A few months ago one of our subscribers asked us if we could help him to find a strategy that would allow him to obtain funding from a program that funds traders after completing an evaluation. He was looking for another kind of holy grail — the holy grail of automated trading strategies for funded trading programs. A month after that, we received another request. Now, the requests are more frequent.

I’m going to cut to the chase — we have not found the holy grail of automated trade strategy or the holy grail of automated trade strategy for funded trading programs. But, we are all in the hunt together so let’s focus on what we can do.

We can give you a strategy for using our strategies to get funded. We can give you our suggestion for how to think about using our strategies as a way to help in your hunt. Personally, if I was going for funding, I would trade manually because there are so many rules. In order to understand the rules a little better, I decided to try out Oneuptrader to better understand the process. I reached my profit goal with 5 days to spare.

I then used the last 5 days to make 1 trade per day until I also met the minimum number of days to trade. That said, I used my own manual trading technique (based on observed trends and market structure), not any of our strategies.

I show this to say that while difficult, it is not impossible. I also learned a lot from the process and I’m sure you will too, even if you don’t pass. After I passed the evaluation, the entire process to get funding took about 4 days. The rules make the task of obtaining a funded account very difficult, sometimes overly so -- like a carnival game. In this way, the rules define the holy grail of trade strategy for funding programs. So, the first step in obtaining funding is finding the funding program with the loosest rule set.

The Best Funding Program

There are many funded trader programs — so many, that it’s hard to keep track. The best funding program is the one that has the fewest restrictions. We did some research and some funded trader programs have heavy restrictions, while many of the newer services do not. Ultimately, the best program offers the loosest restrictions and newer programs use this as a way to lure traders away from the older, more established programs.

What do we mean by loose?

You want a funding program:

that lets you trade anything you want and/or as many assets as you want.

that will allow you to swing trade (keep positions open throughout the week), but this isn't necessary.

that has only 1 evaluation step. Some require you to take two tests, while others only require 1.

that has zero monthly data fees for funded traders and $0 commissions if possible. To date, the only platform I know that offers $0 commissions is TopStep, and that’s only if you use their trading platform, which is obtuse compared to NinjaTrader.

that allows you to reach your target in the least amount of time. For example, TopStep requires a 2 step evaluation, but only requires 5 days to reach your target on the first test and 10 days to reach your target on the second for a total of 15 days. Oneuptrader only has a 1 step evaluation, but requires 15 days to reach your target. Uprofittrader has a 1 step evaluation, but only requires 10 days.

that allows you to keep 80%+ of your profit. That said, if a company does have a lower split, they are going to be more interested in your success.

that allows you to make weekly withdrawals with no restrictions.

The wider the restrictions, the better.

The next question is: how do you select the best funding package or subscription?

The Best Funding/Subscription Package

The best funding package has the widest risk parameters. These parameters are in addition to the rule set. Here are the risk parameters for a $50K account with Uprofittrader:

Target - $2500

Max Position/Contracts - 6

Daily Loss Limit - $1,100

Pro Drawdown - $2,000

Minimum Trading Days - 10

The only thing that’s relevant is that your daily loss limit is $1,100 and your cumulative loss limit is $2,000. It’s no mistake that the most expensive funding package coincides with the loosest rule set. Again, the only thing that matters is your daily loss limit and cumulative drawdown. Everything else, including the account and contract size, is just cake.

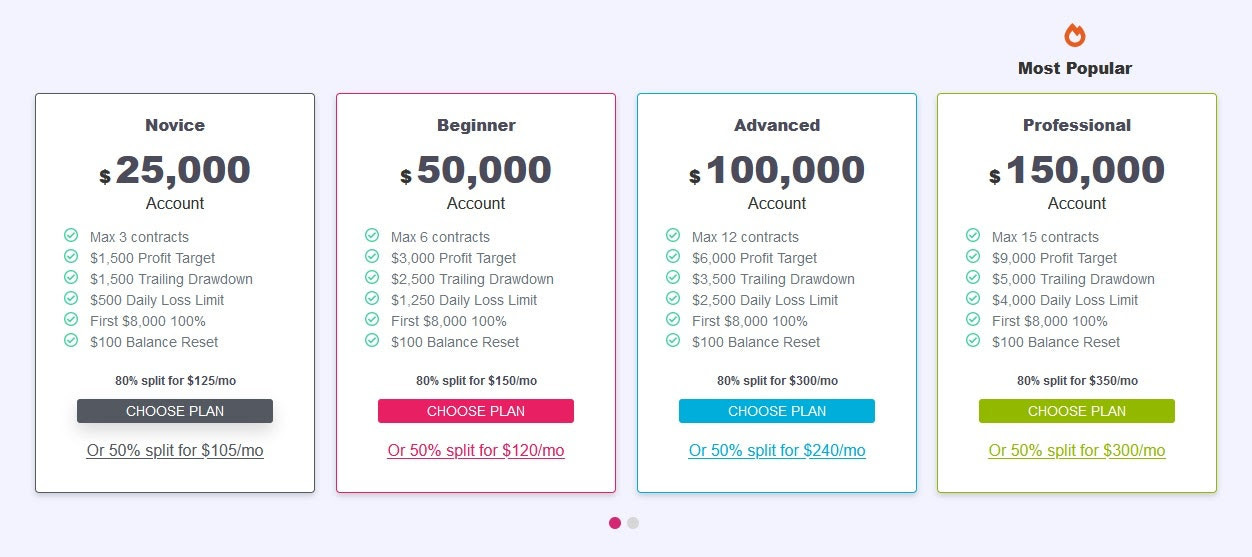

Here’s an example of the subscription options for Uprofittrader:

These packages are marked by trade-offs. You can “try out” for funding for a:

$25K account at a cost of $145/month, but you’ll have a daily loss limit of $500 and a max drawdown of $1,250.

On the other end of the spectrum, you can apply for a $100K account at a cost of $315/month, but you’ll have a daily loss limit of $2,200 and a max drawdown of $3,000.

Here’s another example of subscription options from Oneuptrader:

Oneuptrader has a daily loss limit for the $50K account of $1,250, while the max drawdown is $2,500. Between these two, Oneuptrader has the best program, but there are many others.

It’s also important to note that in some funded trader programs, the rules change when you get funded. Most programs have a weekly loss limit as well as a daily loss limit once you’re funded. So it’s important to read and compare everything (both pre and post funding) before making a decision. As a quick side-note: we are not endorsing any funding program. We are only pointing out the differences.

What Strategy Should You Use?

This is the million dollar question. Personally, I don’t feel comfortable enough to use any of our strategies for trading yet (for a link to all strategies and the most recent performance chart, click here). That's why we're on the hunt for the holy grail of trade strategy, which is defined by the following:

Profit factor greater than 3

Annual drawdown less than 3%

Annual return greater than 500%

Minimum daily net profit of -$1,000

Avg Daily profit greater than $1,000

Less than 5,000 trades annually

Greater than 253 trades annually

So our hunt is a little different from ‘the hunt for the holy grail of funded trading programs’.

We were once asked, "if your strategies are so good, why are you sharing them with others?" The answer is: we may all be on a hunt of some kind, but different people have different agendas and risk profiles — this is a perfect example. It will take a strategy that is able to perform like the strategy outlined above to get our attention. That said, we don't care how our subscribers use our strategies (evidently some are using them to make money on replica sites like Collective2), but our goal is to find the holy grail of trade strategy. When we find it, we'll trade it. I only mention this to reinforce the fact that we have different goals. That said, we're going to approach the question of which strategy to use with the funded trader hunt in mind.

Since we usually only get asked about a $50K account, we’re going to use that for this example. What works at the $50K level will work at higher levels as well. That said, you will find more strategies that fit your subscription criteria at higher account levels because they allow for more risk.

So, if we’re looking at Oneuptrader for reference, we need a strategy that makes on average $200 / day (total $3,000 net profit over a 15 day period). We’re also looking for a strategy with a max cumulative net loss of $2,500 and a max daily drawdown of $1,250. We’ll start with net profit.

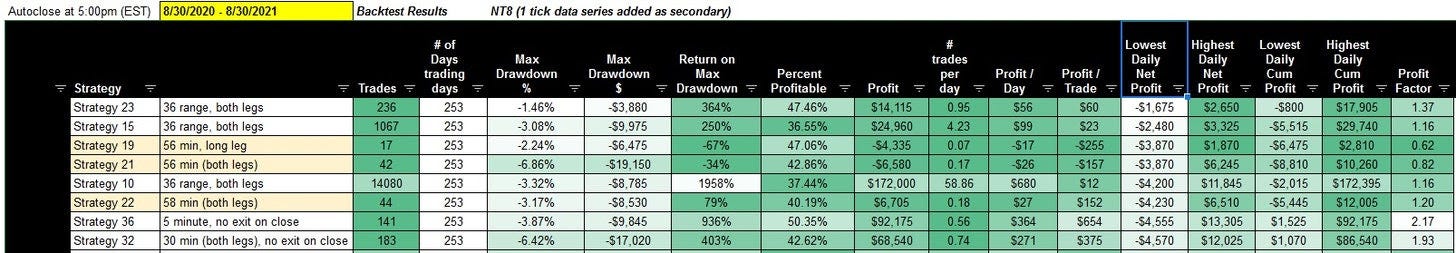

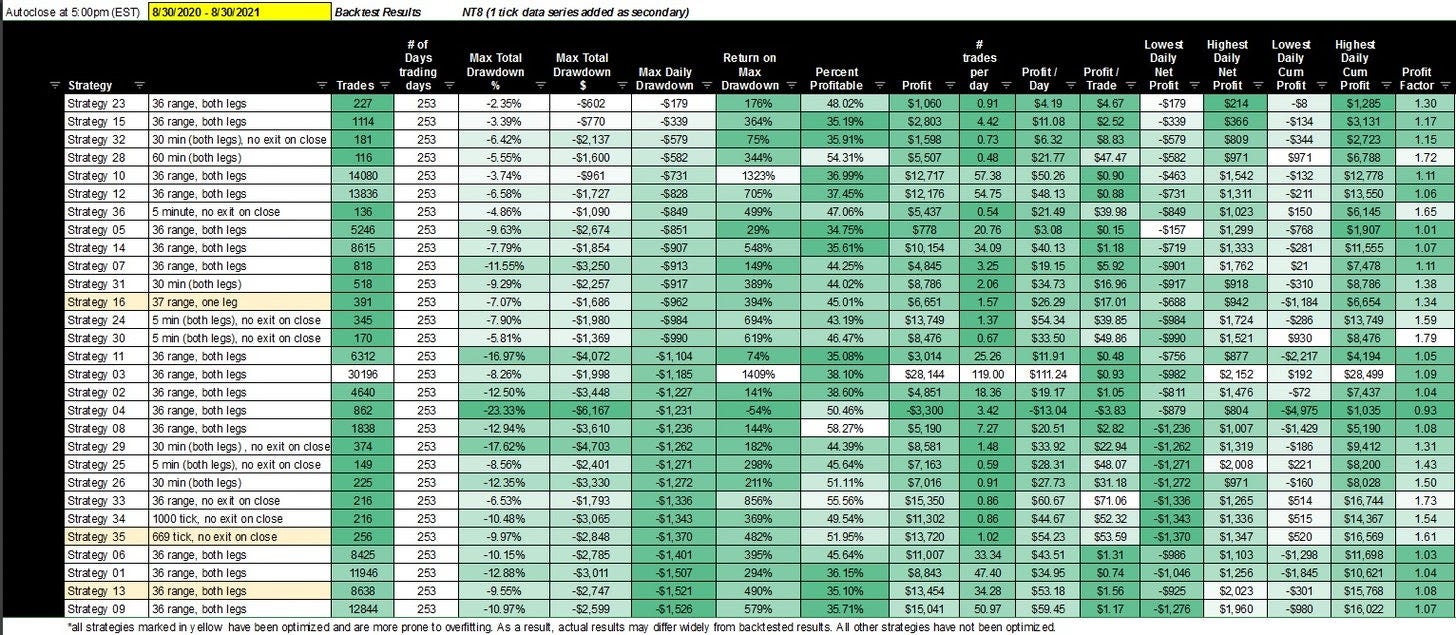

See below for the strategies with the most favorable daily net profit:

(Click on chart to enlarge. Note, all strategies marked in yellow are optimized and tend to have inconsistent results. To learn more about why this is, click here)

As you can see, all of these strategies have a minimum daily net profit that is lower than what is required to obtain funding for a $50K account. Knowing this, what do we recommend:

The lowest daily net profit and the highest daily net profit are extremes. If we were looking for the holy grail of funded trading strategies, we would be more interested in the average daily net profit/loss rather than the actual daily net profit/loss. You would also want to focus on the minimum daily drawdown rather than the cumulative max drawdown. We’ll talk a bit more about why that is in a moment.

You could also level up to a higher funding package as a way to increase the daily loss limit. At Oneuptrader, the trailing drawdown goes up to $5,000 and the minimum daily net profit loss is $4,000 for the $150K account. Both give us a little more room to work in and one of our strategies actually meets the requirement (Strategy 23). Even though Strategy 23 meets the requirement it also has a low profitability and makes on average just $56 per day. Whereas Strategy 36 (to be published shortly) makes $364 per day ($664 per trade).

You might also want to employ a strategy that assumes a certain failure rate. Just because a strategy has a max daily loss of $5,000, doesn’t mean it’s going to hit that every day. The beauty of obtaining a funded trading account is that it’s not your account. If you fail, you are not going to lose $50K. In other words, if you fail, you’ve only lost the fee associated with the evaluation account. I asked Oneuptrader if you could have multiple accounts and they said yes, but you can only have one funded account. So, while you can’t have more than one funded account, you can pass as many evaluation accounts as you want. What does this mean? This allows traders to line up multiple evaluation accounts in case the strategy hits one of the limits. I suspect other funding programs are the same way.

Finally, you might want to use our strategies with e-mini contracts. The profit will be lower, but so will the risk.

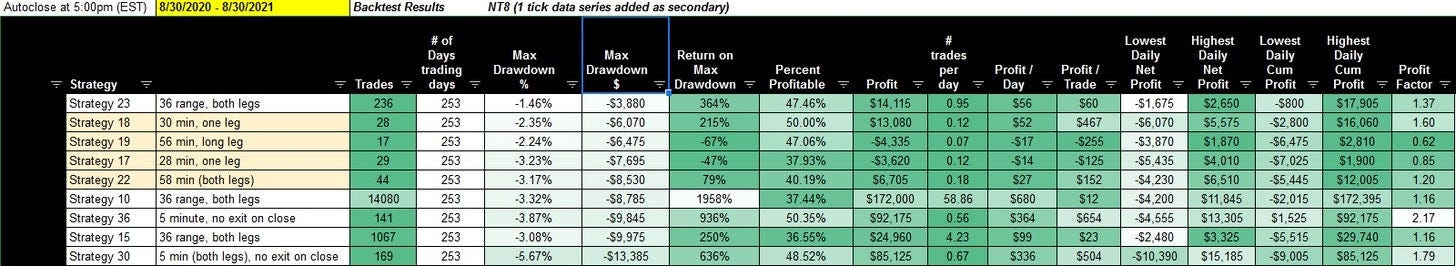

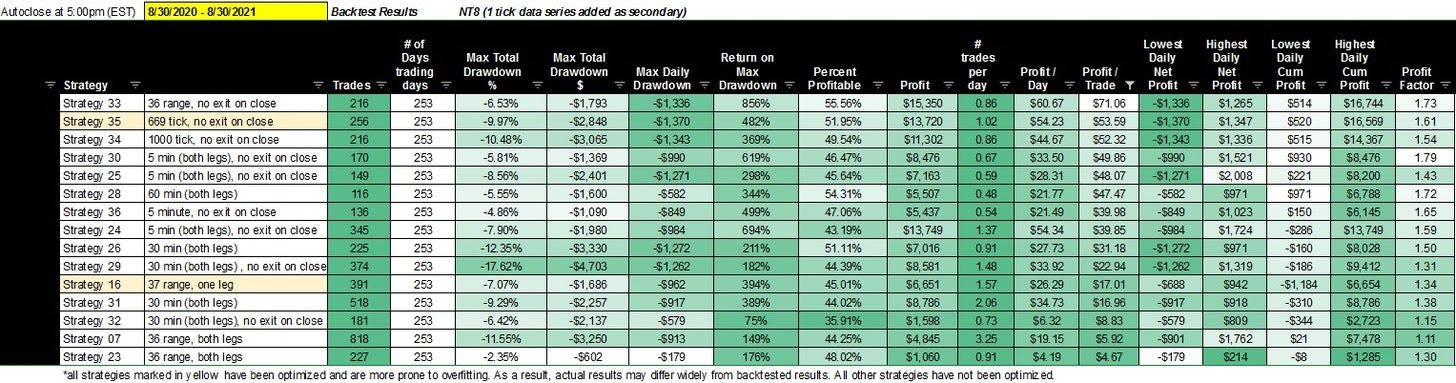

We’ll look at an example of how you could use e-mini contracts in a moment, but first, let’s look at the strategies with the most favorable max drawdown.

Again, none of these strategies fit the criteria at the $50K level. The best we can do is Strategy 23, which has a max drawdown of $3,880. This is a lot higher than the maximum drawdown of $2,250 you need in order to get funded. It is worth noting that even though Strategy 23 has a max drawdown of $3,880, only 6 trading days out of the year had a daily net profit that dropped below $1,100, so the probabilities are on your side. Strategy 23 only works if you purchase a $150K evaluation account, which has a maximum drawdown of $5,000. As discussed above, Strategy 23 also has low net profitability, so it will take a long time to make your new profit target, which is $9,000. It’s only 3,000 at the $50K level. We should also look at the strategies with the most favorable cumulative profit. These are the strategies with the lowest daily net cumulative profit:

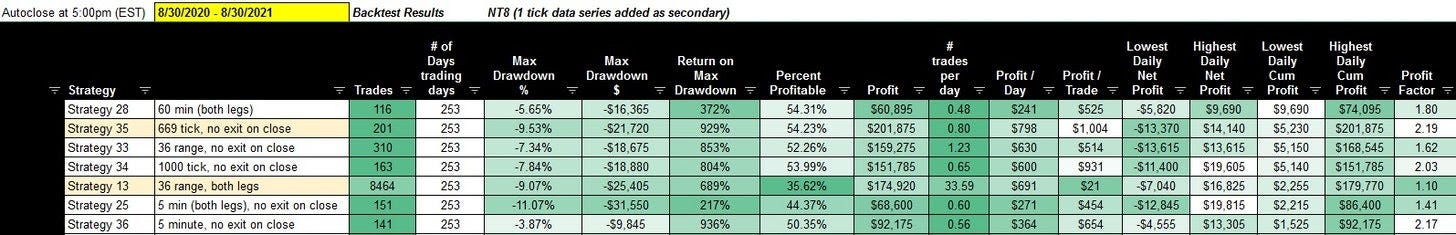

As you can see, lowest cumulative net loss is not the same as max drawdown. The lowest cumulative net loss is the lowest the account value has ever gone. None of these strategies ever dipped below $1,500 over the backtest, but that doesn’t mean the account did not have a significant drawdown.

What else does this tell us? From a funded trader perspective, having the lowest daily net loss is more important than having the lowest daily cumulative net loss. That is, a funded account can mimic Strategy 28 and have an account that never falls below $9,690, but has a max drawdown of $16,365, which is too high for a funded account. While our hunt has many things in common, this is perhaps the largest difference. That said, we are also looking for a strategy that has a max daily drawdown of -3%, not -5.65%, like Strategy 28.

Perhaps a better approach is to use e-mini contracts like MNQ.

Can You Use E-Mini Contracts To Reduce The Draw-down?

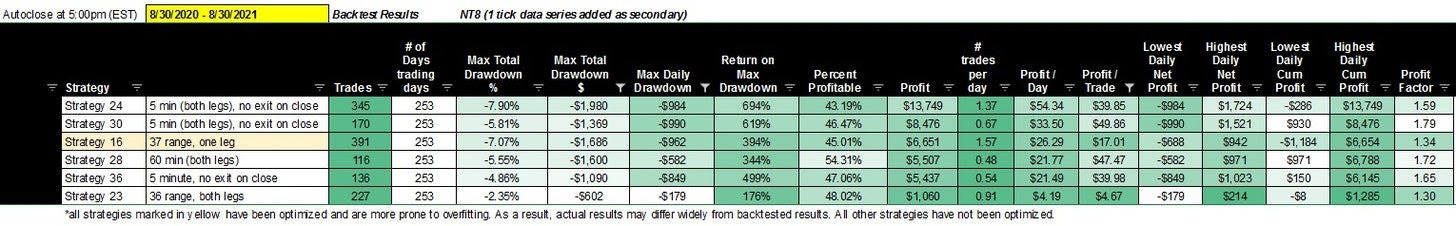

The following chart provides performance stats on a 1 year backtest for all of our strategies based on trading 1 MNQ contract rather than 1 NQ contract. In an e-mini MNQ account the value of each tick is 1/10th the size of a regular NQ contract.

