Automated Trading Strategy #35 (Public Version)

Strategy 35 made $201K in the last 12 months, makes $1,004 per trade and has a Profit Factor of 2.19.

There is no guarantee that these strategies will have the same performance in the future. Some may perform worse and some may perform better. We use backtests to compare historical strategy performance, but there are no guarantees that this performance will continue in the future. Trading futures is extremely risky. If you trade futures live, be prepared to lose your entire account. We recommend using our strategies in simulated trading until you/we find the holy grail of trade strategy.

Note: The public version of the strategy does not include the strategy description or the download.

For a link to all strategies and the most recent chart, click here.

Click on the table to enlarge.

*See below for Column Definitions

Strategy #35 Description:

Futures Contract: NQ

Strategy 35 is the same as 33, however, instead of using 36 range as the default data series like Strategy 33, Strategy 35 is back-tested over the 669 tick chart. From a publication perspective, we will be treating this as one strategy (read: these three strategies will count as one of the two strategies we publish per month), but we decided to break these strategies out like this to show the performance level of each data series alone. In other words, this allows you to view the performance stats (net income by day of week, hour of day, cumulatively) individually.

It is hard to believe that Strategy 33, 34 and 35 are all the same, and that the only difference is the chart type, but the chart type tells you what the closing price is on the previous bar and these strategies are based on a comparison of the current bar to the closing price of the previous bar. Look for a post coming out shortly that analyzes the difference between these chart types and what it can tell us about the holy grail of trade strategy.

Additionally, we are listing Strategy 35 as an optimized strategy. We did not find this data series through optimization because we no longer optimize strategies (for an explanation on why, click here), but it is an odd number that was discovered by accident, so we are publishing it as an optimized strategy. In other words, we advise caution here. It will take some time to see if this strategy performs consistently over time. If we see the same results in the March 2022 update, we’ll remove the caution.

Subscribers: Click here for the full description of the strategy including a download for Ninjatrader 8 in C#.

This is what the strategy looks like in chart form. It makes on average .80 trades per day, and has an average net profit of $798 per day or $1,004 per trade.

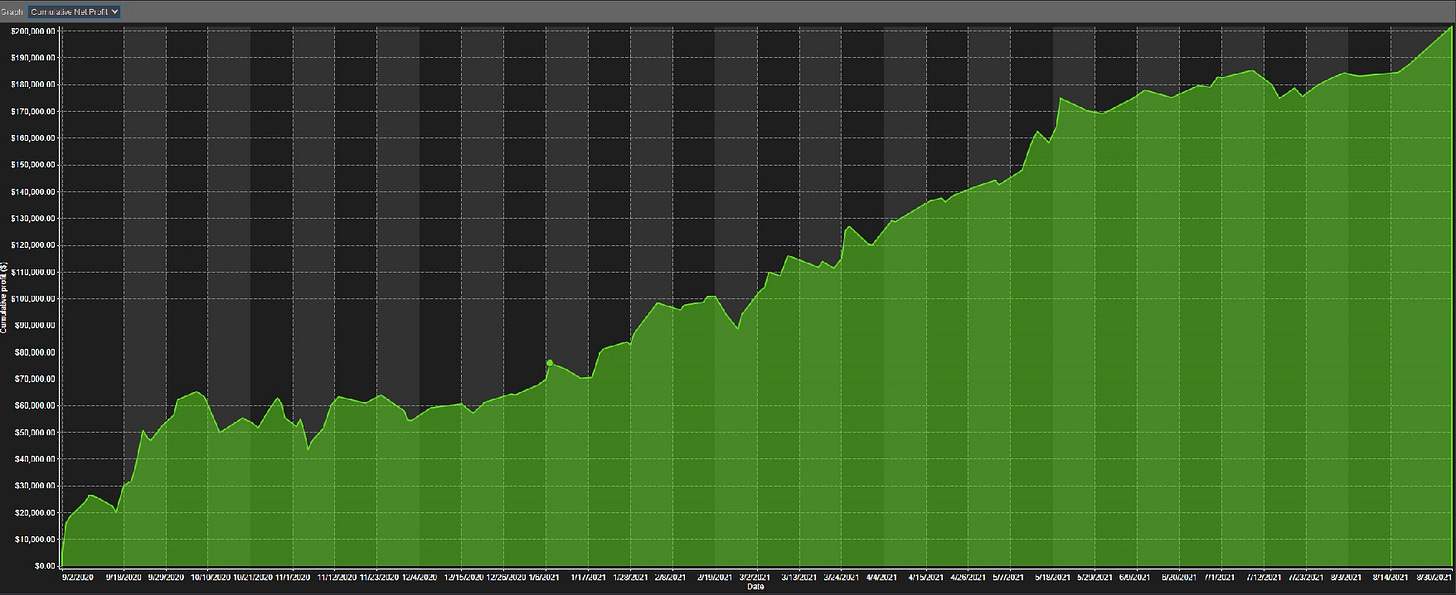

This is the cumulative profit of Strategy 35 over a 1 year period. It never falls lower than $5,230, but this is due to timing more so than anything else. Still, it has a profit factor of 2.19, which means that the ratio of gross profit to loss is 2.19. In other words, the strategy made 2.19 times more money than it lost during the period. Our next strategy has a profit factor of 2.17.

