The Prop Firm Paradox: Win Too Much, You Lose

Why Your Best Trading Day Might Be Your Worst Prop Firm Nightmare

Important: Trading futures is extremely risky. You should only use risk capital to fund live futures accounts and if you do trade live, be prepared to lose your entire account. There are no guarantees that any performance you see here will continue in the future. I recommend using ATS strategies in simulated trading until you/we find the holy grail of trade strategy. This is strictly for learning purposes.

I’m not just developing strategies—I’m on a quest for the holy grail of automated trading. Questions? Check the FAQs first, then feel free to reach out directly: AutomatedTradingStrategies@protonmail.com. If you’re looking for a one-on-one consultation, you can contact me directly for rates, but it is not included with the subscription unless you’re a founder.

“Why does it say paper jam, when there is no paper jam?”

-Samir from the movie Office Space

I wanted to take a moment to alert you of something that I have just now been made keenly aware of. As many of you know, I’ve been conducting research for a series on using LLMs to pass funded trader or prop firm evaluations. So, I’ve been testing out the TopStep Funded Trader Evaluation program with several strategies/strategy selection ideas.

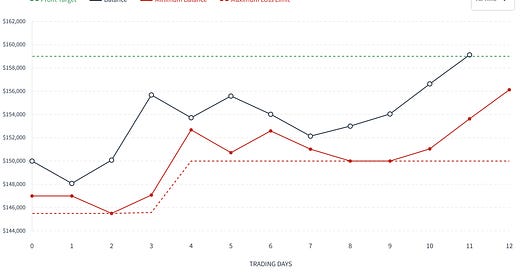

The first account was $50K, it passed with no issues. So I decided to try for a $150K account. I made it past the $9K profit target (green dotted line below). Here’s an overview of daily performance:

Instead of a funded account, however, I was told that I needed to make another $2,205 to satisfy the ‘consistency’ rule. The rule states that your best trading day can’t be better than 50% of your total. Here’s a snapshot of my Dashboard and the rule.

As you can see, I’ve met all conditions except for the consistency target. I understand wanting to discourage gambling or one day windfalls, but that’s not what this rule does. The truth is, I exceeded the profit target by $123, showed a 64% win rate over 11 (non-consecutive) trading days, and demonstrated consistent profitability. The consistency rule is punishing excellence rather than preventing gambling. Yeah, I said it: EXCELLENCE. Bastards!

If TopStep really cared about finding the best traders it would have rules that matched the intention such as:

Statistical Deviation Method—Allows profits within 2.5 standard deviations of average. My best day was well within normal variance.

Profit Distribution Rule—Best 2 days can't exceed 60% of total winning days. Only 49.7% of my profits came from my best 2 days.

Context-Based Evaluation—If best day ≤5% of account, it's reasonable risk. My 3.74% daily return is reasonable for any professional trader, not reckless.

These are all proper forms of evaluating risk and I would have passed all three.

I digress…(mostly)

Alternative Prop Firms?

Right, so the question I have for you is: do you know of any prop firms that have better rules?

I suppose the good news is that this isn’t an issue after you obtain a funded account, but I’m fairly principled. I don’t want to prop up (no pun intended) a prop firm that has inconsistent rules, let alone share 10% of my profits with them.

Naturally, I am also extra anxious to see what NinjaTrader will do if it enters the prop trading game. While there’s been no confirmation of this (there have been many rumors), I think it’s highly possible ever since Kraken acquired NinjaTrader for $1.5 billion in March.

NinjaTrader entering the prop firm space would be a logical revenue expansion. The prop firm industry has exploded in recent years, and NinjaTrader has a front-row seat to this growth through their platform usage. If NinjaTrader launches their own prop firm, they'd have unique advantages that would be more valuable than any fees it might collect from other firms using their platform including:

Direct platform integration

Lower operational costs

Existing user base of 2 million traders

Kraken's capital for funding traders

No doubt terms would be better for traders as well.

So while NinjaTrader hasn't officially confirmed plans to become a prop firm, the evidence strongly suggests they're positioning for something significant in this space. The restriction of new prop firms while maintaining existing relationships, combined with the Kraken acquisition providing substantial capital, creates a compelling case for the speculation.

Has anyone else heard of any rumors? I think I first heard this rumor back in February from a subscriber. Meanwhile, keep your eyes peeled. If NT launches their own prop firm, it could shake up the entire industry. All the more reason for Topstep to review its consistency rule.

Apex Could be a good option. but but but... something they are so weird for payout, I have around 2 years working with that company, and sometimes they are so annoying to accept the payout. moreeee flexible rules. (one day pass)

If ninja has 2 million users, how many does Tradestation have? Why do don't u include TS code for ur systems?