Automated Trading Strategy 103: The Dog

This strategy made $3K in one week using micros.

Important: There is no guarantee that ATS strategies will have the same performance in the future. I use backtests and forward tests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. Forward tests are based on live data, however, they use a simulated account. Any success I have with live trading is atypical. Trading futures is extremely risky. You should only use risk capital to fund live futures accounts and if you do trade live, be prepared to lose your entire account. There are no guarantees that any performance you see here will continue in the future. I recommend using ATS strategies in simulated trading until you/we find the holy grail of trading strategy. This is strictly for learning purposes.

We're not just developing strategies—we're on a quest for the holy grail of automated trading. Questions? Check the FAQs or feel free to reach out directly: AutomatedTradingStrategies@protonmail.com.

I like automated trading for many reasons. The primary reason: it takes the emotion out of trading. Over the years, however, I’ve realized that many of you are interested in automated trading because you don’t know how to trade manually and automated trading serves as a learning tool.

Strategy 103 is a strategy that is specifically designed for those using automation to learn manual trading concepts. It’s simple in concept, yet surprisingly challenging to automate properly (trust me, I learned this the hard way through multiple database crashes).

This is also the first strategy I teach people for manual trading because it fundamentally shifts how you think about markets. The goal is to take your mind off price prediction and redirect it to order placement—a subtle but game-changing adjustment in perspective.

In many ways, this strategy reminds me of something my tennis instructor would always say—”keep your eye on the ball”. It seems counter-intuitive in the moment, but you have to watch the ball before you can think about placement. If the ball is price, then your goal as a trader isn’t to predict where it’s going—it’s to position your orders optimally to capitalize on its inherently stochastic movement.

That’s exactly what this strategy teaches you: where to focus and how to think about order placement rather than price prediction.

The Challenge: When Good Strategies Break Bad

Any strategy that trades like a professional human trader needs to act quickly and update orders constantly. This is precisely where most automated strategies fail—and where I ran into serious problems developing The Dog.

I experienced database crash after database crash. The strategy would work beautifully in testing, then blow up when running at full speed. The culprit? Something called “throttle”—the safety mechanisms that platforms use to prevent runaway algorithms from flooding the system with orders.

In NinjaTrader, if a strategy submits too many order modifications in a short burst, the platform automatically disables it. You’ve probably seen this yourself—your strategy suddenly “turns itself off” for no apparent reason.

After weeks of frustration, I discovered a solution that’s actually a form of risk management I’d never considered before—and it’s now built into The Dog strategy.

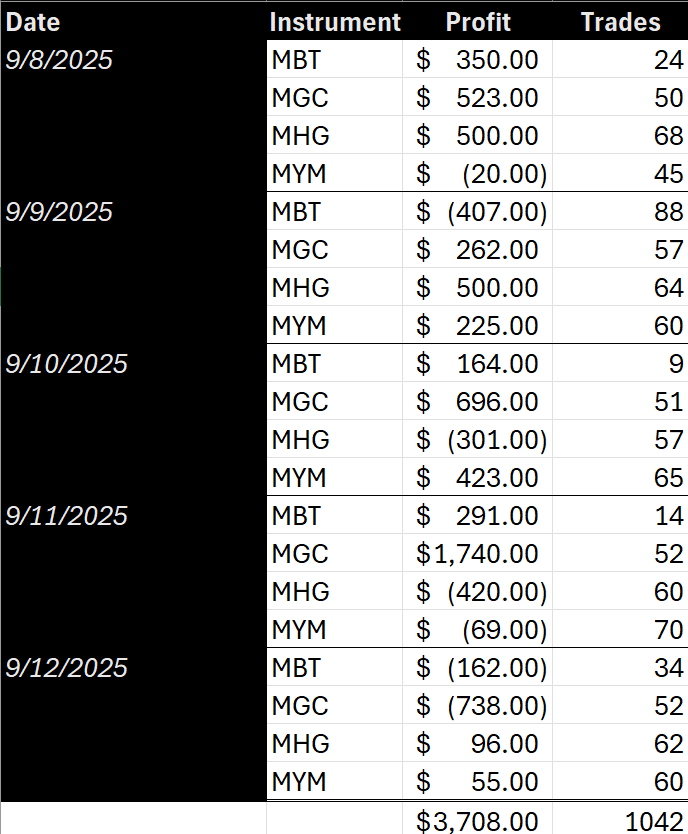

Here are the results of running Strategy 103 for one week on a set of micros:

My one way commission is $.09 on micros so total commission is $93.78.

Using standard contracts, we’re looking at $37K for the week with $615 in commissions ($.59 per side).

Here’s an example of how The Dog moves. This is a high-frequency strategy that executes 50-100 trades per day depending on bar frequency. The 7 min video below shows how the strategy works at 50x speed, demonstrating the strategy applied to MGC and MHG (though it works on almost any instrument).