🚨 Q2 Forward Test Launch 🚨

This is the most ambitious Forward Test I've EVER published. I’m taking the reins off! Recommended account size: $100K.

IMPORTANT DISCLAIMER: Past performance is no guarantee of future results. All backtests and forward tests represent hypothetical or simulated trading—not actual profits or losses. Trading futures carries extreme risk; only use capital you can afford to lose. Any success shown here is atypical. Be prepared for the possibility of losing your entire account. This content is strictly educational.

We're not just developing strategies—we're on a quest for the holy grail of automated trading. Questions? Check the FAQs first, then feel free to reach out directly: AutomatedTradingStrategies@protonmail.com.

Quick reminder: All seven strategies from the Q1 Forward Test have been ‘unpublished’ and are no longer available with the subscription. Only three strategies survived Q1 to join the Q2 cohort. After June's Q2 completion, additional strategies will be removed. All subscribers will receive advance notice before any removals.

Need links to all subscription strategies? Click below for complete list.

Call to Arms: Your Forward Test Results Wanted

Friends, countrymen, traders, lend me your forward test results!

I know many of you want to help. Over the years I’ve come to realize that the most valuable contribution you can make is sharing forward test results. And if you have strategy improvement suggestions, I’d love to hear them, but please validate them with forward test data first. Real-world performance speaks louder than theoretical improvements. I look forward to hearing from you!

Q2 2025: Unleashing the Beast

We’ve learned a lot over the last four years, and even more over the last four quarters. I want to thank everyone for all your feedback and support. In particular, I want to thank Jeff, Xa, Kevin, Z and Cora. Your support is greatly appreciated.

So where are we today…

Today I’m publishing the Q2 2025 Forward Test. This is the culmination of years of hard work and is by far the most ambitious portfolio I’ve ever ran.

In the last Mudder Report, we separated the Q1 winners from losers and introduced Strategy 94—featuring 10 variations for Q2. While not traditionally forward tested, Strategy 94 evolved from one of our star performers: Strategy 44b.

Strategy 44b's performance record speaks volumes:

Crushed expectations in Q3 and Q4 of 2024

Continued domination through Q1 2025

Extraordinary stats: only 2 losing trades out of 79 total trades

Both losses occurred at midnight on 2/21 (pattern identified and addressed)

average trade duration is 7 min allowing for increased capital allocation

After deep analysis of time-of-day patterns and sequential trade behaviors, Strategy 94 emerged as the enhanced version of its predecessor—skipping the Incubator phase to debut directly in the Q2 Forward Test. So while Strategy 44b is no longer available through the subscription, you can download its successor here.

Q2 2025 Forward Test Launch

The evolution of the Forward Test:

2023: Initial serious commitment to live forward testing

2024: Methodology upgrade—tracking individual variations instead of strategy groups

2025: Next-level alpha hunting through ML pattern recognition, optimal portfolio allocation, and advanced risk management. Strategy 94 is the first application of this.

Q2 Portfolio Composition

Scale: 11 distinct strategies with 37 variations

Timeline: Launching today (March 23, 2025, 6 PM EST) through mid-June

Legacy performers: Three strategies carried over from Q1 (4c, 44b, 77c)

New blood: Eight strategies advanced based on stellar Q2 Incubator performance

Instrument Diversity:

NQ (Nasdaq futures): 22 strategies

ES (S&P 500 futures): 7 strategies

MNQ (Micro Nasdaq futures): 2 strategies

GC (Gold futures): 2 strategies

Specialized instruments: ZB (Treasury bonds), RTY (Russell 2000), CL (Crude oil), 6B (British Pound), YM (Dow Jones), and HG (Copper)

Timeframe Range: Multiple timeframes from 3 to 90 minutes

Recommended account size: $100K

Incubator Standouts Join the Field

Three of the strategies in the portfolio are from the Q1 Forward Test (4c, 44b and 77c). All other strategies in the Q2 Forward Test were advanced based on their performance in the Q2 Incubator.

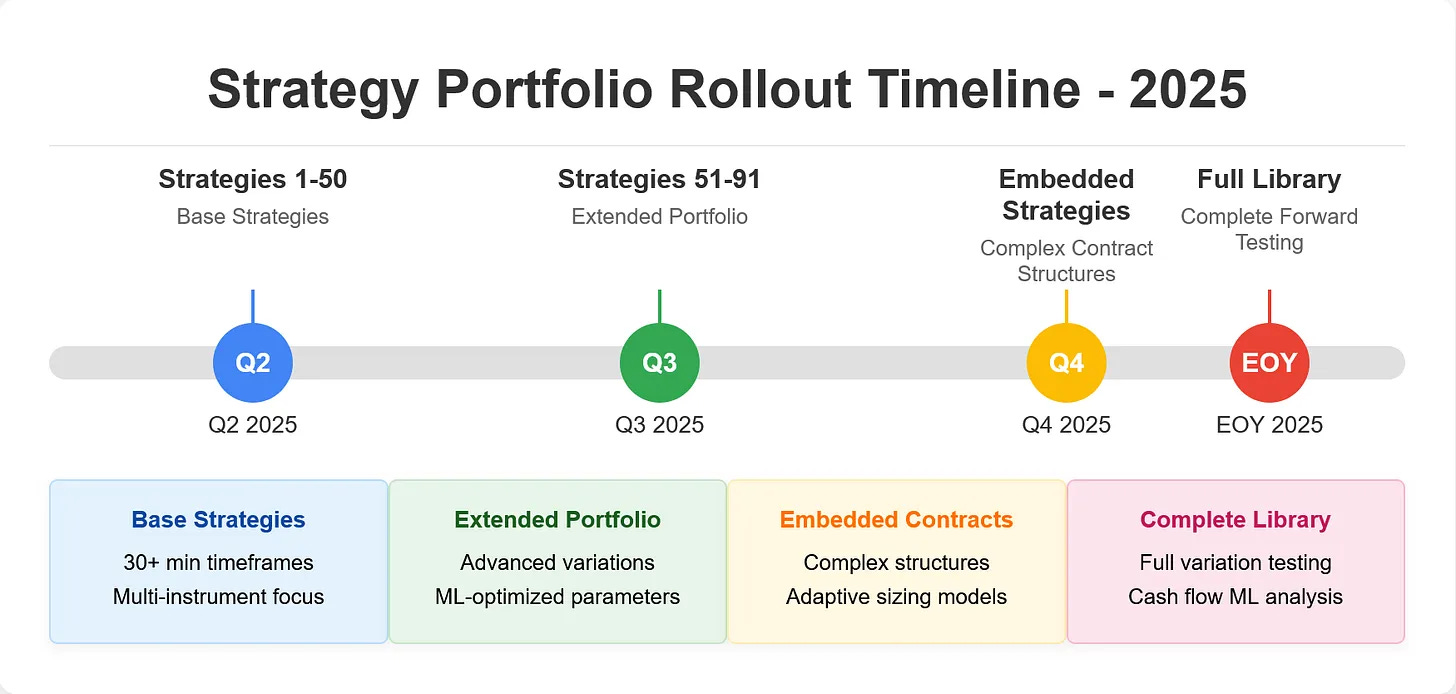

The Q2 Incubator showcases different variations of the first 50 strategies. In Q3, I’ll add strategies 51 through 94 and in Q4, I’ll add all strategies with embedded contracts. Here’s a tentative timeline:

The hope is to obtain as much actual data as possible for ML pattern recognition analysis by year end.

I’ve only been running the Q2 Incubator for one month, but there have already been some very promising results. These are the highest performing strategies sorted by profit factor: