Automated Trading Strategy #45

Strategy 45e made $317K based on a one year backtest period and a risk management system that uses 1 to 5 contracts.

There is no guarantee that these strategies will have the same performance in the future. Some may perform worse and some may perform better. We use backtests to compare historical strategy performance. Backtests are based on historical data, not live data, so these results are purely hypothetical. There are no guarantees that this performance will continue in the future. Trading futures is extremely risky. If you trade futures live, be prepared to lose your entire account. We recommend using our strategies in simulated trading until you/we find the holy grail of trade strategy.

For a link to all strategies and the most recent chart, click here.

Click on the table to enlarge.

As a quick reminder, our goal is to find the holy grail of automated trade strategy as defined below:

Profit factor greater than 3

Annual drawdown less than 3%

Annual return on max drawdown greater than 500%

Maximum daily net loss of -$1,000

Avg Daily profit greater than $1,000

Less than 5,000 trades annually

More than 253 trades annually

I recently received a question about these attributes that I wanted to disregard, but it’s a fair question — do you really need to define attributes for the holy grail? Well, I was trained to create measurable goals and these attributes are a by-product of that training, but I understand the question. If we’re going to use the holy grail to conceptualize our goal, then we’re talking about a strategy that’s simple and resembles perfection. Perhaps we’re complicating the issue. What if the best way to define the holy grail of automated trade strategy is simply: a strategy that doesn’t lose money. One way to do that is to incorporate a risk management system into the strategy.

Traders employ many different types of risk management systems for themselves. It’s not enough to have an edge, but you need a way to shield yourself from large drawdowns until you’ve made enough money to cover it. Best case scenario — the true holy grail of automated trade strategy — you want a strategy that pays for its max drawdown.

The kind of risk management system you employ depends on your account and temperament. Personally, I only allow myself to lose $500/day. I start off with a few trades in MNQ (Micro E-mini Nasdaq-100 futures contract) and then graduate to NQ (E-mini Nasdaq-100 futures contract) if those go well. If I’m having a really good day, I’ll use more than 1 contract. So, Strategy 45 is my attempt at incorporating certain aspects of this system into a strategy.

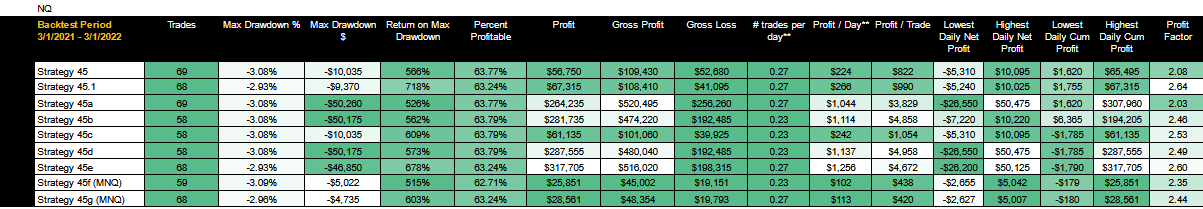

Before we get into how Strategy 45 is formulated, let’s look at the performance results from Strategy 45 and its variations:

First, I want to apologize for the variation ‘labels’. We started off with three variations and then it ballooned to nine so I had to make changes without changing the labels that were already created.

Second, you will notice that the last two variations are for MNQ. As a quick reminder, MNQ trades at one tenth the size of NQ. While it only gets you to $28K net profit for the year, it can be used as a way to build up to NQ. In the same way that Strategy 45g starts off with one MNQ contract and then slowly ramps up to 5, Strategy 45e starts off with one NQ contract and then slow ramps up to 5 as well. So, once you hit $10K in cumulative net income for MNQ, you can switch over to NQ. We use max drawdown on one NQ contract as a proxy for minimum starting account value. For example, the max drawdown on Strategy 45.1 is $9,370, so you’ll want to have $10K (at a minimum) to trade before leveling up from MNQ to NQ.

As you can see, this strategy doesn’t make many trades throughout the year, but we don’t think this will impact consistency. This is because we’ve used the strategy to carve out the best part of the cake. While it’s not a big piece, it’s the best. And, we’ve defined the best using market structure, not trends. Profit margins range from $25K to $317K depending on the variation used. And, profit factors range from 2.03 to 2.64.

Strategy 45 Performance Charts

This is what Strategy 45.1 looks like in chart form. It makes on average .27 trades per day, and has an average net profit of $266 per day or $990 per trade on one NQ contract.

Strategy 45e ramps Strategy 45.1 up from 1 to 5 contracts based on the strategy’s net income. It still only makes on average .27 trades per day, but it makes an average net profit of $1,256 per day or $4,672 per trade on 1 to 5 NQ contracts. Strategy 45g is the MNQ version of this strategy.

This is the cumulative profit of Strategy 45.1 over a 1 year period (3/01/2021 - 3/01/2022). It never falls lower than $1,755.

This is how the strategy breaks down on a day-of-week basis. The strategy is designed to only enter a trade on Monday. Some of those trades don’t close until Tuesday. Monday was chosen because it was the best performing day for Strategy 44, which is what this strategy is based on.

Due to insights found in the Mudder Report (documentation of weekly strategy performance) we’ve decided to pay closer attention to weekly trends by adding a weekly chart to all strategy descriptions. We’re doing this for two reasons:

It might help with our weekly strategy selection process

It might help to determine the best time for entry, with the goal being a cumulative low greater than $0

In this case, the chart gives us an idea for what a normal high or low week looks like.

This is the weekly profile of Strategy 45.1.

There is no discernible trend, but you’ll notice that the weekly high is more than twice the amount of the weekly low.

Now, let’s talk about how to recreate Strategy 45 and its variations for yourself. The risk management system we’ve incorporated into the strategy can be used on/added to any of our strategies. If you need help with that, please let me know.