Using AI To Pass Funded Trader Evaluations: Part 2

Claude AI is up $31K and Grok 3 is up $9K in the forward test, but can they pass a prop firm evaluation?

Important: There is no guarantee that ATS strategies will have the same performance in the future. I use backtests and forward tests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. Forward tests are based on live data, however, they use a simulated account. Any success I have with live trading is untypical. Trading futures is extremely risky. You should only use risk capital to fund live futures accounts and if you do trade live, be prepared to lose your entire account. There are no guarantees that any performance you see here will continue in the future. I recommend using ATS strategies in simulated trading until you/we find the holy grail of trade strategy. This is strictly for learning purposes.

Prop Firm Strategies

A few weeks ago, I published Part 1 of a series about the use of AI to help answer one of the most common questions I receive: Do you have any strategies that pass a funded trader evaluation?

In the past my answer to this question has always been “No”.

Why?

Manual trading is hard to learn. It takes an awareness of both the markets and self that is difficult to achieve. The only way to improve is to identify your weakness, which is likely mental. Automation offers a way to leapfrog the process. Like braces or training wheels, it can provide the support you need to gain the technical and mental strength required without the heavy lifting that generally has to occur up front. In this way, automated systems are a kind of flotation device that can help you learn how to swim.

Creating an automated trading strategy with a smooth and rising equity curve is one thing; creating an automated trading strategy that can meet the requirements of funded trader evaluations is something else entirely. Not only are the requirements more stringent, but you have to split your profit with the firm. For these reasons, I’ve used and viewed funded trader evaluations as a sandbox, not an opportunity.

But the landscape has changed. There are more firms. More firms means better terms for the trader. We also have the help of AI with regard to risk management. In this series, I’ll be using AI to help develop strategies for a live experiment with my favorite strategy-friendly prop firm. In the end, I hope to give a proper answer to the question: which strategy in ATS is best for prop firm trading.

The Approach

For those new to the game: A proprietary ("prop") trading firm trades its own capital, not client funds. Traditional firms hire salaried traders; modern "remote" firms allocate capital to independent traders and split the profits instead.

The last decade has seen an explosion of "funded-trader programs", but not all firms play fair. Some create impossible hurdles by design. Others claim to be automated-system friendly, but aren't. Your first task is picking the right battlefield, which we covered in Part 1. Next, we need the strategy.

My approach: I interviewed five leading AI systems (Claude.ai, Manus, Grok3, OpenAI3, and OpenAI4.5) using the prompting techniques described in Part 1. Each AI developed a strategy tailored to specific prop firm parameters. The code revealed features I hadn't considered before.

I’ve been running these strategies over the last month or so and these are the results:

It’s worth noting that all strategies backtested extremely well, however, only Claude.ai and Grok actually performed like the backtest. This is why forward testing is some important.

Here’s a performance summary of Claude.ai’s strategy:

And here’s a performance summary of Grok 3’s strategy:

Note, the time period for these strategies is 24 and 16 days, respectively.

Manus and Open AI have failed to perform over time, but might with a few changes. Both started off very strong. Open AI 04 mini performed so poorly that I’ll be reversing the command structure.

Max MAE

One thing I want to highlight is Max MAE. Max MAE is the most the trade goes against you—it is an intra-trade drawdown. Even though the prop firm we’re using only measures trailing drawdown at the end of each day, there’s still a daily loss limit to adhere to.

As you can see from the chart above, the Max MAE for all five AI created strategies is high. While these are maximum figures (Claude.AI’s average MAE is ~$200), it gives you an idea for the daily loss limit you need for each strategy. Again, these are all high enough to knock you out of most evaluations.

The good news is that I’ve been running a forward test Incubator of ~200+ strategy variations. Incubator strategies are run on live data using simulated accounts.

