The Mudder Report 3.0: 1/15/23 - 1/20/23 (Week 3)

7 strategies showing gains based on real-time tests, Strategy start dates added, Apex Interim Forward-test results, new ideas for testing scalping strategies...

Important: There is no guarantee that our strategies will have the same performance in the future. We use backtests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results we share are hypothetical, not real. There are no guarantees that this performance will continue in the future. Trading futures is extremely risky. If you trade futures live, be prepared to lose your entire account. We recommend using our strategies in simulated trading until you/we find the holy grail of trade strategy.

As a quick review, the goal of the original Mudder Report was to provide a weekly tracking report of our best strategies (click here for links to all 60 strategies) based on historical or backtest data. The goal of the revised Mudder Report 3.0 is to provide weekly tracking of our best strategies based on real-time trade data. The trades are being made on a simulated account, so the results as still hypothetical, but the data driving the simulation is live.

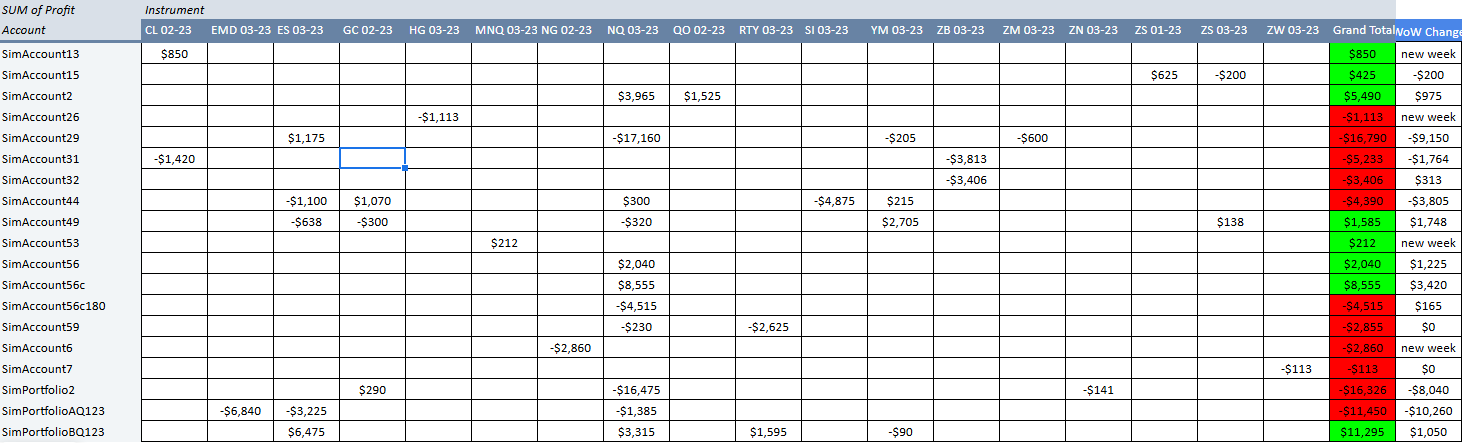

These are the real-time results for the time period January 1, 2023 to January 20, 2023 for some of our strategies:

Note, the SimAccount is connected to the Strategy #, so SimAccount13 is Strategy 13; SimAccount15 is Strategy 15, and so on. We also added Strategy 13, 26, 53 and 6 to the real-time test last week. Unfortunately, this test does not include all of our strategies because it is difficult to test all strategies at the same time, but we’ll be adding more strategies periodically throughout the year.

Strategies 13, 15, 2, 49, 53, 56, 56c and Portfolio BQ123 have all posted gains. As a quick reminder, SimPortfolioBQ12 is a test for a portfolio strategy based on the strategy variations from the master equity futures portfolio with the highest percentage of profitable trades. The strategy behind Portfolio BQ123 was also successful in our Q4 real-time test.

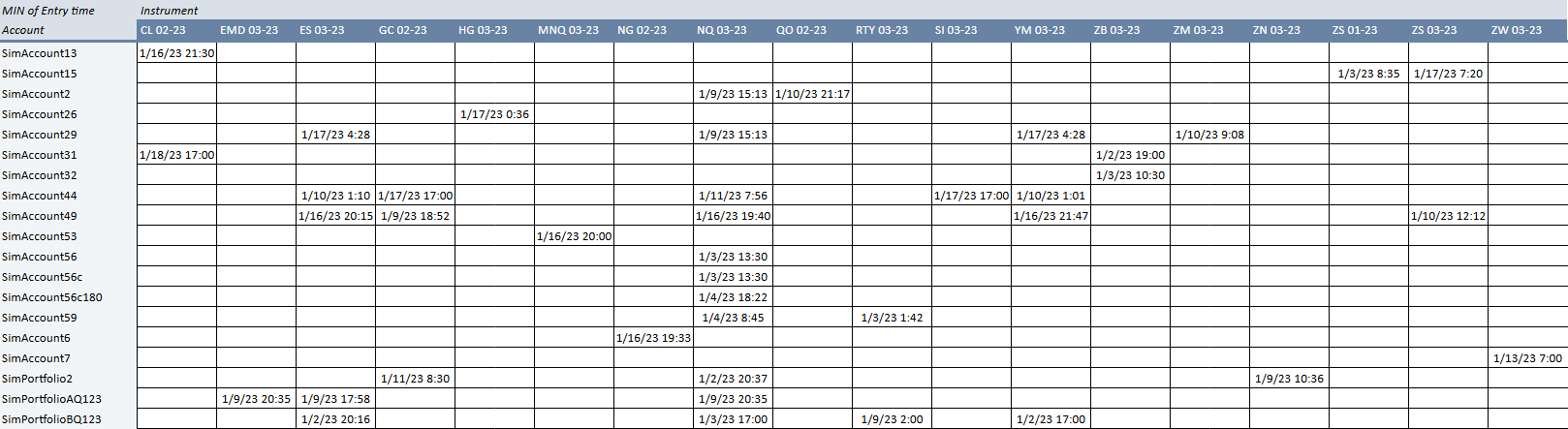

Since we’ll be adding strategies at various times throughout the year, the following chart shows when the first trade was made for each strategy. We’ll use these dates as a proxy for start date on the strategies represented above.

We’ll also be:

Starting Strategy 2 (QO) on Apex. Start time/date: Wednesday at 6:01 pm EST on 2 to 3 contracts.

Removing Strategy 29 (NQ) from real-time test. Keeping Strategy 29 (ES).

Removing Portfolio AQ123.

Starting Strategy 56 on Apex. Start time/date: day after large loss.

Starting Strategy 56c on Apex. Start time/date: day after large loss.

Apex Interim Forward-test

In addition to focusing on cumulative net income over the forward-test period, we’ll also be tracking a few strategies on Apex. In this way, we’re using Apex in a dual capacity; it is both sandbox and potential funding partner. It also provides another way to gain and share trade performance objectively.

If one of the strategies passes the evaluation, we’ll continue to run it through to the live test, however, it will continue to serve as a learning experience for the quarterly live test in April. In other words, the live test in April will be conducted under a specific framework that will be developed using information gathered with these interim tests.

Where are we this week?

Here’s an overview of where we stand with all strategies in the current interim test. Last week we ran the strategies on the left. This week we’ll be running the strategies on the right: