Automated Trading Strategy #46

Strategy 46e made $202K based on trading 1 NQ contract on a 5 year backtest period.

There is no guarantee that these strategies will have the same performance in the future. Some may perform worse and some may perform better. We use backtests to compare historical strategy performance. Backtests are based on historical data, not live data, so these results are purely hypothetical. There are no guarantees that this performance will continue in the future. Trading futures is extremely risky. If you trade futures live, be prepared to lose your entire account. We recommend using our strategies in simulated trading until you/we find the holy grail of trade strategy.

For a link to all strategies and the most recent chart, click here.

Click on the table to enlarge.

As a quick reminder, our goal is to find the holy grail of automated trade strategy as defined below:

Profit factor greater than 3

Annual drawdown less than 3%

Annual return on max drawdown greater than 500%

Maximum daily net loss of -$1,000

Avg Daily profit greater than $1,000

Less than 5,000 trades annually

More than 253 trades annually

These are the metrics we use to track performance over time. There’s been quite an evolution of these metrics over the last year. Each iteration is based on the addition of a metric that helps to compare that strategy against the rest. So, the goal is not only to use the performance chart as a tool for tracking performance, but as a tool of comparison.

There are times, however, when a tool that you’ve come to rely on can hinder performance and therefore achievement of a goal. To that end, I’ve been challenging myself to think outside the box. I used the performance chart as a way to represent that box. The following strategies are a by-product of these thought experiments.

Strategy 46 Performance

Before we get into how Strategy 46 is formulated, let’s look at the performance results from Strategy 46 and its variations: Strategy 46e and Strategy 46c:

The first thing I want to point out is that these results are based on a 4-5 year backtest rather than a 1 year backtest. That is, the backtest for this particular strategy is over a 4 to 5 year period unlike all of our other strategies, which are based on a 1 year backtest.

Strategy 46 currently has 4 years of performance results. It made 364 trades, has a profit factor of 1.50 and a net profit of $133K.

Strategy 46e is a variation of Strategy 46. Instead of starting in March, it starts today, April 1, 2022. As you can see, this strategy has a higher profit factor at 1.62 and we’ll talk about what’s creating the boost in a moment. It also has a net profit of $202K over the same time period.

Strategy 46b only makes $28K, but has a slightly higher profit factor at 2.13.

Perhaps the best thing to note about these strategies is that due to the way they are constructed, there is a no backtest risk. That is, there is no risk that the backtest is wrong or misleading. Remember, we define backtest risk as a strategy specific risk that tells us how well a particular strategy acts like its backtest. Some strategies are simply more prone to backtest risk than others, but this is the first strategy we’re publishing that has little to no backtest risk and I’ll explain why that is shortly. That doesn’t mean the strategy will perform the same in the future — there’s always risk, especially when trading futures — but that risk is not associated with the backtest.

Strategy 46 Performance Charts

The performance charts for Strategy 46 are a bit different because this strategy is a bit different. Instead of indicators, this strategy is based on event/business cycle studies from the NDX (NASDAQ-100 Index). The NDX is the underlying instrument of the NQ (E-mini Nasdaq futures) so whatever impacts the NDX will naturally impact the NQ.

Why event/cycle studies?

In addition to providing updates every other month (March 2022 update), we’ve also been tracking the performance of strategies at the weekly level. The publication we do this in is referred to as the Mudder Report. One of the most profound lessons of the Mudder Report is that it’s better to hunt for market events/cycles rather than trends. In the same way that ancient people were able to use lunar and solar calendars to forecast seasonal events/cycles, we can use the economic calendar to forecast market movements. So instead of looking for the trend, we’re looking for the event or cycle that caused the trend. In particular, we’re looking for events/cycles that cause a reliable trend every year.

Before we get into what these events/cycles are and how we used them to create a viable strategy, let’s review the charts.

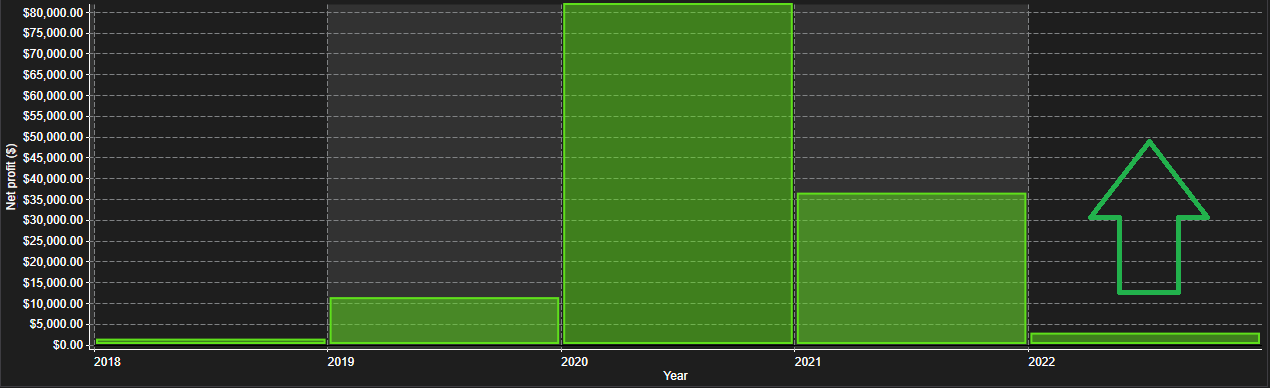

This is the net profit of Strategy 46 since 2018. 2022 has already started making money even though the strategy just started in March.

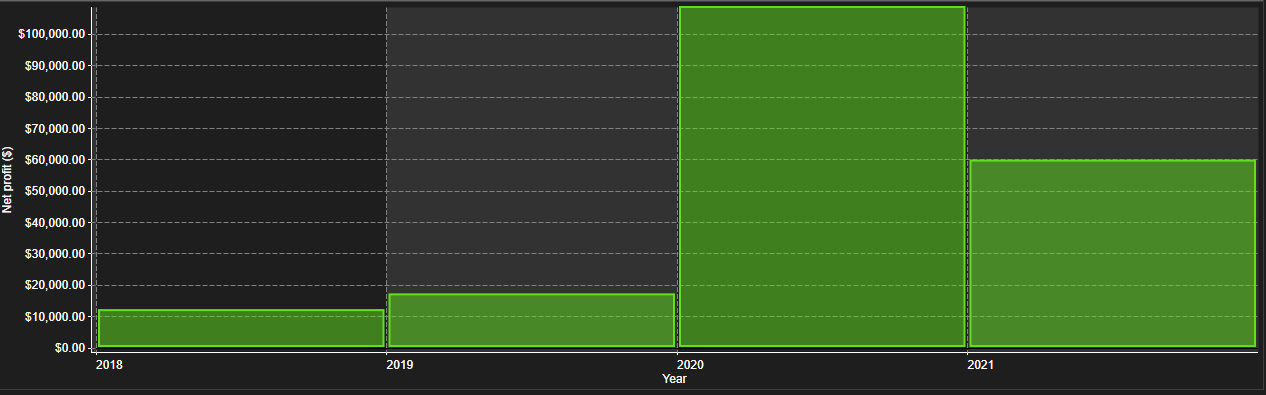

When we refined Strategy 46, we came up with Strategy 46e:

As you can see, every year is a bit higher, with an explosive 2020 and a lower 2021. You’ll notice that this strategy has no income in 2022 — yet. That’s because Strategy 46e starts today, April 1. I’ll explain why that is in a moment.

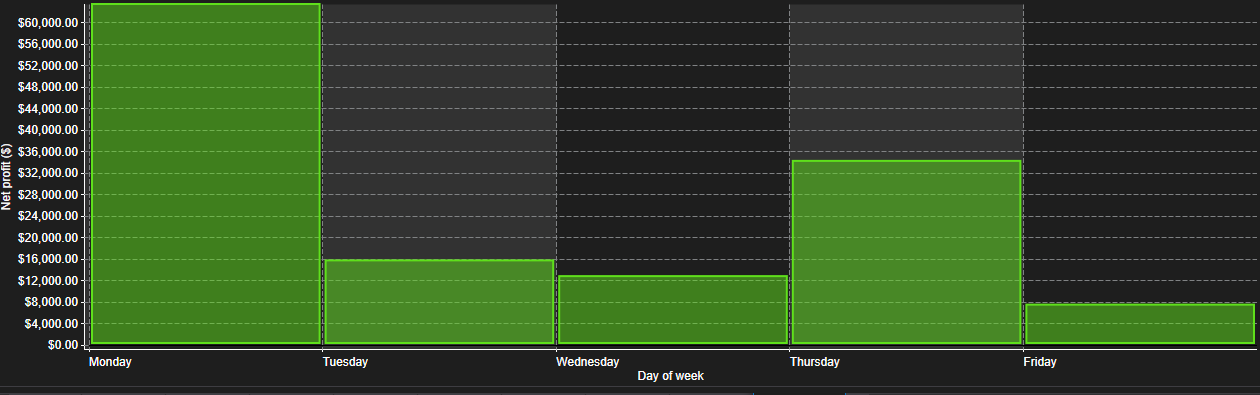

This is how Strategy 46 breaks down on a day-of-week basis. Clearly, Monday is the highest performing day, followed by Thursday. So if you wanted to further refine the strategy, you might want to isolate these days going forward.

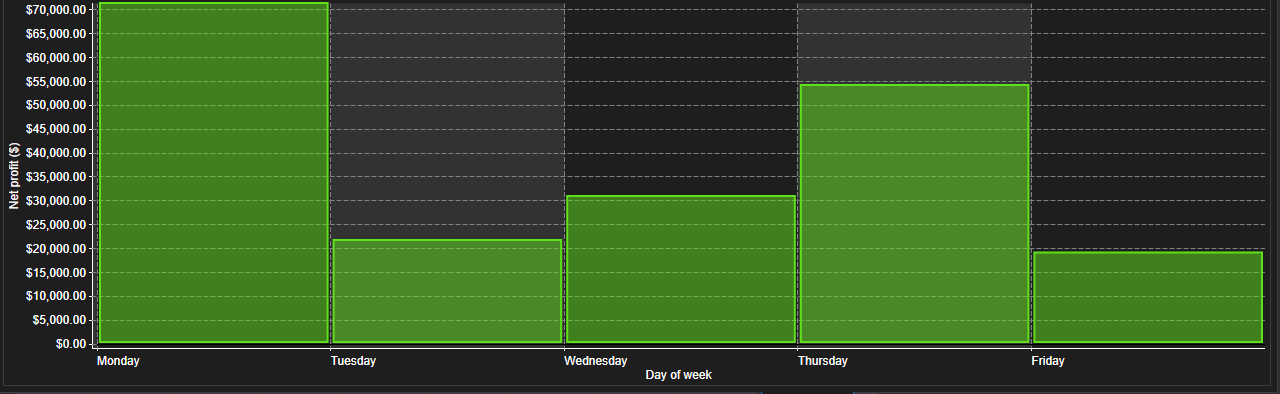

This is how Strategy 46e breaks down on a day-of-week basis.

For the most part it mirrors Strategy 46, except that Wednesday performs much better.

Now, let’s talk about how we created Strategy 46 and how you can recreate it for yourself. We’ve also included a description and download for each strategy: 46, 46e and 46c.