to include it in the account name. So instead of all strategy variations funneling into one Strategy account, each variation has its own account. This is a tedious process, but necessary. If anyone knows a better way to do this, I’d love to hear it.

Added additional, low volatility instruments. Also added instruments with a high dollar value per tick. These instruments have been shown to be less volatile since tick movements are made in higher increments. I will be adding more instruments this week as well.

Updated embedded contracts.

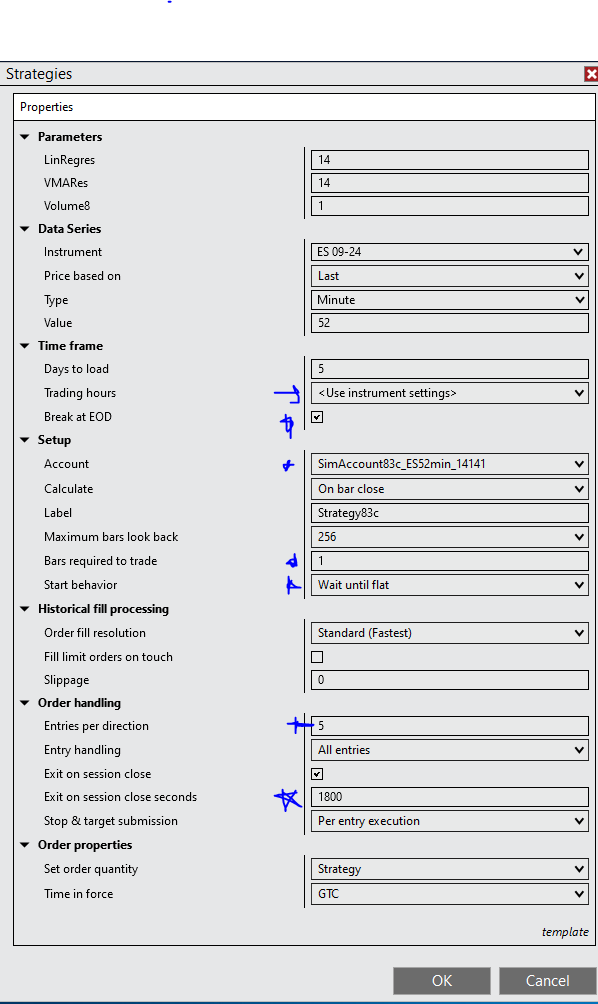

Updated properties template for all strategies. Some strategies have different requirements, but this is the default. Here’s an example for Strategy 83c, 1 ES futures contract, 52 minute data series:

Subscribers: See below for links to both the Q2 Forward Test Analysis and the Q3 2024 Forward Test Portfolio.

The portfolio is in spreadsheet form by Strategy, Account Display Name, Data Series, Instrument and Parameters like so:

If you’re tying to mimic the ATS 2024 Q3 Forward Test Portfolio these are all the data points you need. For help on how to create your own forward test, click here.

Each strategy is trading on one contract and I hope to add additional strategies over the week. Those strategies will be based on 1) running the reverse of certain strategies that performed poorly over the last 6 months, 2) adding additional low-volatility instruments, 3) adding Strategies 4b and 4c; and, 5) adding Strategy 84 variations. The spreadsheet below is a live document so I’ll be sharing updates to the portfolio in real time.

Also note that this is a vacation week for the market so we’re probably going to see volume based matching algos from dealers/exchange houses. This tends to add a level of noise or chop to the market that indicators have a hard time with, but it's a great week to trade manually. You should see some very defined patterns. All the same, it’s not a good week to start the forward test. The Q3 Forward Test won’t officially start until July 7.

Rebuilding this portfolio was not an easy task, but I think it’s the best portfolio we’ve created since the start of this project. Not only is it based on forward and live test results, but we’re getting more granular in terms of what works and what doesn’t. I’m really looking forward to the results this quarter.