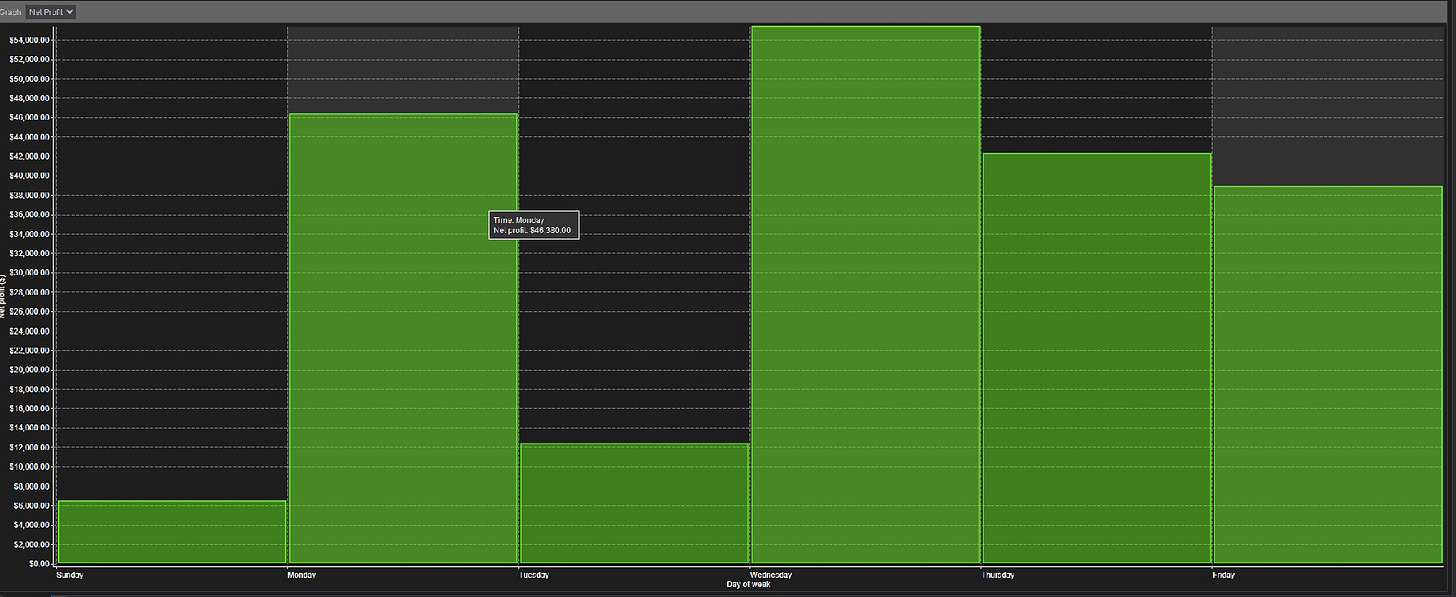

This is how the strategy breaks down on a day-of-week basis. This chart can help with determining the best time to get into a strategy. Wednesday looks like the best day to enter.

This is a chart of the strategy by hour of day. Keep in mind, this strategy does not close at the end of the day, but has a large number of profitable trades in the most volatile hours of the day. The average time in the market for each trade is approximately 1.8 days. The longest flat period is 9.92 days.

Clearly, we like this strategy because of its high profitability. It is profitable over 54% of the time and has a return on max drawdown of 929%. It also has an MAE, MFE and ETD of .82%, 1.19% and .79%, respectively. In general, the lower the MAE and ETD the better, and the higher the MFE, the better. This strategy has one of the highest MFE’s in our portfolio, especially when considering the MAE and ETD. For an overview on MAE, MFE and ETD statistics, click here.

This strategy fits much of our criteria, but has a drawdown of 9.53%, which isn’t bad if you get into the strategy on a good day, but it is still higher than what we’re looking for. You’d want to have at least a $30K account to trade this strategy. It also only made 201 trades in the backtest period.

We’re looking for a strategy that has high profitability, low drawdown and makes at least 253 trades per year. We really like this strategy, but the hunt continues.

For links to all strategies click here.

*Column Definitions:

Strategy - The name of the strategy.

Trades - The number of trades used in the backtest to analyze performance. Our goal is ~1,000 trades for comparison.

Start date- The beginning date of the backtest.

End date - The ending date of the backtest.

# of days - The number of days in the strategy.

Drawdown - This refers to the maximum drawdown statistic, which provides you with information regarding the biggest decrease (drawdown) in account size experienced by the strategy. Drawdown is often used as an indicator of risk.

Drawdown = single largest Drawdown

As an example, your account rises from $25,000 to $50,000. It then subsequently drops to $40,000 but rises again to $60,000. The drawdown in this case would be $10,000 or -20%. Take note that drawdown does not necessarily have to correspond with a loss in your original account principal.

Return on Max Drawdown - We’ve added a dollar value for max drawdown along with a measure of return (return on max drawdown), which is calculated by dividing net profit by the max drawdown. In this way, max drawdown is considered the max capital investment. You can use the dollar value of max drawdown as a proxy for how much capital you need to trade the strategy. And, the higher the return on max drawdown, the better the strategy is in terms of risk/reward.

Percent Profitable - This is a metric that shows the number of winning trades divided by the number total trades.

Profit - The net profit made on the strategy for the backtest.

#trades per day - The average number of trades made per day using the strategy.

Profit / Day - The average profit made per day.

Profit / Trade - The average profit made per trade.

Lowest daily new profit - The worst performing day of the strategy in the backtest.

Highest daily net profit - The best performing day of the strategy in the backtest.

Profit Factor - Gross Profit divided by Gross Loss

Lowest daily cumulative new profit - The worst performing day on a cumulative basis.

Highest daily cumulative net profit - The best performing day on a cumulative basis.