The Mudder Report 2.0: 10/02/22 - 10/07/22

Over the last 3 weeks, these six portfolios have made $49K on a profit factor of 1.49. These are real-time results.

Note to Subscribers reading via email: You may need to view this post within Substack to read in full.

As a quick review, the goal of the original Mudder Report was to provide a weekly tracking report of our best strategies (click here for links to all 50+ strategies). The goal of the revised Mudder Report 2.0 is to provide weekly tracking for our best strategies based on real-time trade data instead of backtest or historical data. The trades are being made on a simulated account, but the data driving the simulation is live. If real-time results are the same as backtest results, the strategy is included in the Mudder Report below.

These are the results from the Mudder Report for last week:

Strategy 49 has been removed from the Mudder Report. The backtest results for Strategy 49 are fairly accurate, however, if even one trade is wrong, it can greatly throw off net income/profit factor. In addition, the strategy has been shown to be highly sensitive to changes in volatility (thank you for your analysis Jozef). So, even though you will likely see high performance from Strategy 49 through the current period of volatility, once that volatility drops off, so does net income.

Let me give you an example of how sensitive this strategy is. I conducted a backtest over a two week period. The results were much better than real-time results. This is due to 1 trade (out of 14). All other trades were the same for the backtest and real-time results. In the backtest, the trade never hit the stop loss of $790. It went down to $785 and then popped back up again to make a profit of $2,770. In real-time, the trade hit the stop loss of $790. So a $5 difference (1 tick) caused a $3,600 swing in net profit. The point is, this strategy is highly sensitive and therefore dangerous because minor differences can have a huge impact on profitability.

Our rising stars are Strategy 2 (CL), Strategy 11 (ZB) and Strategy 13 (CL). All three have been profitable for at least three weeks in a row. Strategy 13 has been profitable for 4 weeks in a row. We’ll see if they can continue this trend into next week.

Portfolio Strategy 54 & 55 Performance (3 weeks, real-time)

In addition to single strategies, we’re also tracking several portfolios (54a, 54b, 54d, 54e, 54f). This is how each portfolio performed in Week 1:

54a & 54b are the clear winners. In week two we added 55a. This is how each portfolio performed in Week 2:

54a underperforms by $4K, but 54b saves the day. This is how each of these portfolios performed in Week 3:

Again, 54a overperforms, and 55a makes a strong showing as well. While 54b underperforms, I would rather a strategy not make a trade than to make a bad one. I think this is an example of a great week for 54b. We’ll talk more about each of these portfolios more below. First, let’s look at the results for the past three weeks combined:

Over the last 3 weeks, these six portfolios have made $49K on a profit factor of 1.49. Again, these are real-time (not backtested) results.

Keep in mind, the last three weeks have been volatile. The market is trying to reconcile/digest rapidly rising interest rates with higher rates of inflation. The Federal Reserve has committed to taking the blame, but has pinned all hope of future growth on lower inflation, which is out of control. Fed Chair Powell essentially has the economy in a headlock, and I applaud him for it, but I don’t think even he knows what the outcome of all this will be. To read more about my thoughts on the conflict click here. When you add energy wars to the equation, we’re in for a wild ride in Q4 and the last 3 weeks have been a sample of what we’ll see from the market over the next 11 weeks.

What is the real-time simulation telling us about our portfolio selection process?

These are the annual results of the portfolios above based on backtest data:

Portfolio 54a - $626K net income, 1.44 profit factor, 3231 trades

Portfolio 54b - $119K net income, 3.71 profit factor, 229 trades

Portfolio 54d - $313K net income, 3.08 profit factor, 832 trades

Portfolio 54e - $201K net income, 4.93 profit factor, 535 trades

Portfolio 54f - $47K net income, 4.14 profit factor, 364 trades

Portfolio 55a (Micro Contracts) - $66K net income, 1.64 profit factor, 2418 trades

What we want is for real-time results to mirror the annual backtest. Let’s talk about each Portfolio Strategy and how it performed in the real-time test compared to the annual backtest.

Portfolio Strategy54a performed as expected based on backtests. Based on the annual backtest results above, I would expect Portfolio Strategy 54a to make ~$12K per week, on 180 trades with a profit factor of 1.44.

What actually happened in the real-time test?

