Mudder Report: Q3 2025 Forward Test Update; Up $70K in 11 Weeks

Get ready for September 17th

Important: There is no guarantee that ATS strategies will have the same performance in the future. I use backtests and forward tests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. Forward tests are based on live data, however, they use a simulated account. Any success I have with live trading is untypical. Trading futures is extremely risky. You should only use risk capital to fund live futures accounts and if you do trade live, be prepared to lose your entire account. There are no guarantees that any performance you see here will continue in the future. I recommend using ATS strategies in simulated trading until you/we find the holy grail of trade strategy. This is strictly for learning purposes.

We're not just developing strategies—we're on a quest for the holy grail of automated trading. Questions? Check the FAQs or feel free to reach out directly: AutomatedTradingStrategies@protonmail.com.

Housekeeping:

First, a few weeks ago I sent out an email informing you that someone was impersonating me. I have since been informed by Substack support that the profile has been deleted. Here’s the full response from Substack:

Hi Celan,

Tex from Substack Trust & Safety here. Thanks for reaching out about this. Reports like this one help us keep the platform safe for the entire Substack community.

It looks like we removed this impersonator over the weekend.

The fastest way to get impersonators removed is by having you or your subscribers follow these steps to report a profile through our web/app reporting flow. We're constantly improving auto-detection of those attempting to impersonate bestsellers but they sometimes get through.

Please don't hesitate to reach out if you have any further questions or concerns.

Best,Tex @ Substack

So if you experience anything odd, contact Substack support (or me).

This is something that is only going to get worse with AI. Most recently, Sam Altman (the CEO of OpenAI) issued a warning to all banks regarding voice impersonation, so be sure to protect yourself.

Second, I’m so glad to be back! As I said before I left for vacation in August, all subscribers should have received one month as a comp. If you did not, please let me know.

As I make my way through your emails, I can’t tell you how thrilling it is for me to see your progress. I know how much the hunt means to me and it’s a blessing to pay some of that forward.

Third, I know some of you are putting off setting up a forward test of your own. I see you. One of my favorite pastimes is clicking “Watch Later” for no sugar dessert recipes on Youtube. Your trading system is becoming the exercise bike of your financial life.

Here's the thing: I spent TWO YEARS avoiding my first forward test (just 10 strategies). You don't need to purchase a subscription to start. Use the two free strategies (strategies 1 & 5) and just tweak them. Create variations. Break them. Fix them. The point isn't to find the perfect strategy—it's to start the process.

ATS strategies allow you to leap frog a step or two, but the holy grail is in the process and that process begins with the forward test. The good news is that what we’re hunting is automated. Once found, it’s an investment—however fleeting— in time.

Last but not least, many of you have already started your own forward test. The following is a framework for how to find redeeming value in any portfolio. Due to the number of trades, it also provides generalized information regarding systematic performance over Q3 that you may find translates to your own forward test. I’ve found that my portfolio tends to perform the same as many of the quant hedge funds I follow, which suggests that there’s some meta element which is a generalized algorithmic issue rather than a strategic one. I suspect it has everything to do with timing, but when I went looking for clues in the performance data, the culprit had more to do with volatility, directional volatility in particular.

Ultimately, the goal is to use this information to create a better portfolio for Q4, which starts in a few weeks.

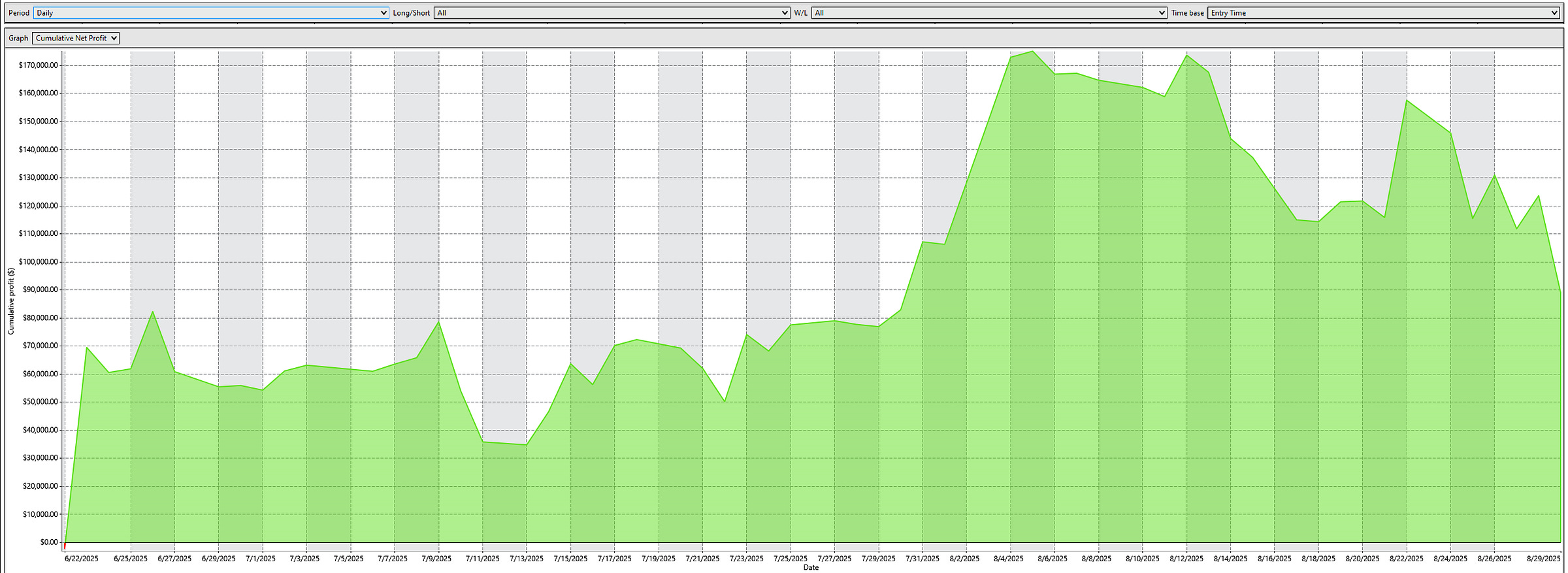

With that said, let’s jump into the results of the Q3 2025 Forward Test, which is currently up $70K since June 19th.

The Q3 2025 Forward Test

"The key is in not spending time, but in investing it."

- Stephen R. Covey

The latest ATS Forward Test (Q3 2025) spans 2,791 trades across ES, NQ, GC, ZB/ZN, and multiple time-frames. The headline is simple: The portfolio made $70,165. Here’s an overview of daily performance:

Notice, the portfolio never dropped below $0. That has everything to do with start date, which was on a Monday. This was intentional.

Here’s a weekly overview:

As you can see, the portfolio is currently in a drawdown so I’m looking forward to seeing if we get a rebound by the end of the quarter. I’m expecting big things on September 17th. According to my alert system, this is the highest confidence trade date for the portfolio this year. I’ll talk more about why that is in a moment.

Q3 Performance

Looking at the results of the Forward Test by day of week, the best days were Monday (+$69,545) and Tuesday (+$54,775). The worst day of the week was Friday (–$63,175). Wednesday had the highest win rate (64.6%), but still lost money (–$12,963). Key takeaway: This regime is deadly for strategies on Friday. Feast on Monday and Tuesday, however.

The belles of the ball:

Strategy 42: $50,875 (just 45 trades)

Strategy 3: $18,615

Strategy 77: $53,988 from 23 trades

Scroll to the bottom of this post for the full forward test.