Important: There is no guarantee that ATS strategies will have the same performance in the future. I use backtests and forward tests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. Forward tests are based on live data, however, they use a simulated account. Any success I have with live trading is untypical. Trading futures is extremely risky. You should only use risk capital to fund live futures accounts and if you do trade live, be prepared to lose your entire account. There are no guarantees that any performance you see here will continue in the future. I recommend using ATS strategies in simulated trading until you/we find the holy grail of trade strategy. This is strictly for learning purposes.

As a quick reminder, we’re on the hunt for the holy grail of automated trading strategy. If you have any questions, start with the FAQs and if you still have questions, feel free to reach out to me (Celan) directly at AutomatedTradingStrategies@protonmail.com.

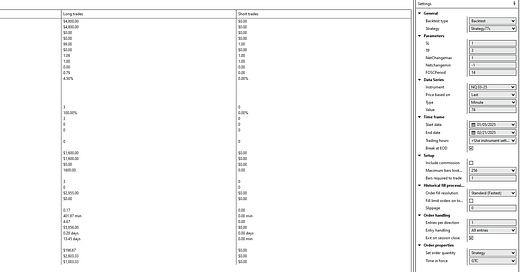

Note: Strategy 77c is no longer available through the ATS subscription. Click on the button below to view all strategies included in the subscription.

“The markets teach you humility and self-awareness.” – Ray Dalio

I’ve been away from my desk for most of the last two weeks, but I did make a point to check in on the Q1 2025 ATS Forward Test periodically. Last week was brutal, which makes now a great time to reflect. I’m also going to tell you what changes I’ll be making to the Q2 Forward Test in response.

The last Mudder Report covered Weeks 1 through 5—net profit was $84K, profit factor was 2.58 on 113 trades.

In Week 6, the Q1 2025 Forward Test made another $16K on a profit factor of 3.46 and 32 additional trades.

So in the first 6 weeks of this year, the portfolio made $100K with a 2.67 profit factor on 145 trades. The bulk of that was from Strategy 77c, but which 77c?