Important: There is no guarantee that these strategies will have the same performance in the future. I use backtests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results shared are hypothetical, not real. There are no guarantees that this performance will continue in the future. Trading futures is extremely risky. If you trade futures live, be prepared to lose your entire account. I recommend using these strategies in simulated trading until you/we find the holy grail of trade strategy.

In Strategy 76 Part I, we looked at the type of trading behavior the quant fund Renaissance Technologies looks for to find opportunities in the market.

In Strategy 76 Part II, we looked at what causes irrational behavior, why it happens and how to spot it in yourself to improve your trading (both manual and automated).

In many ways Strategy 77 is part III. We’re going to build on Strategy 76 by adding a forecasting model. Then we’re going to take it one step further by applying mean reversion to the forecasting model, with the idea being that the model is better or worse depending on how well it forecasts the current price.

Let’s get started…

Forecasting is the new black. Yesterday, it was zero latency, but what comes before zero in the measure of time? The future. Enter predictive analytics. Of course the conundrum is that the further you go into the future, the less accurate the prediction.

So, if I could create my very own AI generated pattern recognition tool, it might be a path to the holy grail, but what forecast algo do you use to train on?

We’ve gone down a rabbit hole trying to understand the answer to this question. Much of the work done on this is not my own so I’m not going to share it, but what has become obvious is that many of the algos aren’t any better than linear regression. While I continue to be on the look out for indicators that measure non-linear relationships, I’m finding that most time series forecasting models (from neural networks like LSTM to ARIMA) have measures of accuracy that are the same as, or worse than, a simple linear regression. So that’s what we’re going to do with Strategy 77—we’re going to add a linear regression forecasting model to Strategy 76.

What kind of results does this produce?

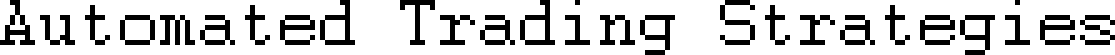

These were the performance results for Strategy 76:

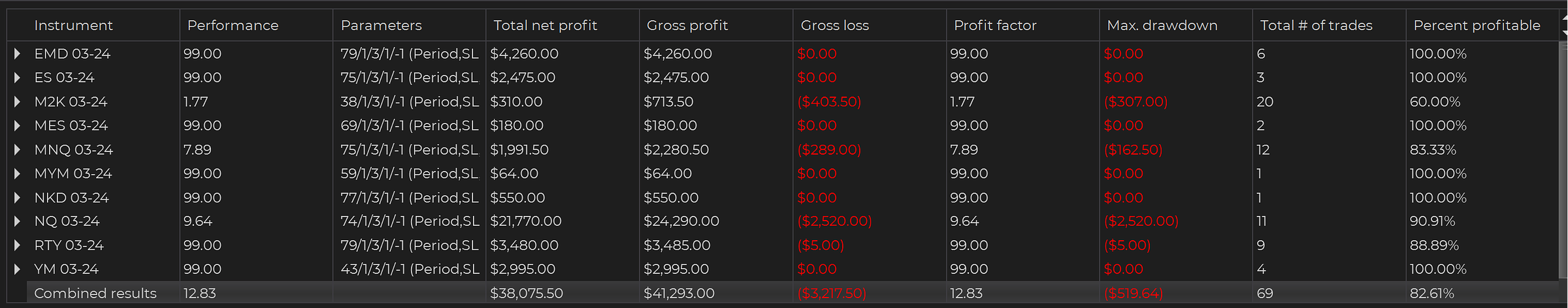

These are the performance results for Strategy 77:

What’s the difference between 76 and 77? I applied a forecasting model to price.

We get a higher number of profitable trades, and a much higher profit factor, 12.83 compared to 5.20, but a much lower trade count, and a lower net income, which probably means we need to loosen threshold parameters a bit.

Let’s pull back and focus in on just NQ. If we look at just NQ for 76, we get the following.

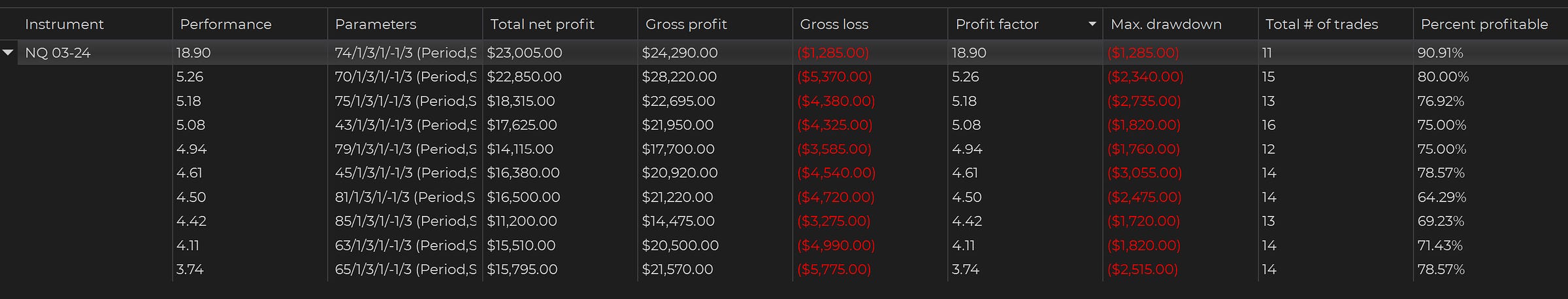

Here’s the same time series optimization on 77:

We get higher profit factor and percent profitability, without the drop off in trade count. What happens if we make a few other minor changes (which I’ll discuss below)?

Even better results and a comparable trade count. The total net profit is low, but we’re looking to follow the lead of Renaissance Technologies—high percentage trades that we can count on during highly predictable periods of high emotion. To read more about Ren Tech’s strategy, click here.

So let’s follow the bread crumbs and build a portfolio of 10 low trade count, high percentage trades—it might not be the holy grail, but it’ll get us so close that we won’t care.