Q3 2025 Forward Test Results: Week 5 Update

The Q3 Forward Test is up $63K on 884 trades executed over the last 5 weeks.

Important: There is no guarantee that ATS strategies will have the same performance in the future. I use backtests and forward tests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. Forward tests are based on live data, however, they use a simulated account. Any success I have with live trading is untypical. Trading futures is extremely risky. You should only use risk capital to fund live futures accounts and if you do trade live, be prepared to lose your entire account. There are no guarantees that any performance you see here will continue in the future. I recommend using ATS strategies in simulated trading until you/we find the holy grail of trade strategy. This is strictly for learning purposes.

We're not just developing strategies—we're on a quest for the holy grail of automated trading. Questions? Check the FAQs first, then feel free to reach out directly: AutomatedTradingStrategies@protonmail.com.

The evolution of the Forward Test:

2023: After years of failed live tests based solely on backtests and walk-forward analysis, I finally started forward testing. It was a game changer.

2024: Methodology upgrade—began tracking individual variations instead of strategy groups. Allowed for greater granularity and deeper insights.

2025: Alpha hunting through ML pattern recognition, optimal portfolio allocation, and advanced risk management techniques. Using an Incubator portfolio to scout strategies for inclusion in the next Forward Test. The Incubator is currently running over 200 strategies. I’ll share an update on that portfolio in a few days.

What is the Q3 Portfolio Composition?

The Q3 Forward Test is the “production/candidate” portfolio. Every strategy here has already cleared the Incubator hurdles. The forward test uses live data on simulated accounts. The goal is to run a capital‑efficient, broadly diversified, but tightly risk‑capped portfolio that can be migrated to a live account.

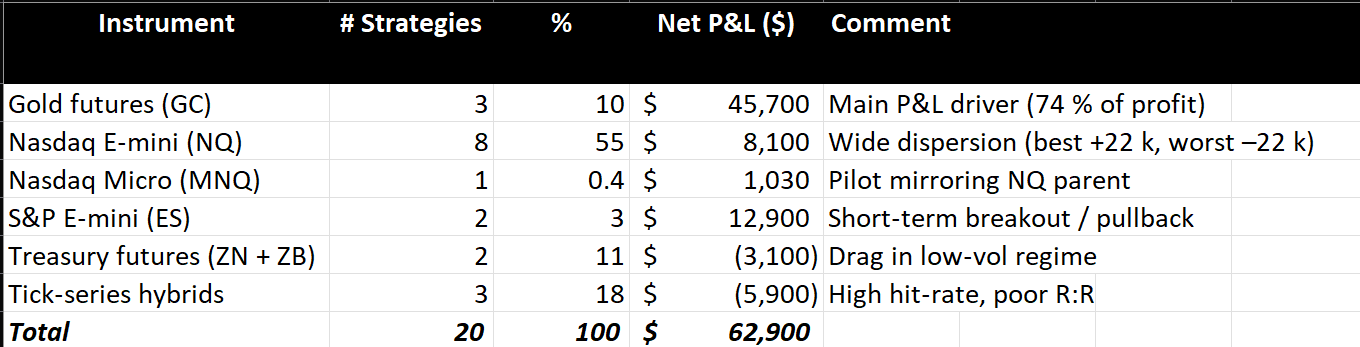

The Q3 Forward Test is a 20‑strategy, multi‑asset portfolio. It netted $63K on 884 trades executed between late June and July 18, 2025 with a 2.0 Profit Factor—driven mainly by gold (GC). This portfolio corresponds with the September 2025 equity contract.

Instruments Traded:

NQ (Nasdaq-100 E-mini) - Dominates with momentum and mean reversion strategies

ES (S&P 500 E-mini) - Regular positions

GC (Gold) - Precious metals are on fire! Longer hold times, often overnight positions. 74 % of portfolio profit is coming from three GC strategies that together generate only 10 % of the trades—great edge. Lots of action in metals this quarter.

ZN/ZB (Treasury Notes/Bonds) - Fixed income futures. One strategy exclusively trades bonds with 5-contract positions. May be crowding margin that could fund better candidates.

MNQ (Micro Nasdaq) - Smaller position sizing

Trading Characteristics:

High Frequency: Some strategies trade multiple trades per day

Mixed Timeframes: From 5-minute to 90-minute strategies

Both Long and Short: Strategies take positions in both directions

Position Sizing

Most trades use 1-3 contracts

Some strategies scale up to 5-8 contracts

Position sizing is correlated with strategy confidence and/or market conditions. I’ll be introducing a few descriptive metrics to help sort this out a bit.

Exit Strategies

Profit targets: Most common exit method

Trail stops: Used for trend-following

Exit on session close: Risk management for overnight exposure

Time-based exits: Some positions closed after specific durations

Performance

Big drawdowns at the start of the quarter (down nearly $20,000), but the system recovered to a profit of $62,890 by July 18. An overview of portfolio performance by strategy, trade count, profit, profit factor, win rate % and dollars/trade is at the bottom of this post.

In the Pipeline…

Incubator Strategies: There are many promising strategies in the Incubator. Some have been published, some haven’t. Look for a post in a few days that takes a closer look at these strategies. I’ll also introduce some new descriptive metrics in this post. See below for a quick look at the top 10 strategies in the Incubator by net income.

The Incubator includes AI strategies, as well as a strategy created by the latest model from Grok—Grok 4. Grok is one of four models chosen by the the Pentagon to help the U.S. military expand its use of advanced artificial intelligence capabilities. In the same way that we’re using AI to create agentic workflows for trading, the Pentagon is using it to develop agentic AI workflows for national security. The other models were from Google (Gemini), Anthropic (Claude) and of course OpenAI (ChatGPT).

Alerts: RL model alerts will start in September. Every subscriber can receive an alert for the two strategies selected for your Forward Test. You can read more about that process here.

August: I will be away from my desk for the month of August. All subscribers as of July 31 will receive one month free added to your subscription. This will be automatic. No action is required on your part, however, if you don’t see the adjustment, please send me an email. I have a few posts in the queue for August, but will not respond to email until I return in September.

If you have any questions, please send me an email.

Contact: Celan @ AutomatedTradingStrategies@protonmail.com

Q3 Performance and Top 10 Incubator Strategies