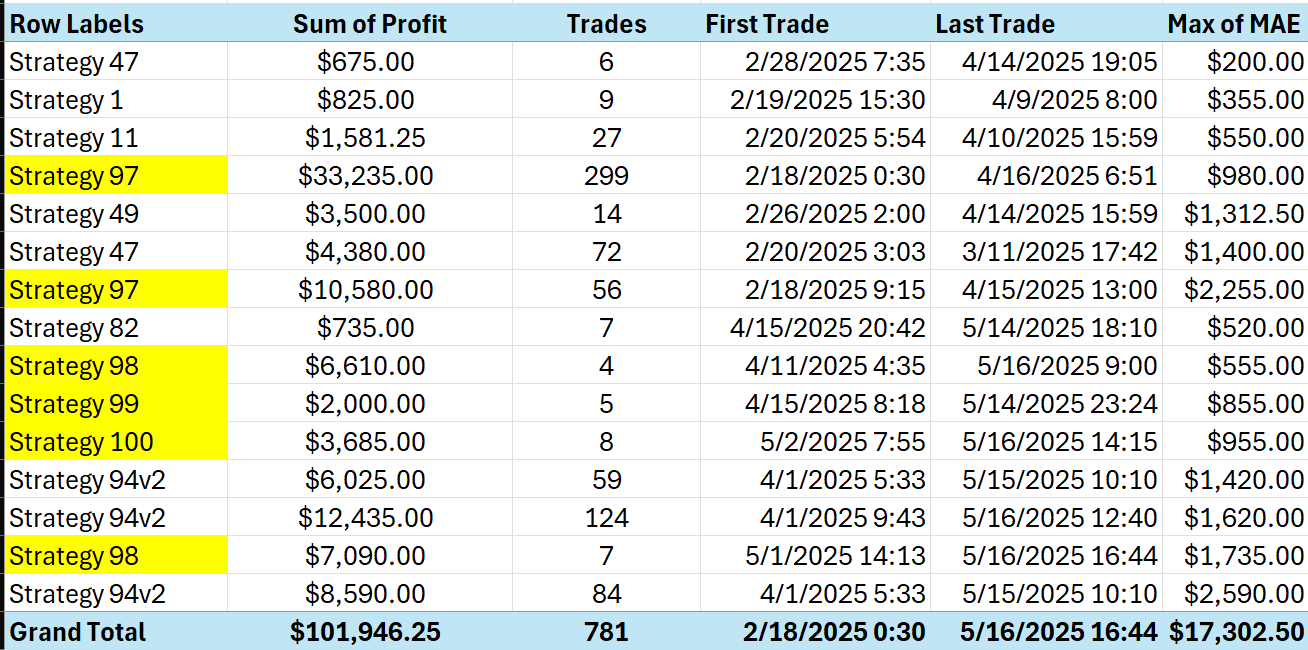

These are the strategies in the Incubator with Max MAE stats in line with the requirements of a prop firm:

A few things to note:

All of these strategies have a Max MAE less than $3K. Some have a low profit given the time period of the test (e.g., 1, 11, 47), but also have low MAE’s which means you can trade more than one contract and still stay under the daily limit.

Some strategies are on the list twice due to strategy variations.

Some strategies in the Incubator have already been published, some have not. Those that have not been published are highlighted in yellow and will be published in the months to come. Click here for a list of published strategies.

I will be running the following seven strategies in evaluation accounts as a test:

Claude AI — MNQ due to large MAE

Grok3 — MNQ due to large MAE

Strategy 94v2 — started last week, already up $1K.

Strategies 97, 98, 99, 100

Strategies 1 (variation), 94v2, and 97 are the product of analysis using machine learning models.

Next Steps & AI Strategy Downloads

Over the coming weeks, I'll share performance updates on these strategies with you. The end goal: a master strategy that combines the strongest elements from each strategy/approach.

See below for downloads of OpenAI 03, OpenAI 04 mini, Manus & Grok 3.

In Part 3, I’ll share Claude.AI’s strategy and we’ll review some of the best features from all 5. I’ll also give an update on how the reverse of OpenAI 04 mini is performing.

In Parts 4 & 5, I’ll give you the specific parameters to use with the strategy variations that have already been published, and introduce Strategy 97.

Parts 6, 7 and 8 will introduce strategies 98, 99 and 100, respectively.

As always, your questions and insights are welcome.

Contact: Celan @ AutomatedTradingStrategies@protonmail.com