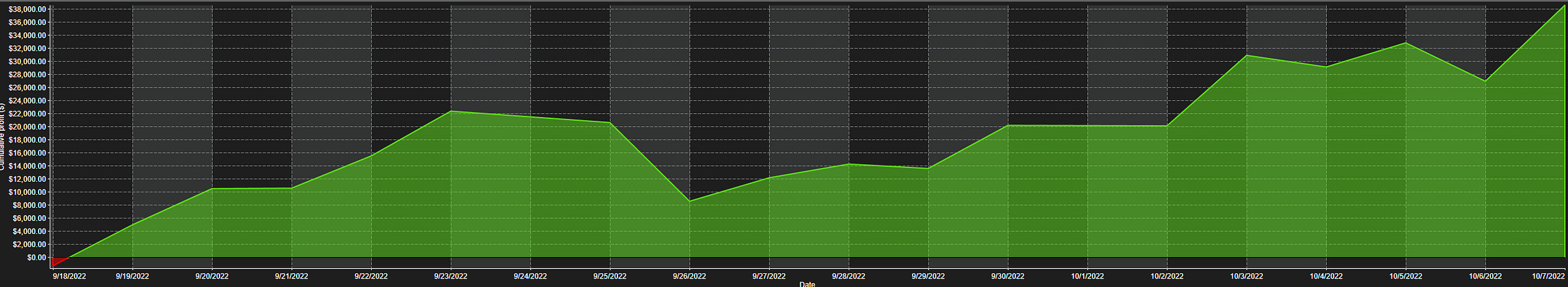

In the last 3 weeks, Strategy 54a made over $36K on a profit factor of 1.45, and 172 trades, which is in line with expectations. 42.44% of the portfolio’s trades were profitable, but it has a win loss ratio of 2. So, the average trade only makes money 42% of the time, but it makes twice as much as it loses. The scariest part about this portfolio strategy is the drawdown, which was $18K. Here’s a chart of cumulative performance over the test period.

Portfolio Strategy54b performed better than expected based on backtests. Based on the annual backtest results above, I expected Portfolio 54b to make ~$2K per week, on 4.4 trades and a profit factor of 3.71.

What did we actually get based on real-time tests?

In the last 3 weeks, Portfolio Strategy 54b made over $11K, on 13 trades with a profit factor of 13.90. This clearly beats expectations. 84.62% of the portfolio’s trades are profitable. It also had a drawdown of only $781, which is akin to spotting a Red Crested Turaco—glorious. Here’s a chart of cumulative performance over the test period.

Portfolio Strategy54d performed lower than expected based on backtests. Based on the annual test, I would expect a strategy that made ~$6K per week, on 16 trades and a profit factor of 3.08.

What did we actually get based on real-time tests?

In the last 3 weeks, Strategy 54d made only $1,851, on 38 trades with a profit factor of 1.22. So, the trade count was right, but that’s about all.

Portfolio Strategy54e also performed lower than expected based on backtests. Based on the annual test, I would expect a strategy that made ~$3.8K per week, on 10.6 trades and a profit factor of 4.93. After all, this is the same portfolio selection process as 54d, but the profit factor minimum is 3 instead of 2.

What did we actually get based on real-time tests?

In the last 3 weeks, Strategy 54e lost $1K, on 18 trades with a profit factor of .42.

Portfolio Strategy54f also performed lower than expected based on backtests. Based on the annual test, I expected a strategy that made ~$1K per week, on 7 trades and had a profit factor of 4.14. This is a portfolio based on strategy variations with the lowest drawdown.

What did we actually get based on real-time tests?

In the last 3 weeks, Strategy 54f lost $1K, on 13 trades with a profit factor of .62.

Portfolio Strategy55a performed as expected based on backtests. Based on the annual test, I would expect a strategy that made ~$1.2K per week, on 46 trades and a profit factor of 1.64. This is a portfolio based on strategy variations with the highest net profit, like 54a. Except instead of using mini contracts, we’re using micros. You can read more about the selection process in the strategy description for Strategy 55.

What did we actually get based on real-time tests?

In the last 3 weeks, Strategy 55a made $1.5K, on 197 trades with a profit factor of 1.14. This isn’t what we expected in a profit factor, but it meets expectations in net income and trade count. It’s also important to note that we only have two weeks of data from Portfolio Strategy 55a. The first week was well below expectations, the second week was well above expectations. It also had a drawdown of $2,905 which is concerning given the level of profitability. It will be interesting to see what the next three weeks bring.

How To Test and Duplicate These Portfolio Strategies For Yourself

Some of you are running your own tests on these portfolios so I want to take a moment to see if I can help make this process easier. Also, feel free to reach out to each other in the comments. I want to encourage collaboration in any way.

I’m going to give you the strategies used in each Portfolio. We’ll use this as a baseline. Any changes made to these portfolios will reference this post. To run the strategy in each portfolio, you will need:

the strategy (click here for links to all strategy descriptions),

the time period,

the instrument (i.e., ES, MNQ, NQ); and,

parameters for each indicator

Before sharing the strategies that make up each portfolio described above, let’s review the optimization strategy and portfolio theory used to select the strategies used in each portfolio.

Optimization strategy and portfolio selection process

The process has evolved. The evolution has been documented in the Mudder Report, but let’s take a moment to review how we came up with the optimization strategy and portfolio selection process.