Weekly Update 10/31/2021 - 11/05/2021

In total, our predictions made $23,010 last week.

Risk Disclaimer: There is no guarantee that these strategies will have the same performance in the future. Some may perform worse and some may perform better. We use backtests to compare historical strategy performance, but there are no guarantees that this performance will continue in the future. Trading futures is extremely risky. If you trade futures live, be prepared to lose your entire account. We recommend using our strategies in simulated trading until you/we find the holy grail of trade strategy.

This is the second post in a new weekly series dedicated to tracking our automated strategies at the weekly level. You can read the first post here or click on the link below. It provides an overview of our approach along with an explanation of the reporting structure.

Just like our annual updates that happen every two months, we’re looking for consistency on a weekly basis. We’re also seeing if there’s an opportunity to create a master strategy by monitoring weekly trends. For example, we made some guesses about what would happen last week based on trends from the previous week. Let’s revisit those ‘best guesses’ now.

Two weeks ago, Strategy 8 and 10 were our best performers from a profit perspective even though they weren’t the most consistent. In terms of consistency, Strategy 3 was our best performer. We made the following observations and subsequent predictions for the week to come:

The strategy that is most consistent with annual results: Strategy 3

The strategy with the highest profit factor of any unoptimized strategy with more than 1 trade: Strategy 8

The strategy with the highest number of profitable weeks: Strategy 3 or 10

In trading, the trend is your friend. The idea here is that trends in the prior day/week will continue into the next, especially if the trend is for more than 2 weeks and has a high profit factor.

Did the trend continue or was there an upset?

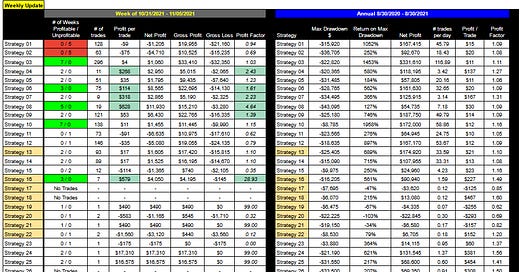

To answer this question we need to update the stats. First, let’s look at the original template from a week ago. It provides weekly stats for 10/24/2021 through 10/29/2021.

Click here for a link to all strategy descriptions.

As you can see, the table is split into two sides — weekly performance is on the left and annual performance is on the right.

The annual stats, which are based on data from 8/30/2020 to 8/30/2021, have already been published here. We have pulled some of those stats into this table for ease of comparison. As a side note, we will be updating annual data to 11/1/2020 to 11/1/2021 on Friday.

We reviewed how the chart is set up in more depth in last week’s post, so we’re not going to do that again here, but you can scroll down to the bottom of this post for help with column definitions or refer back to the original post.

Now let’s look at an updated table with the most recent weekly data.

Weekly update 10/31/2021 - 11/05/2021

As an example of how to read the table, if I were reading Strategy 1 from left to right, I would say that it:

had 5 unprofitable weeks, back to back (continuing the trend from last week)

had 128 trades (down from 145 trades last week)

lost $9 per trade (this is a new column we just added this week)

lost $1,205, which is slightly better than the $1,710 it lost last week

had a gross profit of $20K and a gross loss of $21K

had a profit factor of .94, which is the same as it was in the prior week.

Strategy 1 is an example of a strategy that has been consistently unprofitable over the last few weeks.

Now that we’ve reviewed how the report is set up, let’s talk about what the data is telling us to run this week.

Weekly Update Analysis

What we’re finding is that consistency is a function of short-term trends in the weekly update. Unlike the hunt for the ‘static’ holy grail of trade strategy, the hunt for the moving target is more concerned with short-term trends in profitability and profit factor rather than similarity to annual backtest results. This is only our second week analyzing strategies on a short-term/weekly basis so it’s going to take some time to see how this plays out.

What we’re doing is looking for strategies that have performed well for at least two weeks in a row. Out of this group, we’re going to select those strategies that have the highest weekly profit factor.

Last week, we found two strategies with a discernible 6 week trend: Strategy 3 and Strategy 10. Both of these strategies had been profitable for 6 weeks. The biggest issue with Strategy 10, however, is that it makes a large number of trades every day so it works best for traders with a flat rate commission plan. Our biggest surprise was Strategy 8. The strategy had a profit factor of 2.76, but its annual profit factor is only 1.09. Again, either the strategy was performing better due to a change in the market OR perhaps this is a sign that it’s due for a correction back to its norm of 1.09. Will we see another week of profitability, as the current trend suggests, or will we see a reversal? These are the questions we had two weeks ago. Then, based on observable trends, we made the following prediction:

Based on this, we ran strategies 3, 6, 8 and 10 last week. We got the following results:

In total, our predictions made $23K last week. Strategies 6 and 8, the strategies with the highest profit factor, had the highest net profit last week. What this shows us, at least for now, is that the holy grail of trade strategy could be a moving target that toggles back and forth between several strategies. Perhaps the holy grail of trade strategy is a portfolio of strategies that changes from week to week based on observable trends?

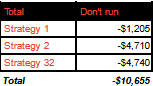

What happened with the three strategies that had the highest number of unprofitable weeks: Strategies 1, 2, and 32? These strategies continued to perform poorly:

What’s interesting about most of our automated strategies is that unless there’s a stop loss and take profit, the order command can be flipped so that the strategy has the inverse profitability. In this case, it would show a profit of $10K rather than a loss. We’ll talk a little more about this and how it might be used in the selection process in future posts.