Important: There is no guarantee that ATS strategies will have the same performance in the future. I use backtests and forward tests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. Forward tests are based on live data, however, they use a simulated account. Any success I have with live trading is untypical. Trading futures is extremely risky. You should only use risk capital to fund live futures accounts and if you do trade live, be prepared to lose your entire account. There are no guarantees that any performance you see here will continue in the future. I recommend using ATS strategies in simulated trading until you/we find the holy grail of trade strategy. This is strictly for learning purposes.

We're not just developing strategies—we're on a quest for the holy grail of automated trading. Questions? Check the FAQs or feel free to reach out directly: AutomatedTradingStrategies@protonmail.com.

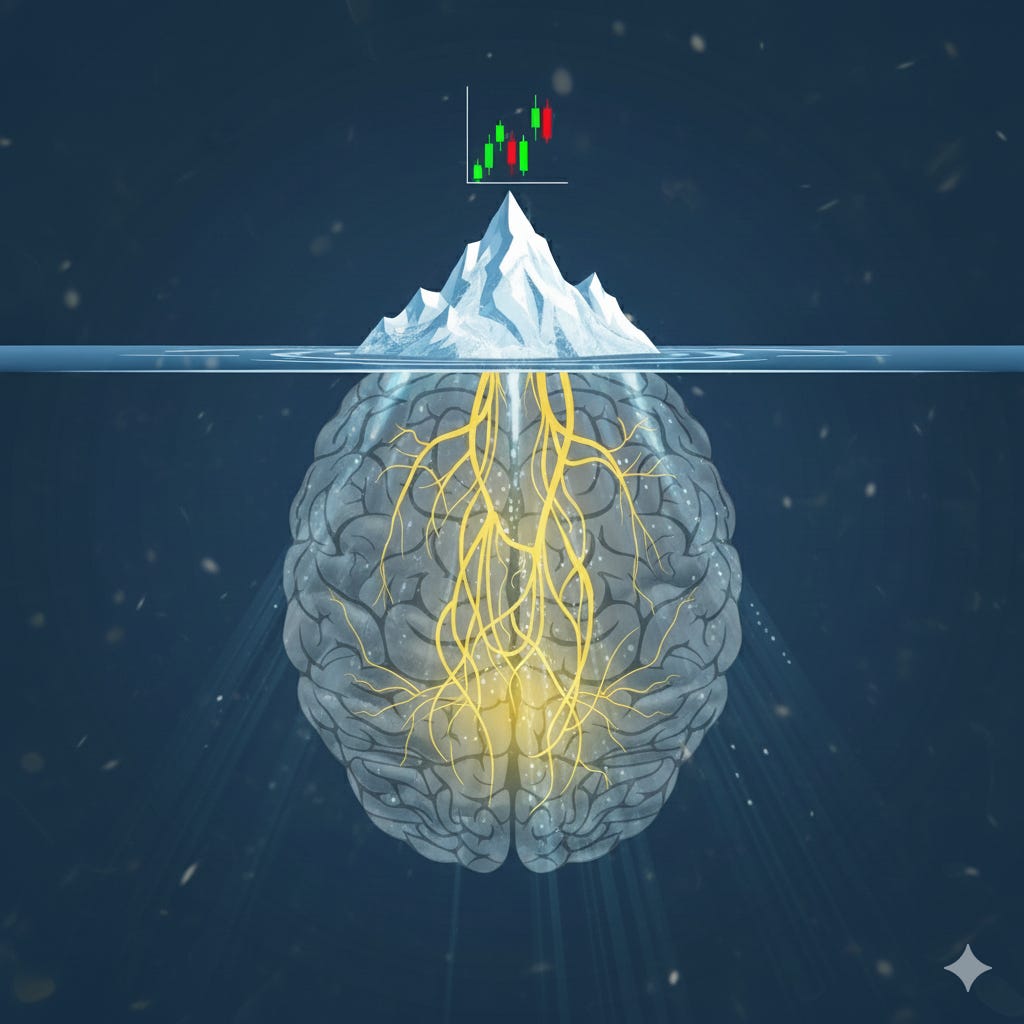

Japan has a name for the two worlds we all navigate: tatemae (the face we show) and honne (what’s really driving us). Markets have them, too. Charts and headlines are the tatemae. Order flow—and the human habits behind it—is the honne.

For traders, the unseen world isn’t mystical. It’s order‑flow dynamics, dark/hidden liquidity, accumulation/distribution, and the behavioral loops that generate them. The useful move is to treat these not as separate from people, but as people at scale. Price is what human behavior looks like when crystallized.

While a single trader isn't "the market," their collective action creates it. The market's "personality” is an emergent property of millions of individual neurochemical states firing at once. This is the ultimate honne—a truth that doesn't even exist at the individual level.

The Hidden Forces of Human Behavior

Neuroscientist Giacomo Rizzolatti discovered our brains literally simulate others' actions as if we're performing them ourselves. The same mirror neurons that make you yawn when someone else yawns are firing when traders see a big green candle.

In markets, this creates behavioral contagion. One trader's panic becomes everyone's panic, not through rational analysis but biological mimicry. Every order book is a real-time map of psychological states:

Bid clustering = Social proof in action (everyone huddles where everyone else is)

Pulled orders = Commitment consistency breaking down (the amygdala overriding the prefrontal cortex)

Iceberg orders = Authority bias being deliberately hidden (the predator concealing its size)

Stop runs = Weaponized FOMO (mirror neurons being hunted)

Each trading session has its own neurochemical signature:

Asian Session (6 PM - 8:30 AM ET): Cortisol peak = maximum focus, institutional positioning

London Open (3 AM ET): Testosterone peak = maximum risk-taking, aggression

NY Open (9:30 AM ET): Dopamine flooding = FOMO activation, reward-seeking

Lunch Hour: Glucose depletion = cognitive fatigue, poor decisions

Power Hour: Adrenaline surge = fight-or-flight trading

These aren't time zones. They're neurochemical states.

Your brain is running evolutionary software that thinks every loss is a tiger and every gain is food. It's performing stochastic calculus with wetware designed for life-or-death, not bid-or-ask. What if:

Market makers hedging delta are actually mimicking neurological inhibition patterns

The "gamma squeeze" is actually a dopamine cascade

Support and resistance levels are actually the exact price points where the most dopamine was previously released

If this were true, it would mean that markets, like humans, are predictably irrational in mathematically beautiful ways.

The Man Who Can Read Your Mind

Chase Hughes is the kind of guy that would make me nervous at a party. I became intrigued with him after an interview on Joe Rogan. His level of insight into human behavior is so profound it can be unsettling.

Hughes is a former Navy chief who spent 20 years perfecting interrogation techniques. His book 'The Ellipsis Manual' was originally written as a manual for intelligence operations and includes word-for-word scripts for what he calls creating a 'Manchurian Candidate'—the kind of content that Amazon categorizes under 'Self-Help' when it should probably require a license.

But his real breakthrough was understanding that by shifting context, you can get people to do almost anything—because context gives us permission to behave in unusual ways.

Think about it: you'd never sing loudly on a subway, but you will at a concert. You'd never give your money to a stranger on the street, but you will to a broker in a suit. Context is the backdoor to the brain.

Hughes found that while humans are unpredictable individually, we're mechanical in aggregate. In markets, these 'unconscious tells' include:

Options flow from pension funds (can't hide hedging needs—like trying not to breathe)

Central bank operations (regulatory requirements—the market's autonomic nervous system)

Index rebalancing (mechanical, predictable—the market's heartbeat)

Tax loss harvesting (calendar-driven—seasonal affective trading disorder)

In other words, the market has reflexes. And reflexes can be triggered.

But here's where it gets interesting for traders. Hughes discovered that humans operate in predictable behavioral loops, as mathematically definable as a Fibonacci sequence. Building on Robert Cialdini's groundbreaking work in "Influence," Hughes identified how these six psychological drivers manifest in behavioral patterns:

Authority Bias—We follow perceived leaders (or why everyone suddenly loves whatever Druckenmiller just bought)

Social Proof—We do what others do (the WSB Effect)

Scarcity Response—We panic when supply seems limited ("Only 21 million Bitcoin will ever exist!")

Commitment Consistency—We stay aligned with past decisions ("I'm not wrong, I'm just early" he said, down 97%)

Reciprocity Pressure—We feel obligated to respond (Market makers thank you for your liquidity)

FOMO—We fear missing out or losing (The eternal driver of both bubbles and crashes)

Where Cialdini identified these principles, Hughes mapped them to micro-expressions and verbal patterns with such precision that he could predict someone's next action before they knew they'd make it.

Now imagine that power applied to millions of market participants simultaneously. Sound familiar? It should. This is exactly what Renaissance Technologies does with market data—looking for hidden, sequential market states caused by human behavior.

They're not predicting prices. They're predicting people.

"Our entire premise was that human actors will react the way humans did in the past….we learned to take advantage."

Jim Simons

The difference is that Hughes reads one person at a time. Renaissance reads everyone at once. And while Hughes uses his system to understand individuals, Renaissance uses theirs to extract billions from the market.

Same psychology. Different scale. Infinite alpha.

This is what I’ve tried to build into Strategy 102 (download is available at the end of this post). Here’s a look at performance:

Before sharing the strategy with you, I want to explain what its doing and why.