We also added a new column - max daily drawdown. While net daily profit high/low tells you the end of day net profitability, max daily drawdown high/low tells you the intraday highs and lows. It is the max daily drawdown that most funded trading programs are tracking as the daily loss limit. This makes the hunt even harder because the lowest ‘end of day’ drawdown is always going to be the same or better than the lowest intraday drawdown. We then sorted the list based on this new metric.

Based on this, almost all of our strategies meet the daily loss limit requirement. Most of the funded trader programs we looked at require you to pay ~$2 per side for commissions (lower for e mini contracts). So we’re going to narrow our search to only include strategies with a profit per trade higher than $4.

Let’s also assume that the max daily drawdown for a $50K account is $1,250. And, let’s assume the max trailing drawdown is $2,500. So we’re going to narrow our search to those strategies with a max daily drawdown that is less than $1,250 and a max total drawdown that is less than $2,500. We’re left with the following six strategies sorted from highest to lowest by profitability:

Strategy 24 pushes the limits on drawdown, but makes $54 per day in profit and $40 profit per trade. This means it’s going to take (on average) 46 trading days or 9 weeks to reach your goal. This is based on one contract.

Another option is to purchase a $150K account. This will cost more, but gives you more options. Instead of using Strategy 24, you can use Strategy 33, which has a much higher profit per day and per trade. Max total drawdown is higher, but since your daily loss limit on the $150K account is $4K, you can double up on contracts as well. That said, your profit target is much higher, so it will take just as long (if not longer) to reach. For example, the profit per day on Strategy 33 is $60, so it will take 150 trading days to reach your goal. If we ramp up to two MNQ contracts, it will take 85 days. So, it will take longer either way, but you’ve lowered the risk of having your account liquidated.

So that’s the extent of our recommendation. There is no silver bullet, but we’re hoping it gave you some ideas for how to improve your hunt.

These are just a few additional thoughts/notes from our research that we wanted to share:

You may want to limit your search to strategies that end at the end of the day as many funded programs require you to close at the end of each day. These strategies are noted on our chart as “no exit on close”. Some funded trader programs also give you the option of holding trades overnight (Swing trade accounts).

When you start a strategy matters. For example, based on backtest results, the best day to start Strategy 24 is a Tuesday. You can find charts that can help with this determination in the strategy description for each strategy. You may even only want to trade on the strategy's best day of the week until you build your account. There is no guarantee that this trend will continue in the future, but it gives you a better chance of starting off with a net cumulative account.

You don’t have to use the same strategy. You can go from a low risk strategy with less profitability, to a higher risk strategy with high profitability once you grow your account. You can also start off by trading MNQ and then graduate to NQ once your account value hits a certain level.

Practice on a simulated account first. Remember, you can have free access to Ninjatrader by opening a Ninjatrader brokerage account. The minimum amount you need to fund a brokerage account is $400 (there’s also a $12 a month fee for data). So opening a brokerage account with Ninjatrader gives you access to the platform and a simulated data environment for $12 a month. This allows you to conduct your own evaluation until you figure out the best approach.

Conclusion & Key Takeaways

Some of you are reading this because you’re interested in the subject matter, but I’d like to take a moment to speak directly to those folks that are here because you’re looking for a strategy to help you pass a funded trader program: There are many different ways to approach this particular hunt, as we’ve outlined above. What you decide to do depends on your proficiency and risk tolerance.

If your interest in ATS is only in finding a strategy that will help you to get funded, we may not be what you’re looking for. We haven’t found what you’re looking for yet and our hunt is different from yours so we may never find what you’re looking for. That said, there are many natural overlaps in our pursuit. Based on our research, if we were to pursue this hunt with vigor, we would think about it in terms of probabilities and do the following:

Stay away from all optimized strategies.

Purchase the subscription account that allows for the greatest risk.

Compare strategies based on max cumulative intraday drawdown rather than max drawdown or end of day net profit.

Compare strategies by looking at the average max daily loss or intraday drawdown rather than actuals.

Look for strategies that only fail the max daily loss or intraday drawdown less than 6 times a year and trade these strategies on the best days based on net income distribution by day of week over the backtest.

Place auto stops on the strategy based on net intraday drawdown rather than by trade.

Going forward, we will keep your hunt in mind when searching for the holy grail of automated trade strategy.

Trade Well,

ATS