Important: There is no guarantee that ATS strategies will have the same performance in the future. I use backtests and forward tests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. Forward tests are based on live data, however, they use a simulated account. Any success I have with live trading is untypical. Trading futures is extremely risky. You should only use risk capital to fund live futures accounts and if you do trade live, be prepared to lose your entire account. There are no guarantees that any performance you see here will continue in the future. This is for educational purposes only. I recommend using ATS strategies in simulated trading until you/we find the holy grail of trade strategy.

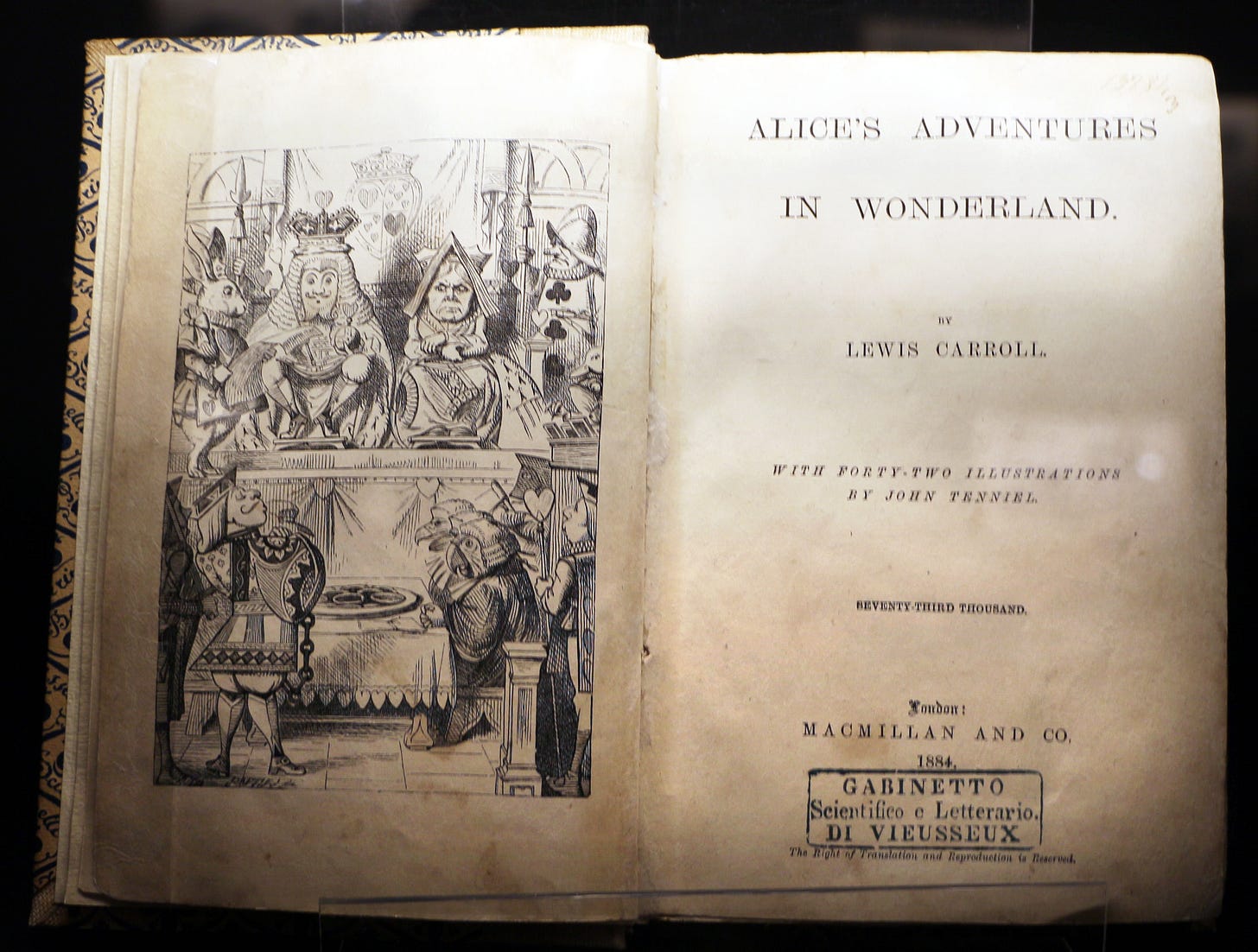

“We're all mad here. I'm mad. You're mad.

You must be, or you wouldn't have come here.”

-- Cheshire Cat, Alice's Adventures in Wonderland

I am currently reading Alice's Adventures in Wonderland by Lewis Carroll. Aside from the revelation that Carroll was likely on mushrooms when he wrote it, the book has me reflecting on how trading has shifted from a "dark and scary forest" to its own very special kind of Wonderland. The AI trading landscape isn't necessarily safer, but operates on different logic. Just as Alice abandons conventional physics, biology, and social rules to navigate her strange new world, traders must embrace the emergent behaviors of AI-driven markets.

Lewis Carroll—mathematician Charles Dodgson by day—wrote Alice's Adventures in Wonderland during a mathematical revolution triggered by non-Euclidean geometry. We stand at a similar crossroads. Modern traders navigate an AI-shaped trading landscape, moving from rigid technical analysis toward a fluid land governed by machine learning's hidden logic.

In Wonderland, traditional logic dissolves. Characters speak in paradoxes and behave erratically, yet maintain an internal consistency within their context. Similarly, machine learning presents traders with seemingly "nonsensical" outputs—unsupervised learning clusters, unnamed patterns, hidden regime transitions, probabilistic causal relationships—that appear absurd through traditional analysis. My hope with this series is to demystify the absurd.

If you've been following this series, you already know how AI and ML are fundamentally reshaping trading in 2025. Within major financial institutions, these technologies are deployed across the trading lifecycle, driven by the potential for significant efficiency gains. Systems like JPMorgan's LOXM have improved trade execution efficiency by ~15% through optimized order placement. Banks utilize ML techniques for market regime identification, mapping complex intermarket relationships and dynamic correlations. Research confirms ML techniques statistically outperform traditional models. This advantage stems from ML's ability to identify and integrate complex patterns across multiple data sets.

The good news is that AI is also a democratizing force. The same tools that are available to banks are available to you. My goal for this series is to bridge the knowledge gap for retail traders. I want us to understand the practical applications of AI tools in trading, and the implications of AI usage on financial markets.

We've explored agentic workflows (Part 1), dissected the interplay between ML and LLMs (Part 2), examined how these technologies are reshaping trading strategies (Part 3), and even found a few trading platforms to deploy these newfound superpowers (Part 4). Now it’s time to develop our understanding of ML capabilities and learn how to apply those abilities to our hunt.

As a quick reminder, we’re on the hunt for the holy grail of automated trading strategy. If you have any questions, feel free to reach out to me (Celan) directly at AutomatedTradingStrategies@protonmail.com.

Traders In Wonderland

So, what's our next step? It begins with developing the same familiarity we have with traditional technical indicators, but now with AI and ML applications. Instead of MACD and RSI, we have the HDBSCAN noise flag or Granger causality tables.

The challenge is that while traditional analysis can be executed with straightforward software and manual chart reading, ML systems require specialized expertise, significant computing resources, and ongoing maintenance—at least that’s the perception. So in addition to sharing some of my favorite ML tools and techniques, I want to share the process I use—an approach that debunks the perception. Best of all, it makes sophisticated, institutional-grade analysis accessible without the need for extensive resources.