The Mudder Report: Weekly Update 02/06/2022 - 02/11/2022 (NT8 Week 7)

In total, Test 3 is up $118K, while Test 5 is up $124K.

Risk Disclaimer: There is no guarantee that our strategies will have the same performance in the future. Some may perform worse and some may perform better. We use backtests to compare historical strategy performance, but there are no guarantees that this performance will continue in the future. Trading futures is extremely risky. If you trade futures live, be prepared to lose your entire account. We recommend using our strategies in simulated trading until you/we find the holy grail of trade strategy.

This is the Mudder Report for the week: 02/06/22 - 02/11/2022

This is the 13th post in a weekly series dedicated to tracking our automated strategies at the weekly level. You can read the first post here. You can also click here for links to all weekly reports. The original post provides an overview of our approach and why we’re doing this. It also provides an explanation of the reporting structure.

Just like our annual backtest updates that happen every two months (click here for the January update), we’re looking for consistency here, but at a more granular level. The goal of the series is two fold:

to compare weekly stats against annual stats

to develop a rubric/framework for a strategy selection process

The latter is based on the premise that the holy grail of automated trade strategy may not be static, but more fluid like a chameleon or rather made up of multiple strategies. We are currently testing several theories concurrently to see which one performs better over time.

Weekly update summary

Before getting into the results of this week’s Mudder Report, I want to take a moment to stress that the results are from backtests, not live data. We are not trading any of these strategies live. If you use any of our tests as way to select strategies for live trading, please be aware that you could lose your entire account. The goal of the hunt is to develop a backtest into a viable strategy, or a combination of strategies, that is so reliable and predictable that you can trade it live with little risk of losing your entire account. Even then, nothing is ever guaranteed and you shouldn’t believe anyone that tells you otherwise.

We’ve defined the holy grail as having the following attributes:

Profit factor greater than 3

Annual drawdown less than 3%

Annual return on max drawdown greater than 500%

Maximum cumulative daily low of -$1,000

Avg Daily profit greater than $1,000

Less than 5,000 trades annually

More than 253 trades annually

It has been over one year and we are making progress. Where possible, we are also attempting to improve return by looking for high probability opportunities. For example,

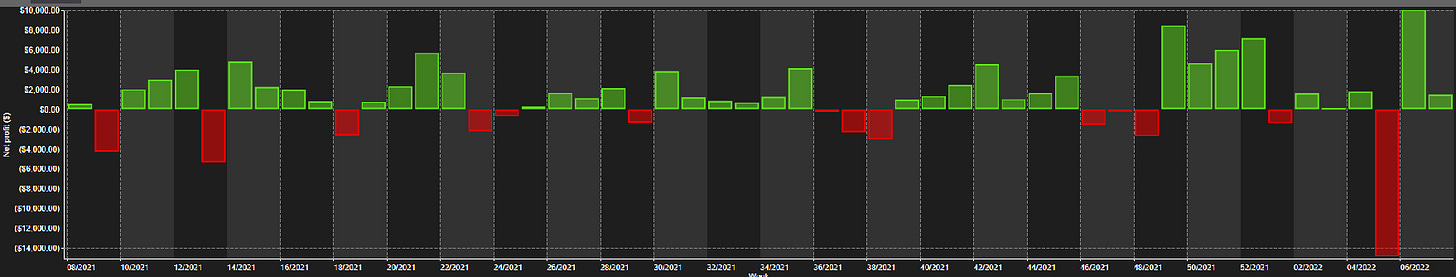

Strategy 40 always has three weeks of profitability — see below for the weekly net income chart. In the prior week, Strategy 40 had “week 1” of profitability. So, based on our observation, we expected the strategy to be profitable again. It was. Last week Strategy 40 made $1,465 on 16 trades. We expect it to do the same this week. In a future post, we’re going to see if we can link negative weeks to a specific economic announcement.

Strategy 10 was also profitable for the 13th week in a row. Last week it made $10,525 on 645 trades.

Three weeks ago we decided to focus on the timing of central bank announcements as well as trends, realizing that the former, when present, is a stronger influence on the markets than the latter. We’ve found that all non-divergence strategies perform better under the extreme conditions created by FOMC announcements. In this week’s Mudder Report we’re going to see how our strategies performed during last year’s January and March 2021 FOMC announcement. In the weeks to come, we’ll see if we can narrow our hunt to a single day (n, n-1, n+1) within the week of the announcement, with n being the day of the announcement.

For links to all strategies, click here.

Test Development

At the end of 2021 we looked at the first 8 weeks of the Mudder Report’s weekly analysis. The observations that came from that analysis can be read in the post: Mudder Report Analysis. The most salient observation made was that our original selection criteria was flawed. As a result, we decided that our new selection process should be based on any one, or all, of the following:

trends in net income from the previous week

the strength of the trend as measured by profit factor

the individual profile of the strategy

weekly historical comps

certain economic announcements from central banks

We ruled out historical comps, but we’re still developing the others. This week we’ve ruled out two other theories. Before sharing which tests have been ruled out and why, let’s review which tests we ran last week:

We continued to test the overall performance of the portfolio (Test 1), but we had no expectations based on economic announcements.

We ran all negative strategies with a low profit factor (Test 2).

We ran all strategies with one positive week (Test 3).

We ran all strategies with at least 2 weeks of positive trending weeks and a high profit factor. This is the selection criteria that we started with in the first week of the Mudder Report (Test 4).

We ran Strategy 10 for its individual performance, but with only one contract. We ran Strategies 13 and 14 with the MNQ on six contracts for individual performance. We also ran Strategy 40 on 5 contracts for its individual performance (Test 5).

This is how each test performed: